|

|

Recent Articles

-

Target’s First Quarter Results Weren’t as Good as Walmart’s

Target’s First Quarter Results Weren’t as Good as Walmart’s

May 22, 2024

-

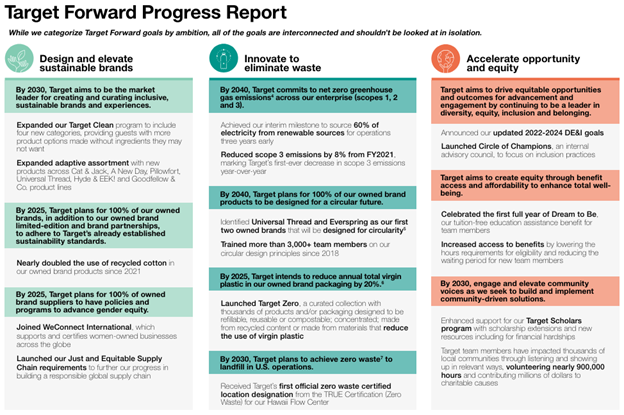

Image Source: Target.

Though Target is working hard to get back on track, it's difficult for us to grow excited about dabbling in Target’s shares given the stiff 3.1% decline in total revenue in the first quarter coupled with increased competition from Walmart and Costco that won’t be going away. We think Walmart and Costco are much better positioned for the current market environment than Target.

-

Lowe’s First Quarter Results Come in Better Than Feared

Lowe’s First Quarter Results Come in Better Than Feared

May 21, 2024

-

Image Source: Lowe's.

Lowe’s continues to navigate a post-pandemic market environment and a relatively stagnant housing market. Comparable store sales were impacted by sluggish Do-It-Yourself [DIY] big ticket discretionary purchases, but strength was evident in sales in Pro and online. The firm reaffirmed its 2024 outlook.

-

Latest Report Updates

Latest Report Updates

May 17, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of May 17

Dividend Increases/Decreases for the Week of May 17

May 17, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|