|

|

Recent Articles

-

Latest Report Updates

Latest Report Updates

Jun 25, 2024

-

Check out the latest report updates on the website.

-

Carnival Corp. Experiencing Strong Demand Trends

Carnival Corp. Experiencing Strong Demand Trends

Jun 25, 2024

-

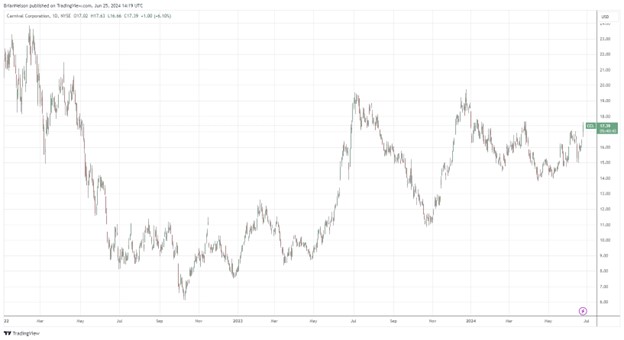

Image: Carnival Corp.’s shares have bounced from its 2022 lows, but the company has yet to return to new highs, despite strong bookings demand.

On June 25, Carnival Corp. reported better-than-expected second quarter results for fiscal 2024. The company is experiencing strong bookings momentum and generated record booking volumes for 2025 sailings. The strong demand is facilitating higher prices (in constant currency) for orders taken during 2024 and its most recently completed second quarter, in particular.

-

FactSet Research Reveals Softness on Top Line

FactSet Research Reveals Softness on Top Line

Jun 24, 2024

-

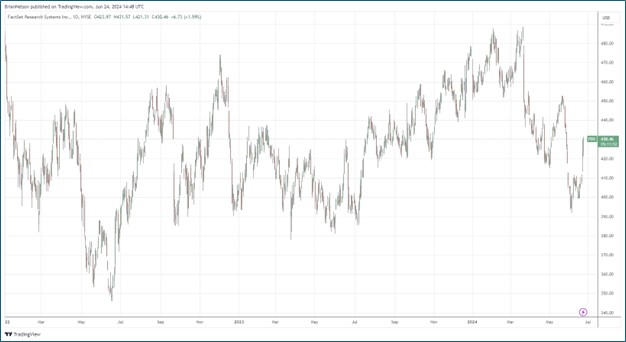

Image: FactSet’s shares have been choppy the past couple years.

On June 21, FactSet Research reported mixed third-quarter fiscal 2024 results that showed revenue increasing 4.3%, in-line with expectations, and adjusted diluted earnings per share of $4.37, up 15.3% from last year’s quarter and better than what the Street was looking for. Quarterly free cash flow was $216.9 million, up 12.6%. FactSet’s recent 6% dividend increase marked the 25th consecutive year the firm has raised its dividend on a stock split-adjusted basis. Shares yield ~1%.

-

CarMax Dealing with Vehicle Affordability Issues

CarMax Dealing with Vehicle Affordability Issues

Jun 21, 2024

-

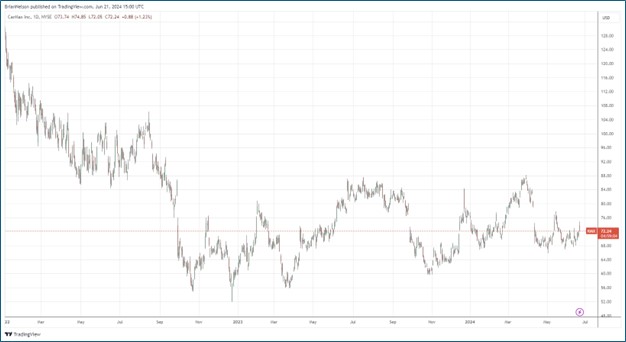

Image: CarMax’s shares have yet to recover from prior year highs.

CarMax’s quarter wasn’t great, and while industry trends are improving, stiff headwinds are still prevalent. We remain on the sidelines with respect to shares.

|