|

|

Recent Articles

-

Hewlett Packard Enterprise Reports Strong AI Systems Revenue

Hewlett Packard Enterprise Reports Strong AI Systems Revenue

Jun 5, 2024

-

Image: Hewlett Packard Enterprise is breaking out nicely.

We liked the AI-related news from Hewlett Packard Enterprise, and shares were up nicely following the report. Hewlett Packard Enterprise’s cash flow performance was also solid, with free cash flow increasing $322 million, to $610 million, for the three months ended April 30, 2024. HPE’s revenue growth for fiscal 2024 is now expected to expand 1%-3% in constant currency (was 0%-2%) and non-GAAP diluted earnings per share in the range of $1.85-$1.95 per share, the midpoint above the $1.88 per share the Street had been expecting at the time.

-

Waste Management to Acquire Stericycle

Waste Management to Acquire Stericycle

Jun 3, 2024

-

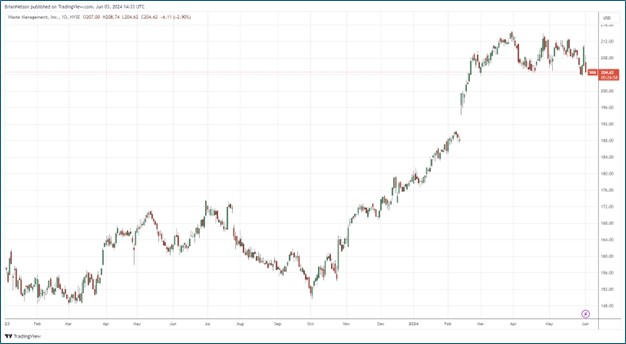

Image: Waste Management’s shares have done quite well the past 12-18 months.

The oligopolistic nature of the waste business is something that we like a lot, and while Waste Management’s deal for Stericycle will be more complementary in nature bringing in an incremental suite of medical waste and secure information destruction services, we have no qualms with the acquisition.

-

Costco’s Comparable Store Sales Deliver

Costco’s Comparable Store Sales Deliver

Jun 2, 2024

-

Image Source: Costco.

On May 30, Costco reported solid third quarter results for its fiscal 2024 period ended May 12. Net sales for the quarter increased 9.1% thanks to total company adjusted comparable sales performance of 6.5% and e-commerce growth of 20.7%. We like Costco’s business quite a bit, but shares are trading at quite the lofty earnings multiple (~50 times fiscal 2024 earnings expectations). We’d wait for a meaningful pull back in shares before taking interest in the name.

-

Latest Report Updates

Latest Report Updates

Jun 1, 2024

-

Check out the latest report updates on the website.

|