|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of May 24

Dividend Increases/Decreases for the Week of May 24

May 24, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Accenture Facing Revenue Growth Pressures But Stock Is Worth a Look

Accenture Facing Revenue Growth Pressures But Stock Is Worth a Look

May 23, 2024

-

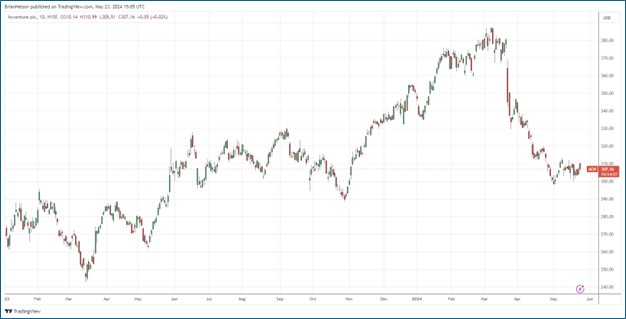

Image: Accenture is facing revenue growth pressure, but the company’s financials remain resilient.

We’re concerned about Accenture’s downward financial guidance revisions in March and pressure on demand growth for its IT and consulting services, but Accenture’s free cash flow generation remains robust, its balance sheet remains solid, and new bookings growth remains healthy with exposure to AI. Accenture pays a healthy dividend, and the firm continues to buy back stock. The company checks a lot of the boxes that we’d be looking for in a new idea, but we’d like to see evidence of revenue growth improvement before growing interested in adding the company to any newsletter portfolio. We remain on the sidelines for now.

-

Nvidia Remains a Free Cash Flow Generating Powerhouse

Nvidia Remains a Free Cash Flow Generating Powerhouse

May 23, 2024

-

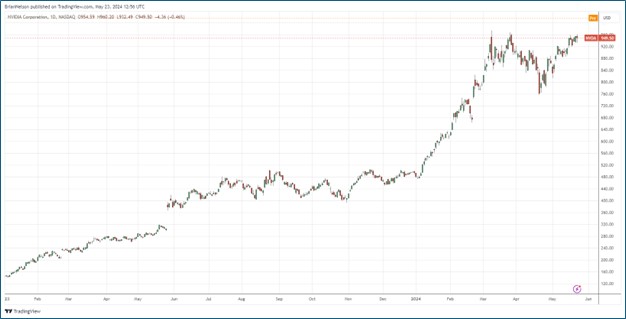

Image: Nvidia’s first-quarter fiscal 2025 results delivered, and the company remains a Wall Street darling of a stock.

Nvidia continues to be the poster child for the AI revolution, and its first-quarter fiscal 2025 results delivered on the high expectations embedded in the company’s stock. The firm announced a 10-for-1 stock split, while it raised its quarterly cash dividend 150%.

-

TJX Reports Strong First Quarter Results; Raises Fiscal 2025 Guidance

TJX Reports Strong First Quarter Results; Raises Fiscal 2025 Guidance

May 22, 2024

-

On May 22, TJX Companies reported strong first quarter results and increased its outlook for fiscal 2025. Net sales for the quarter ended May 4, 2024, advanced ~6% from the same period a year ago thanks in part to consolidated same store sales that increased ~3% due to strength in customer transactions. Diluted earnings per share came in at $0.93 versus $0.76 in the same period of fiscal 2024. The off-price apparel and home fashions retailer continues to deliver for consumers and investors alike. We like the company.

|