|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of June 21

Dividend Increases/Decreases for the Week of June 21

Jun 21, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Kroger’s Identical Store Sales Beat Consensus

Kroger’s Identical Store Sales Beat Consensus

Jun 20, 2024

-

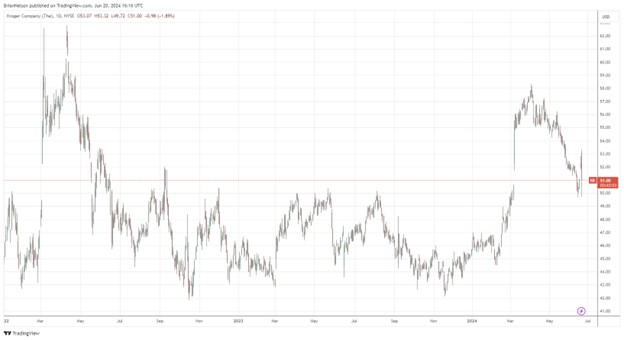

Image: Kroger’s shares have been choppy during the past couple years.

Kroger reaffirmed its full-year 2024 guidance. The company expects identical-store without fuel of 0.25%-1.75%, adjusted FIFO operating profit of $4.6-$4.8 billion and adjusted net earnings per diluted share of $4.30-$4.50. Adjusted free cash flow is targeted in the range of $2.5-$2.7 billion on capital expenditures of $3.4-$3.6 billion for the year. Kroger ended the quarter with ~$12.2 billion in debt and $345 million in cash. All things considered, we liked Kroger’s report, but uncertainties regarding its deal with Albertsons coupled with a large net debt position leave us on the sidelines. Shares yield ~2.2% at the time of this writing.

-

Lennar Navigating Fluctuating Interest Rate Environment Well

Lennar Navigating Fluctuating Interest Rate Environment Well

Jun 18, 2024

-

Image: Lennar has been a strong performer since the beginning of 2023.

We liked the quarterly update from Lennar, and while we won’t be adding this homebuilder to any newsletter portfolio, we’re interpreting its performance as another positive data point regarding the macroeconomic environment.

-

Adobe’s Outlook Doesn’t Disappoint

Adobe’s Outlook Doesn’t Disappoint

Jun 17, 2024

-

Image: Adobe’s shares are getting back on track after it issued a strong outlook for fiscal 2024.

We like Adobe’s asset-light business model, strong free cash flow generation, and better-than-expected outlook, but we’re already quite tech heavy in the newsletter portfolios.

|