|

|

Recent Articles

-

Latest Report Updates

Latest Report Updates

Jun 14, 2024

-

Check out the latest report updates on the website.

-

Dividend Increases/Decreases for the Week of June 14

Dividend Increases/Decreases for the Week of June 14

Jun 14, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Broadcom Issues Strong Guidance, Announces Stock Split

Broadcom Issues Strong Guidance, Announces Stock Split

Jun 13, 2024

-

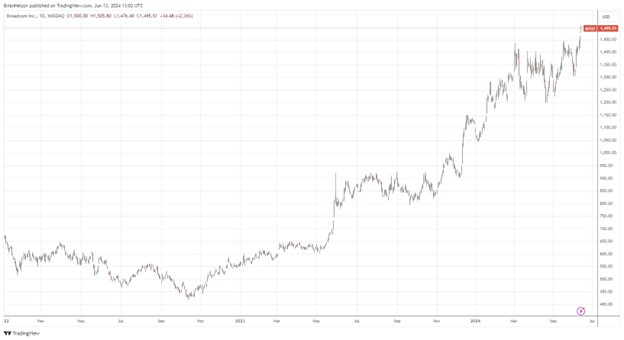

Image: Broadcom’s shares have done quite well in the past couple of years. We liked its fiscal second quarter results and outlook.

Broadcom’s fiscal second quarter results were fantastic, and its levels of profitability are a sight to see. We like the momentum behind its operations, its forward-looking guidance, as well as its free cash flow generating capacity. Shares yield ~1.4% at the time of this writing.

-

Oracle Misses in Q4 But Bookings Performance and Outlook Strong

Oracle Misses in Q4 But Bookings Performance and Outlook Strong

Jun 12, 2024

-

Image: Oracle’s shares have done quite well since the beginning of 2023, and management’s outlook speaks to continued strength.

We liked Oracle’s cash flow performance for fiscal 2024 and outlook for not only fiscal 2025 but also its positive commentary associated with the momentum it has built for fiscal 2026. We continue to like Oracle as an idea for the Dividend Growth Newsletter portfolio and ESG Newsletter portfolio. Shares yield ~1.3% at the time of this writing.

|