|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of May 31

Dividend Increases/Decreases for the Week of May 31

May 31, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

In the News: CRM, FL, DG, BBY

In the News: CRM, FL, DG, BBY

May 30, 2024

-

Image Source: Mike Mozart.

Salesforce issued a weaker-than-expected outlook for its fiscal second quarter 2025, and shares have been punished following the report. Foot Locker's bottom-line guidance for its full year pleased the Street, while Dollar General continues to benefit from increased store traffic. Best Buy's comparable store sales remain under considerable pressure, but the big box retailer is managing expenses well.

-

Dick’s Sporting Goods Puts Up Strong First Quarter, Raises Guidance

Dick’s Sporting Goods Puts Up Strong First Quarter, Raises Guidance

May 29, 2024

-

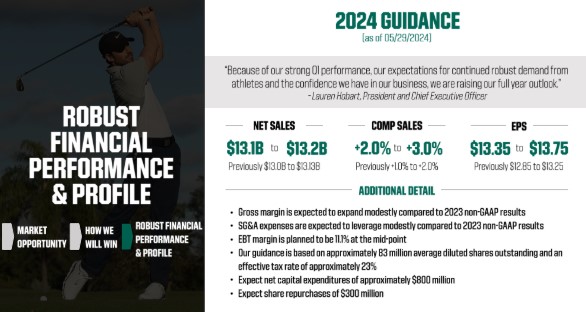

Image: Dick’s Sporting Goods’ guidance pleased investors. Image Source: Dick’s Sporting Goods.

On May 29, Dick’s Sporting Goods reported excellent first quarter results that beat expectations on both the top and bottom lines. We continue to like Dick’s Sporting Goods as an idea in the Dividend Growth Newsletter portfolio. The company was recently highlighted as top dividend growth stock for the long run. Shares yield ~2.26% on a forward estimated basis.

-

NextEra Energy Expects 10% Annual Dividend Growth Through 2026

NextEra Energy Expects 10% Annual Dividend Growth Through 2026

May 24, 2024

-

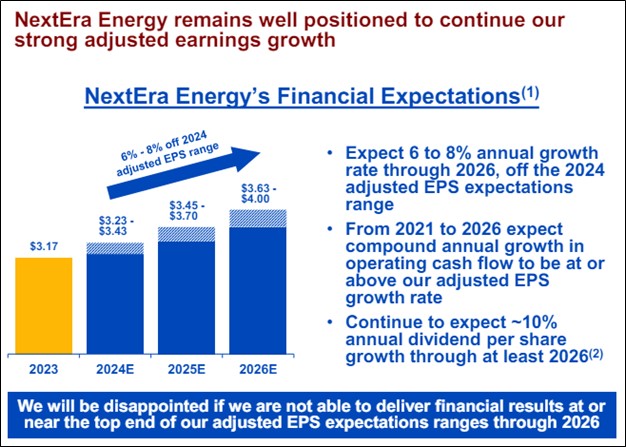

Image Source: NextEra Energy.

NextEra Energy reaffirmed its long-term outlook. For the current year, management expects adjusted diluted earnings per share in the range of $3.23-$3.43, with the measure targeted to increase to $3.45-$3.70 per share in 2025 and $3.63-$4.00 per share in 2026. The company also reiterated its expectations to grow its dividends per share at approximately a 10% clip each year through at least 2026, using 2024 as the baseline. We like the company’s expected pace of dividend growth and its position as a leading clean energy company.

|