|

|

Recent Articles

-

Walmart Winning Business as Consumers Remain Cost Conscious

Walmart Winning Business as Consumers Remain Cost Conscious

May 16, 2024

-

Image Source: Walmart.

Walmart is doing a fantastic job connecting with the consumer and delivering where it matters, both with respect to convenience and savings. Its e-commerce business contributed ~280 basis points to Walmart U.S.’s comp in the most recently reported quarter, for example. Traction with respect to store-fulfilled pickup and delivery are two main considerations driving Walmart’s comp resilience, while consumers continue to enjoy buying in bulk via Sam’s Club. We like Walmart’s positioning in the current retail environment as the firm continues to attract the cost-conscious consumer amid a step change in consumer goods inflation the past couple years.

-

Cisco Still Looks Cheap, Shares Yield ~3.2%

Cisco Still Looks Cheap, Shares Yield ~3.2%

May 16, 2024

-

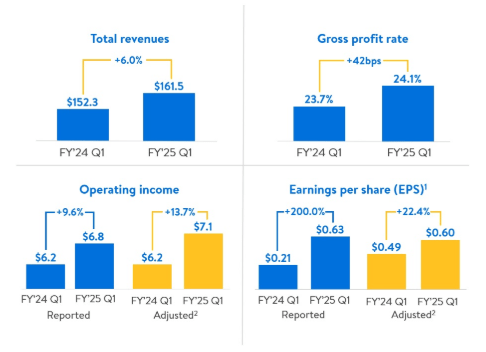

Image Source: Cisco.

Shares of Cisco are trading at an attractive 13.4x multiple of current fiscal year earnings, while shares yield ~3.2% on a forward estimated annualized basis. We like its position in the newsletter portfolios.

-

Home Depot Sees Softness in Some Larger Discretionary Projects

Home Depot Sees Softness in Some Larger Discretionary Projects

May 14, 2024

-

Image Source: Home Depot continues to experience some softness in sales of big ticket items.

Though Home Depot noted a delayed start to spring and softness in big ticket items, we like the company’s resilience through thick and thin, and it remains a key idea in the Dividend Growth Newsletter portfolio.

-

Energy Transfer Ups Adjusted EBITDA Guidance for 2024

Energy Transfer Ups Adjusted EBITDA Guidance for 2024

May 13, 2024

-

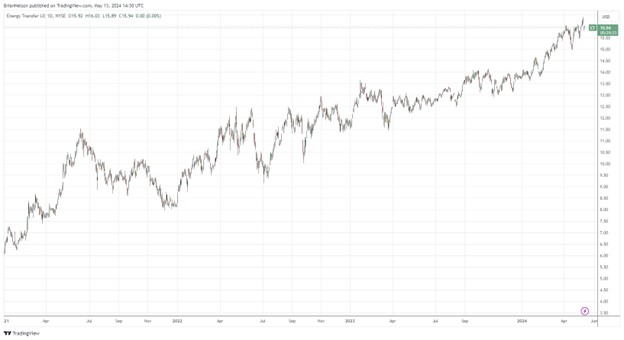

Image: Energy Transfer’s financials are in much better shape than they were years ago.

Energy Transfer's cash flow from operations during the first quarter of 2024 was $3.772 while the firm spent $795 million in capital spending, resulting in traditional free cash flow of ~$2.98 billion, far in excess of distributions paid to partners, noncontrolling interests, and redeemable noncontrollable interests. We like Energy Transfer’s EBITDA growth, free cash flow coverage of the distribution, and improved credit quality. The pipeline operator has come a long way in the past decade.

|