|

|

Recent Articles

-

Earnings Roundup: MO, EPD, SBUX, CLX, HON

Earnings Roundup: MO, EPD, SBUX, CLX, HON

Feb 4, 2024

-

Image: Starbucks’ international store growth potential remains robust. Image Source: Starbucks.

High-yielding tobacco giant Altria offered an outlook through 2028 that spoke to continued robust earnings and dividend-per-share expansion. Enterprise Products Partners, now a Dividend Aristocrat, is handling record volumes through its pipeline network, and the firm is investing heavily to drive improved long-term cash flow trends. Starbucks recently disappointed on a number of metrics, but the company's margin and earnings performance remains excellent, as is its international store growth opportunities. Clorox has recovered nicely from a recent cyberattack, and the firm is now forecasting adjusted earnings per share growth in fiscal 2024. We're monitoring its cash flow trends closely, however. Honeywell is targeting tremendous free cash flow growth in 2024 thanks to continued strength in its commercial aerospace operations.

-

Earnings Roundup: ABBV, CVX, NYCB, XOM

Earnings Roundup: ABBV, CVX, NYCB, XOM

Feb 2, 2024

-

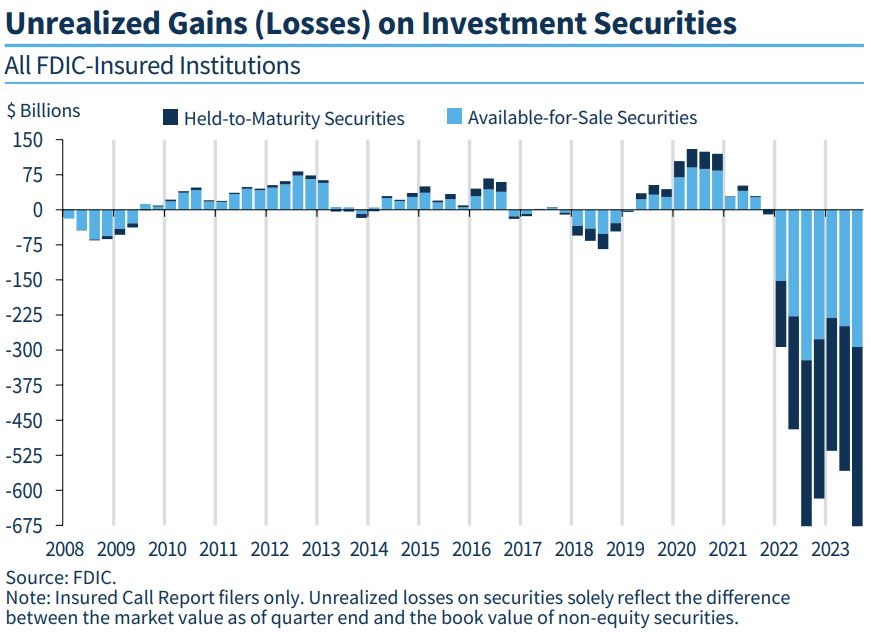

Image: Unrealized losses continue to mount for banking entities due to the Fed's rate-hiking cycle. "Unrealized losses on securities totaled $683.9 billion in third quarter, up $125.5 billion (22.5 percent) from the prior quarter, primarily due to an increase in mortgage rates that reduced the value of mortgagebacked securities. Unrealized losses on held-to-maturity securities totaled $390.5 billion in the third quarter, while unrealized losses on available-for-sale securities totaled $293.5 billion." -- Image Source: FDIC Quarterly.

AbbVie is facing pressure from declining sales of Humira, but the company's long-term outlook looks fine to us bolstered by promising growth of Skyrizi and Rinvoq. Chevron put up mixed fourth-quarter 2023 results, but its free cash flow easily covers its dividend payout. We've grown cautious on Chevron due to its deal making, however. New York Community Bancorp is provisioning for greater credit losses, while its net interest margin is under pressure. The bank recently slashed its payout, and we continue to reiterate why we don't like the dividends of banking firms. Exxon Mobil put up an excellent 2023, and while the firm's dividend is in great shape, we no longer are pursuing new energy-related ideas in the newsletter portfolios at this time.

-

Dividend Increases/Decreases for the Week of February 2

Dividend Increases/Decreases for the Week of February 2

Feb 2, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Big Cap Tech and Large Cap Growth Continue to Lead Market Higher

Big Cap Tech and Large Cap Growth Continue to Lead Market Higher

Feb 1, 2024

-

Image Source: Marco Pakoeningrat.

We continue to like the areas of big cap tech and large cap growth as the top firms in these areas have strong cash-based sources of intrinsic value: net cash on the balance sheet and strong expected future free cash flow generation. After the close February 1, the market received the quarterly earnings reports from Meta Platforms, Amazon, and Apple, and we were pleased by the trio’s performance during the calendar fourth quarter. We maintain our long-held view that big cap tech and large cap growth will continue to lead the market higher, and we continue to overweight these areas in the newsletter portfolios.

|