|

|

Recent Articles

-

Boeing Shakes Up Executive Team

Boeing Shakes Up Executive Team

Mar 27, 2024

-

Image Source: Kanesue.

We like the shake-up in the executive suite at Boeing, and while there is much work to do to get Boeing back on track to improve relations with the public regarding the safety of their planes following a number of incidents the past few years, we're optimistic the changes will be a means to that end. Boeing continues to benefit from its oligopolistic position in the aircraft making industry, and its backlog of unfulfilled deliveries remains robust. We're not changing our fair value estimate of Boeing as a result of the management shakeup, but we don't have any plans of adding Boeing to any newsletter portfolio at this time either.

-

McCormick Targeting Strong Adjusted Earnings Growth in Fiscal 2024

McCormick Targeting Strong Adjusted Earnings Growth in Fiscal 2024

Mar 26, 2024

-

Image Source: McCormick.

On March 26, spice maker McCormick & Company reported solid first quarter fiscal 2024 results for the period ended February 29. The company’s sales advanced 2% on a constant-currency basis, while adjusted operating income increased 4% on a constant-currency basis. Adjusted earnings per share came in at $0.63 compared to $0.59 in the same period last year, showcasing a 7% year-over-year increase. The results were good enough to send the stock meaningfully higher following the report.

-

Fedex Bolstered By Cost Savings from Its DRIVE Program

Fedex Bolstered By Cost Savings from Its DRIVE Program

Mar 25, 2024

-

Image: FedEx continues to extract cost savings from its DRIVE initiatives.

FedEx is doing a lot of things right as it drives cost savings from its DRIVE program in the face of a challenging revenue environment. Shares of FedEx bounced nicely following the release of its fiscal third quarter report, and while they aren’t trading at bargain basement prices on the basis of our fair value estimate, we think shares could have upside to north of $300 based on the high end of our fair value estimate range. Shares yield ~1.8% at the time of this writing.

-

Ameresco’s Shares Under Pressure Despite Record Backlog and Asset Pipeline Metrics

Ameresco’s Shares Under Pressure Despite Record Backlog and Asset Pipeline Metrics

Mar 24, 2024

-

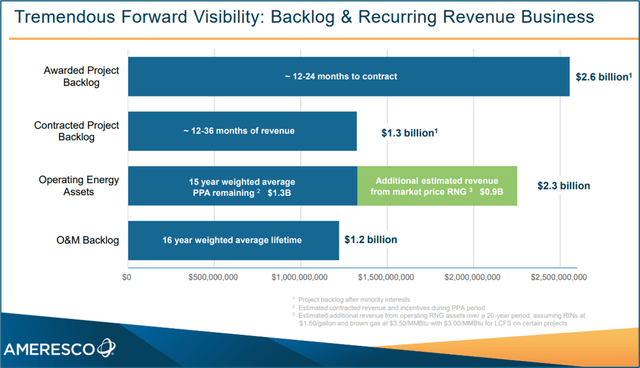

Image Source: Ameresco’s backlog of opportunities remains robust.

We like the trajectory of Ameresco’s backlog, its order momentum as well as commentary that “proposal activity (remains) at an all-time high.” The company’s track record and technical know-how suggest to us that win rates will likely continue to be healthy. That said, we continue to monitor Ameresco’s debt position and adjusted operating cash flow trends closely, and while the firm remains an idea in the ESG Newsletter portfolio, we’re viewing it as a source of cash should another ESG idea present a better risk-reward opportunity.

|