Member LoginDividend CushionValue Trap |

There Will Be Volatility

publication date: Oct 22, 2023

|

author/source: Brian Nelson, CFA

By Brian Nelson, CFA Last year, 2022, was a big test for equity investors, and the downside volatility that we witnessed during the year wasn’t comfortable, to say the least. Following the COVID-19 crash and rebound during 2020, and then the market surge in 2021, it wouldn’t be a stretch to say many investors’ heads are probably still spinning from all the volatility witnessed to start this decade. That said, part of what we’ve been warning about the past few years with respect to the equity market, especially in Value Trap, is that the proliferation of price-agnostic trading (e.g. quant, machine/algorithmic trading, etc.) will only lead to more and more market volatility, so while we were somewhat surprised by last year’s market swoon, we’re not at all surprised by the heightened volatility, nor the sector/style leadership that has emerged during 2023 once again in big cap tech and large cap growth, which are overflowing with cash-based sources of intrinsic value. It’s difficult to say this, but many income-oriented equity investors may continue to feel the pinch when it comes to their capital as yields continue to rise. Many dividend payers, dividend growers, and high yielders are ultra-sensitive to rising interest rates (as interest rates rise, many dividend investors flee to fixed-income instruments), and while many believe popular areas of dividend investing such as equity REITs, utilities and consumer staples stocks are safe havens in today’s market environment, we beg to differ. But why? Well, their financials don’t speak of safety at all, particularly their balance sheets. Instead, we maintain the areas of big cap tech and large cap growth represent not only the best areas for capital appreciation potential but also for downside risk protection, and 2023 has proven so. With their tremendous net cash positions and strong expected free cash flow generation, these entities do not need the markets to even be “open,” unlike many equity REITs and other companies that are spending (cash flow from investing) more than what they generate in operating cash flow. Cash is and will always be king when it comes to valuation and the markets. In many ways, we arrive at big cap tech and large cap growth as our favorite areas in the market, almost by default. Equity REITs are heavily tied to the capital markets, while utilities and consumer staples equities are very net-debt heavy. We also don’t like many banking entities, and this was on clear display earlier this year with the well-publicized regional bank runs. Banks generate cash from cash, meaning that assessing free cash flow for the group is rather murky at best, and it’s difficult to get a true handle on what their businesses are worth given what could be massive changes coming to the financial industry that may require higher capital positions (lower ROE) and less risky dealings. Nobody wants to wonder whether their savings are safe at their local bank, and regulators may work to ensure that’s the case going forward with stricter controls. Mom and pop should be focusing on enjoying their golden years, not worrying about capital ratios at their local banks, as if these measures are even a good way to truly gauge risk either. To us, banks will always be too overleveraged and tied to volatile capital market conditions, especially when compared to the net-cash-rich, free-cash-flow generating powerhouses of big cap tech and large cap growth. We only include a broad-based financials ETF in the newsletter portfolios for diversification reasons. As it relates to the energy and healthcare spaces, we also include broad based ETFs in the newsletter portfolios primarily for diversification reasons. Energy equities will often follow expectations of energy resource pricing, making broad based ETFs a great proxy for collective exposure to the group, while broad based healthcare ETFs offer even more “shots on goal” when it comes to capitalizing on a collection of pharma entities’ pipeline of drugs, rather than playing the hit-or-miss game in any one biotech's pipeline. For energy stocks, betting on the direction of crude oil prices is a difficult proposition (just ask the airlines), while betting on the next winning drug of a pharma/biotech should probably only comprise but a very small portion of one’s equity portfolio, in our view. We’re still big fans of biotech Vertex Pharma (VRTX) as the company’s cystic fibrosis franchise remains a cash cow, and its prospects in pain management could help to provide an answer to the opioid epidemic. In any case, where we have a clear line of sight with respect to healthy balance sheets and free cash flow generation in big cap tech and large cap growth, other sectors are just murkier with respect to these cash-based sources of intrinsic value. Again, we're drawn to big cap tech and large cap growth almost by default. The elephant in the room remains the 10-year Treasury rate, which is roughly 5% at last check, and that means generally lower equity and bond prices in the near term, but not always. The long-run average of the 10-year Treasury rate isn’t too far off from where it is currently trading, so investors shouldn’t get panicky. In fact, investors should never panic. Some investors are expecting the 10-year Treasury to go higher as the Fed may have to continue to battle inflation in a weakening economy, but we’re not rushing to make any prognostications with respect to what the Fed may do from here or where the economy may go (the stock market is not the economy). Our valuation models assume a long-term average 10-year Treasury rate of ~4.3%, and we’ve been at this level for some time, so we won’t be making any fair value estimate changes based on our 10-year Treasury assumption rate, which will remain unchanged in our valuation models. Despite the rise in the spot 10-year Treasury rate though, the stylistic area of large cap growth, as measured by the Schwab Large Cap Growth ETF (SCHG) is still up more than 30% so far this year--and while these companies are coming off a very difficult 2022, we expect their leadership to continue.

