|

|

Recent Articles

-

Amazon’s Third Quarter Operating Income Guidance Conservative

Amazon’s Third Quarter Operating Income Guidance Conservative

Aug 2, 2025

-

Image Source: TradingView.

Though Amazon’s operating cash flow has increased for the trailing twelve month period, free cash flow languished to $18.2 billion compared with $53 billion for the trailing twelve months ended June 30. Similar to its Magnificent 7 peers, Amazon is spending aggressively to capitalize on AI demand and to further grow its AWS business at a hefty pace. There were some soft spots in the quarter related to its third-quarter operating income guidance and free cash flow performance, but we expect Amazon to once again beat the range of its operating income guidance when it reports third quarter results. Free cash flow, however, will continue to be weighed down by robust capital spending.

-

The Risks to Apple Are Increasing

The Risks to Apple Are Increasing

Aug 2, 2025

-

Image Source: TradingView.

Apple’s fiscal third quarter results were a head-turner and showcased outperformance with the iPhone and Greater China sales, through we note that tariff-related headwinds will impact the firm’s cost structure and possibly its product pricing strategy in the months ahead. The Street is also anxious when it comes to Apple’s strategy in artificial intelligence, where it is spending much less in this area than its Magnificent 7 brethren, as well as the sustainability of its current revenue share agreement with Google. The magnitude of risks is growing to the Apple story, but we still like shares in the newsletter portfolios given its strong underlying performance, robust cash flow generation and superb balance sheet. Our fair value estimate stands at $235 per share.

-

Meta Platforms Issues Third Quarter Revenue Guidance Well Above Consensus

Meta Platforms Issues Third Quarter Revenue Guidance Well Above Consensus

Aug 2, 2025

-

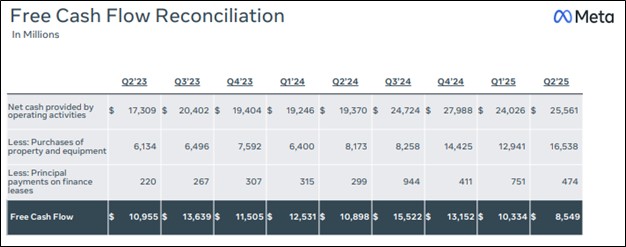

Image: Meta’s free cash flow remains robust despite higher capital spending.

Looking to the third quarter of 2025, Meta Platforms expects revenue to be in the range of $47.5-$50.5 billion (consensus was $44.8 billion), revealing sequential growth at the midpoint relative to second quarter numbers. The company’s guidance assumes a 1% tailwind to revenue growth from foreign currency, based on current exchange rates. Meta fell short of providing an outlook for fourth quarter revenue, but it noted that its year-over-year growth rate for the quarter will be slower than the third quarter as it laps a period of stronger growth in the fourth quarter of last year. Though Meta is not a large dividend payer, we think its dividend growth prospects are fantastic.

-

Dividend Increases/Decreases for the Week of August 1

Dividend Increases/Decreases for the Week of August 1

Aug 1, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|