|

|

Recent Articles

-

Apple Breaks Through Uptrend; Expect Modest Market Pullback

Apple Breaks Through Uptrend; Expect Modest Market Pullback

Aug 4, 2023

-

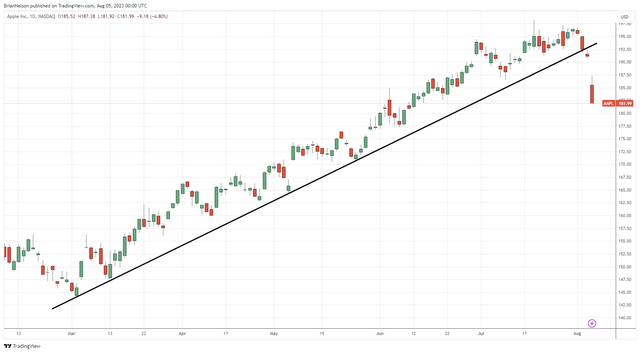

Image: Apple has been a strong performer thus far in 2023, but the stock has broken through its uptrend. Further selling may be ahead of shares. In light of Apple’s weighting across major market indices, investors should expect a modest pullback in the markets.

On August 3, Apple Inc. reported third-quarter fiscal 2023 results that gave the market a reason to sell its shares. Though the iPhone maker’s quarterly results largely matched the consensus forecasts for both the top and bottom line, year-over-year declines in iPhone, Mac, and iPad sales, while expected, were evident in the quarter, even as its Services business grew meaningfully from last year's period. A technical breakdown in its uptrend sparked selling after the report, but we continue to be in awe of Apple’s financial prowess that continues to showcase a substantial net cash position and tremendous free cash flow generation.

-

ICYMI -- Shocking?!?! Utility Dividends Aren’t Always Safe

ICYMI -- Shocking?!?! Utility Dividends Aren’t Always Safe

Aug 4, 2023

-

Image Source: Oran V.

There is plenty to like about the business models of utilities. Regulated utilities, for one, are monopolies in their operating regions, providing an essential service to businesses and customers. This, coupled with the fact that the returns of regulated utilities are set by a regulatory body within a defined ratemaking process, causes the sector to be full of operators that boast steadily-growing earnings that appear to be materially dependable. As we note in this article, however, a surprisingly large number of utilities in our coverage universe have cut their dividends in the past. Are the dividends of utilities as safe as many make them out to be? Let’s dig in.

-

Dividend Increases/Decreases for the Week of August 4

Dividend Increases/Decreases for the Week of August 4

Aug 4, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Best Idea Booking Holdings Soars!

Best Idea Booking Holdings Soars!

Aug 3, 2023

-

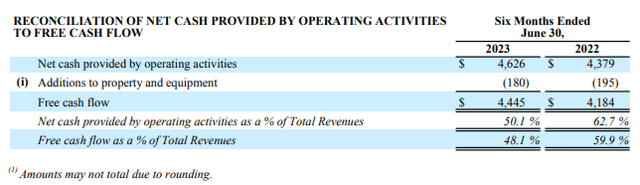

Image: Booking Holdings’ free cash flow conversion is about as good as it gets. The company remains a key idea in the Best Ideas Newsletter portfolio. Image Source: Booking Holdings.

Booking Holdings fits the mold of the type of companies that we’re looking for in this market environment. The company has an asset-light business model that is tied to secular growth trends, all the while it boasts a net cash position and significant free cash flow generation. The company’s outlook also speaks to continued strength as it relates to leisure demand, a key data point suggesting that the broad economic environment remains resilient despite rate increases and the erosion of excess consumer cash savings built up during the COVID-19 pandemic. The quarterly report was welcome news.

|