|

|

Recent Articles

-

In the News: Inflation, Walgreens, SPACs/IPOs, and Marine Insured Losses

In the News: Inflation, Walgreens, SPACs/IPOs, and Marine Insured Losses

Mar 29, 2024

-

Inflation comes in-line with expectations regarding the critical PCE price index release for February. Walgreens remains in the doghouse following the firm's recent dividend cut. SPACs and IPOs are alive and well with Redditt hitting the market and Trump Media & Technology garnering interest. The tanker Dali collided into Baltimore's Francis Scott Key Bridge, causing loss of life and billions in estimated insured damages.

-

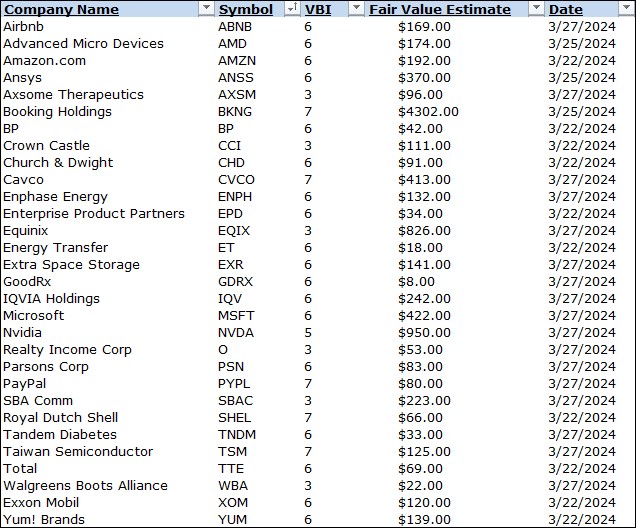

Latest Report Updates

Latest Report Updates

Mar 29, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of March 29

Dividend Increases/Decreases for the Week of March 29

Mar 29, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

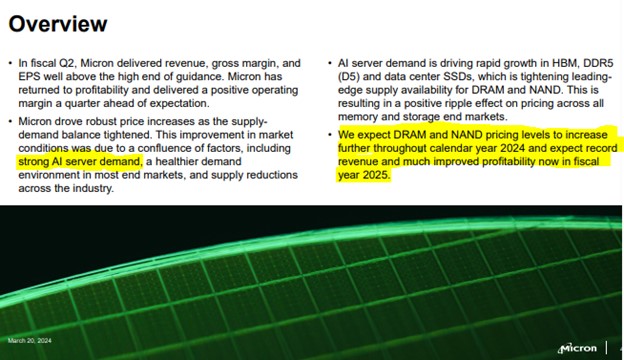

Micron Issues Strong Outlook, Points to Multi-Year Opportunity in AI

Micron Issues Strong Outlook, Points to Multi-Year Opportunity in AI

Mar 28, 2024

-

Image Source: Micron.

Micron operates in the ultra-cyclical semiconductor industry, and while the next few quarters may be robust, we’re cautious on the sustainability of the momentum and pricing health beyond the next few quarters, despite management’s optimism in fiscal 2025. Free cash flow has also been negative during the first six months of its fiscal year, and its net debt position precludes it from being a net-cash-rich, free-cash-flow generating powerhouse like so many other companies in the technology space. All things considered, we liked Micron’s quarterly report and outlook, but it’s not enough for us to pull the trigger on the idea for the Best Ideas Newsletter portfolio.

|