|

|

Recent Articles

-

Not Expecting Much From Consumer Staples Stocks

Not Expecting Much From Consumer Staples Stocks

Aug 3, 2023

-

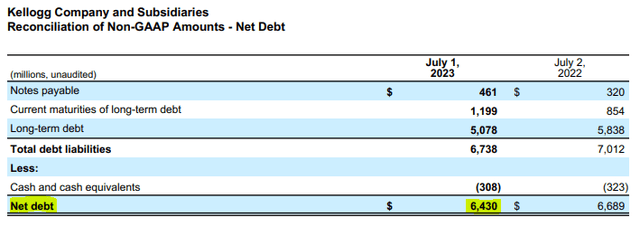

Image: Kellogg is representative of many consumer staples stocks that have considerable net debt positions. Image Source: Kellogg’s second-quarter press release.

Though consumer staples equities have shown tremendous resilience in the face of adversity and their dividend yields can make sense in certain portfolios, the group is overflowing with net debt positions, meager long-term growth prospects, and free cash flow generation that is largely absorbed by growing per-share dividend liabilities. On the other hand, big cap tech and large cap growth have tremendous net cash positions and substantial future expected free cash flow generation, paving the way for what could be considerable long-term return potential. As with the last decade, we expect cash-based sources of intrinsic value to prevail, and for that, we continue to point to big cap tech and large cap growth as areas for consideration.

-

Albemarle Is One of the Best Growth Stories on the Market Today

Albemarle Is One of the Best Growth Stories on the Market Today

Aug 2, 2023

-

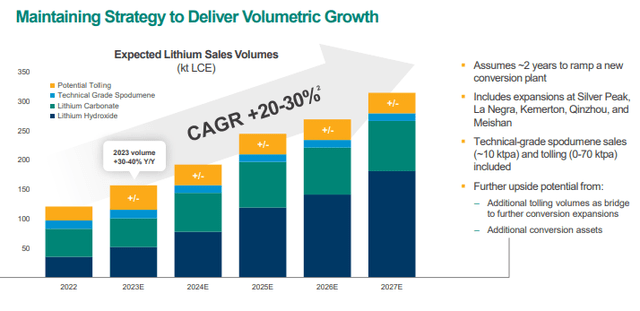

Image: Albemarle is a low-cost producer of lithium derivatives, an end market that is expected to experience tremendous demand in the coming years.

On August 2, Albemarle Corp. reported excellent second-quarter 2023 results that showed net sales advancing 60% and adjusted diluted earnings per share more than doubling in the quarter. For the full-year 2023, net sales are now expected to be between $10.4-$11.5 billion (was $9.8-$11.5 billion) thanks in part to continued strength in electric vehicle (EV) demand. Our fair value estimate for Albemarle stands at $257 per share, well above where shares are currently trading. We think the market is underestimating not only its growth potential but also mid-cycle levels of profitability.

-

ICYMI: Let’s Play Devil’s Advocate: What’s the Bear Case for Realty Income?

ICYMI: Let’s Play Devil’s Advocate: What’s the Bear Case for Realty Income?

Aug 2, 2023

-

Image Source: Realty Income.

It’s helpful to challenge one’s thesis on a favorite idea every now and then, and we’ve done just that with Realty Income in this article. We see three areas of weakness at Realty Income that could challenge our bullish take on the name: 1) its retail exposure, 2) its financial leverage and arguably unwarranted investment-grade credit rating, and 3) the current rising interest rate environment. Perhaps the most compelling component of the bear case on Realty Income is its massive net debt position and present value of future dividend liabilities that dwarf its annual operating cash flow. The REIT business model isn’t as attractive as many make it out to be.

-

Trash Taker Republic Services’ Outlook Keeps Getting Better

Trash Taker Republic Services’ Outlook Keeps Getting Better

Jul 31, 2023

-

Image Source: Republic Services.

Republic Services reported solid second-quarter 2023 results July 31, and it raised its full-year 2023 guidance across the board. During the period ending June 30, 2023, total revenue advanced 9.1% with more than half coming via organic means, while GAAP earnings per share of $1.41 exceeded the consensus forecast by $0.10. Republic Services continues to experience strong pricing power, helping to drive double-digit EBITDA expansion in the quarter. Adjusted free cash flow came in at ~$1.265 billion through the first six months of the year. Earlier in July, Republic Services increased its dividend ~8% to a quarterly payout of $0.535 per share (was $0.495). Shares yield ~1.4% at the time of this writing.

|