|

|

Recent Articles

-

McDonald’s Returns to Positive Comparable Sales Growth

McDonald’s Returns to Positive Comparable Sales Growth

Aug 13, 2025

-

Image Source: Valuentum.

Looking to all of 2025, McDonald’s is targeting a full year adjusted operating margin in the mid-to-high 40% range, above the 46.3% adjusted operating margin in 2024. McDonald’s remains on pace to open approximately 2,200 restaurants globally this year (1,800 net). We liked McDonald’s return to positive comp growth in the second quarter, but we no longer include the idea in any newsletter portfolios.

-

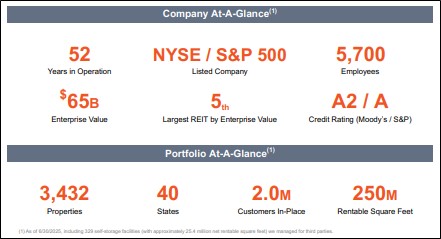

Public Storage Raises Outlook

Public Storage Raises Outlook

Aug 8, 2025

-

Image Source: Public Storage.

Looking to 2025, Public Storage expects revenue growth in the range of -1.3% to 0.8%, with net operating income growth targeted in the range of -2.6% to 0.3% (was -2.9% to 0.2%). Public Storage raised its 2025 non-same store net operating income guidance to the range of $465-$475 million from $444-$464 million previously and its 2025 ancillary net operating income to the range of $200-$205 million from $198-$203 million previously. Interest expense is now targeted at $304 million for the year, up from expectations of $285 million previously. Core FFO per share is now anticipated in the range of $16.45-$17.00, up from the range of $16.35-$17.00. We like Public Storage’s improved outlook and continue to include shares in the High Yield Dividend Newsletter portfolio.

-

Dividend Increases/Decreases for the Week of August 8

Dividend Increases/Decreases for the Week of August 8

Aug 8, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Vertex Reports Strong Q2, Trial Setback Punishes Shares

Vertex Reports Strong Q2, Trial Setback Punishes Shares

Aug 5, 2025

-

Image Source: TradingView.

Though the trial setback in pain management has sent shares of Vertex Pharma tumbling, we continue to like Vertex’s net cash rich balance sheet, cystic fibrosis franchise, its groundbreaking CRISPR/Cas9 gene-edited therapy and its novel non-opioid pain medicine. Shares remain a holding in the Best Ideas Newsletter portfolio. Our $445 per share fair value estimate remains unchanged at this time.

|