|

|

Recent Articles

-

Apple's Looming ‘Watch X’ Likely a Game Changer in Smartwatches

Apple's Looming ‘Watch X’ Likely a Game Changer in Smartwatches

Aug 14, 2023

-

Image Source: Wiyre Media.

Apple is expected to do a refresh of its Apple Watch this year, but the changes won’t be as significant to draw many to upgrade. However, as we look out to fiscal 2024 and fiscal 2025, exciting things could happen. According to a report from Bloomberg, the “Watch X,” marking the 10th anniversary of the rollout of the first Apple Watch, is targeted to include a blood-pressure monitoring tool, among other upgrades. Not only do we think a blood-pressure monitoring tool will drive considerable adoption from many that do not have a smartwatch, but it could also drive a huge market share shift to the device from Samsung and Alphabet’s Fitbit.

-

Dividend Increases/Decreases for the Week of August 11

Dividend Increases/Decreases for the Week of August 11

Aug 11, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Will Crude Oil Prices Hit $100 Again?

Will Crude Oil Prices Hit $100 Again?

Aug 9, 2023

-

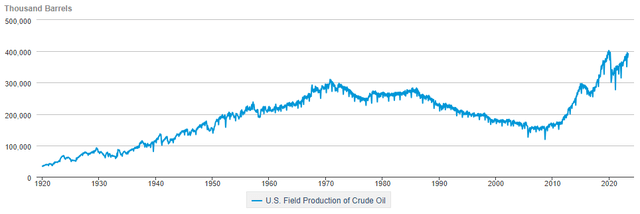

Image: US field production of crude oil is approaching record highs. Source: EIA.

The next few weeks will likely see a rally in energy equities, but we note that U.S. field production of crude oil is approaching all-time highs and will likely eclipse all-time highs this year, given the pace of monthly year-over-year increases. With shale oil abundant and production still advancing nicely, the rise in crude oil prices this summer is largely of the speculative variety, in our view. We could see a run in black gold to the triple digits, but both supply and production remain healthy, and if crude oil prices reach the $100+ mark, we don’t see them staying there for long. We think investors are rotating out of this year’s big winners, a healthy consolidation, and we won’t be making any changes to the newsletter portfolios on account of what we believe is a temporary rotation into energy equities.

-

Berkshire’s Stake in Apple Has Been a Boon for Shareholders

Berkshire’s Stake in Apple Has Been a Boon for Shareholders

Aug 6, 2023

-

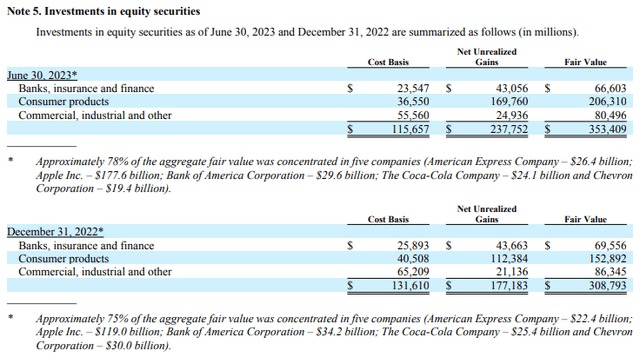

Image: Apple has been a blessing for Berkshire Hathaway. Image Source: Berkshire Hathaway’s second-quarter 2023 10-Q.

Berkshire Hathaway fits the bill of the types of companies we’re looking for in this market environment. The company holds a nice cash position on the books, to the tune of ~$147.4 billion, while notes payable and other borrowings stood at ~$125.3 billion--good for a solid net cash position. Operating cash flow advanced to ~$21.1 billion through the first six months of the year (up from ~$15.4 billion from the same period last year), while purchases of property, plant, and equipment came in at ~$8.4 billion (up from ~$6.8 billion), good enough for free cash flow generation of ~$12.7 billion year-to-date in 2023 (up from ~$8.5 billion). Berkshire’s strong net cash position and impressive free cash flow generating profile are big reasons why we continue to like shares in the Best Ideas Newsletter portfolio.

|