|

|

Recent Articles

-

Alphabet, Microsoft Remain Cash-Rich, Secular Growth Powerhouses

Alphabet, Microsoft Remain Cash-Rich, Secular Growth Powerhouses

Jan 30, 2024

-

Image Source: Shawn Carpenter.

All eyes were on Alphabet and Microsoft after the bell January 30. We include both Alphabet and Microsoft in the newsletter portfolios due to their tremendous cash-based sources of intrinsic value: net cash on the balance sheet and free cash flow generation. It would take a monumental shift in the trajectory of these fantastic businesses for us to ever consider removing them from the newsletter portfolios, and we’re reiterating our favorable long-term view on both following their respective calendar fourth-quarter reports.

-

Energy Transfer Making a Comeback, Shares Yield ~8.7%

Energy Transfer Making a Comeback, Shares Yield ~8.7%

Jan 28, 2024

-

Image: Energy Transfer is working its way back after a long stretch of underperformance.

On January 25, Energy Transfer raised its dividend modestly, by 0.8%, to $0.315 per share on a quarterly basis, and while Energy Transfer still has a massive net debt position to the tune of ~$47.6 billion, the firm’s traditional free cash flow of the payout suggests sustainability, absent any exogenous shocks. Standard & Poor’s recently upgraded its unsecured debt rating to BBB with a Stable outlook, and the firm’s capital spending guidance for 2023 was recently lowered, further helping free cash flow. Energy Transfer is staging a comeback, and for risk-seeking income investors, its ~8.7% dividend yield is worth a look.

-

14%+ Yielding AGNC Investment May Be Worth a Trade

14%+ Yielding AGNC Investment May Be Worth a Trade

Jan 28, 2024

-

Image: AGNC Investment has managed to level out its dividend payments following a few years of dividend cuts.

We’ve never been fans of the mortgage REIT arena, but some stabilization in the marketplace is likely to be expected, allowing a window for investors to generate what could be a very nice dividend yield on an otherwise very risky, leveraged area. As of the end of last year, AGNC Investment Corp. ended the year with $8.70 in tangible net book value, which increased 7.7% from September. Though the stock trades at a slight premium to its tangible net book value at the time of this writing, management’s positive commentary indicates to us that tangible book value may be poised to rise nicely given a more sanguine backdrop. AGNC Investment Corp. is not for long-term investors, but with its 14%+ dividend yield, the stock could make for a very nice high yield dividend income trade, in our view.

-

Earnings Roundup: V, INTC, HUM, PYPL

Earnings Roundup: V, INTC, HUM, PYPL

Jan 28, 2024

-

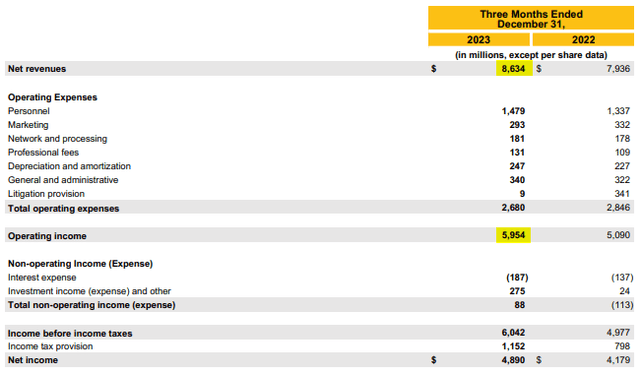

Image: Visa’s operating margins are phenomenal. Image Source: Visa.

Visa's first-quarter fiscal 2024 results were solid, and the firm noted that consumer spending remains resilient, paving the way for what we think will be a strong year. Intel's outlook for 2024 left a lot to be desired, and its balance sheet coupled with free cash flow burn should give more conservative investors pause. Humana's earnings outlook for 2024 spoke of considerable cost pressures, and we think this is yet another data point that the near term will be difficult for many health insurers as pent-up demand for procedures delayed during the pandemic begin to materialize. PayPal's stock remains in the dog house, and while its recently-announced innovations are great, consumer sentiment remains poor on the name.

|