|

|

Recent Articles

-

JPMorgan Chase’s Return on Capital Shines in Second Quarter

JPMorgan Chase’s Return on Capital Shines in Second Quarter

Jul 12, 2024

-

Image Source: Hakan Dahlstrom.

On July 12, JPMorgan Chase reported second quarter results that beat expectations on the top line, but came up a bit short on the bottom line. JPMorgan is an important bellwether for the global economy, and its second quarter results spoke of continued strength and high returns on capital. We include Financial Select SPDR in the Best Ideas Newsletter portfolio to capture diversification benefits from the largest financial institutions. Shares of JPM yield 2.2% at the time of this writing.

-

Dividend Increases/Decreases for the Week of July 12

Dividend Increases/Decreases for the Week of July 12

Jul 12, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Delta Air Lines Speaks of Industry Fare Pressures

Delta Air Lines Speaks of Industry Fare Pressures

Jul 11, 2024

-

Image Source: Colin Brown.

Delta Air Lines reported disappointing second-quarter results on July 11 with both revenue and non-GAAP earnings per share coming in lower than expected. The company put up record June quarter revenue, which reached $15.4 billion on an adjusted operating basis, up 5.4% from the same period a year ago, but the Street was looking for more. Earnings per share of $2.36 also missed the consensus forecast. Though airlines have largely rationalized capacity in recent years, fare pressures are starting to weigh on performance. We maintain our view that airlines are not long-term investments given their leverage to a cyclical economy and volatile jet fuel prices.

-

PepsiCo Adjusts Organic Revenue Growth Guidance

PepsiCo Adjusts Organic Revenue Growth Guidance

Jul 11, 2024

-

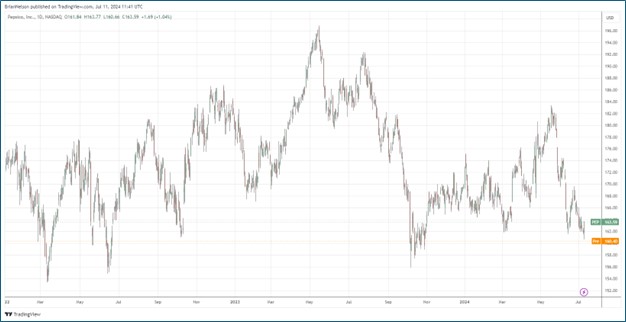

Image: PepsiCo’s shares have been choppy since the beginning of 2022.

We’re not reading too much into PepsiCo's modest downward organic revenue growth guidance revision for 2024 (approximated 4% versus at least 4%), as the firm's underlying profitability remains strong, with expectations for at least 8% core constant currency expansion in 2024. Total cash returns to shareholders is targeted at $8.2 billion for 2024, consisting of dividends of $7.2 billion and share repurchases of $1 billion. For the 24 weeks ended June 15, PepsiCo had negative free cash flow, while it retained a hefty net debt position on the balance sheet. Though PepsiCo is not a net-cash-rich, free cash flow generating powerhouse, we like the diversification benefits it provides in the Best Ideas Newsletter portfolio.

|