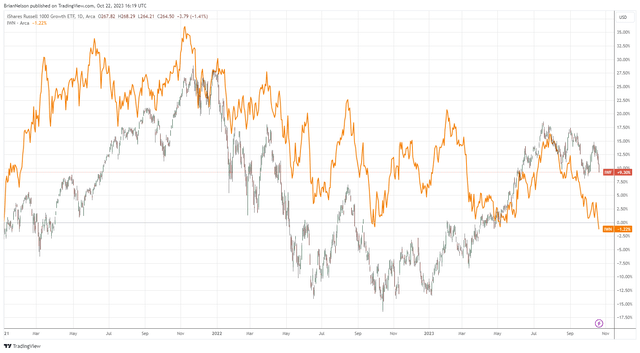

Image: An ETF tracking Russell 1000 "growth" stocks has outperformed an ETF tracking Russell 2000 "value" stocks since the beginning of 2021. Oftentimes, investors want to find hidden gems--and we’ve done so with many in the Exclusive publication--but other times, the best ideas are right in plain sight, as the biggest "growth" companies have held up better than the smallest "value" companies so far in 2021-2023 (see above image). Stock prices and returns are in part driven by net cash that a company has on its balance sheet and changes in future expectations of free cash flow, and large companies tend to have the strongest cash-based sources of intrinsic value. It's probably a good time to remind readers that the dividend, itself, is a symptom, not a driver behind a company’s business valuation, and the dividend is only meaningful when it is paid out of free cash flow, from our perspective. Financially engineered payouts, where a company is dependent on the capital markets for more and more capital to fund investments, are often at the biggest risk of being cut during difficult times, and for investors seeking capital appreciation potential, these types of companies should generally be avoided, in our view. A close look at the price charts of large dividend paying entities reveals that the stock price is adjusted downward by the amount of the dividend on the ex-dividend date, so be careful with high yielders. Make sure you're investing in the company, not just hoping to reap the dividends of a cigar butt. In these cases, one is likely just trading capital for income, and betting on the performance of a subpar company to largely get paid with one's own money. Excluding dividends, the S&P 500 is up more than 50% during the past 5 years, and the index is still much higher than the peak prior to the COVID-19 collapse, and we view this as pretty good. With concerns about “higher interest rates for longer,” a looming recession, and ongoing geopolitical concerns, sometimes the best move is no move at all, and that’s kind of how we feel when it comes to the simulated newsletter portfolios. Perhaps we were premature to remove Meta Platforms (META) from the newsletter portfolios some time ago, but for those that want to have reduced exposure to big cap tech and the stylistic area of large cap growth, then that actually wasn’t too bad of a move. Meta Platforms did cost some performance during 2022, but it didn’t derail the "outperformance" that the entire simulated Best Ideas Newsletter portfolio delivered last year. The latest update to our report of Meta Platforms showed that the company has returned to a net-cash-rich, free-cash-flow generating machine with top-line growth potential, but we’re not looking back on this one given what were clearly evident challenges to its business during 2022. To us, the market remains hypersensitive to almost every economic data point that hits the wires, and we’re just not going to play that game. The macro headlines and never-ending news flow are what many quant and algorithmic traders are trading on, and to a very large extent, for investors with a long-term horizon, these macro data points just don’t factor into the equation. When valuing equities, we’re always after mid-cycle expectations, not peak or trough performance, so our valuations implicitly embed a "normal" recession. Warren Buffett didn’t become a billionaire buying and selling on macro data points, and volatility is simply to be expected given the proliferation of price-agnostic trading these days. Instead of panicking over higher interest rates, we think investors should view the Fed’s work thus far as future potential dry powder to stimulate both the economy and the markets. Whenever you feel like stocks are no good, have a read of Warren Buffett’s classic piece written during the Great Financial Crisis, “Buy American. I Am.” To us, we still like stocks for the long run. Happy investing! ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment