|

|

Recent Articles

-

3 High Dividend Yielders for Consideration

3 High Dividend Yielders for Consideration

Jul 8, 2024

-

Image: Energy Transfer, Philip Morris, and Altria have outperformed the SPDR S&P 500 Dividend ETF since the beginning of 2024.

The market remains laser-focused on inflation readings and employment trends – two of the main dynamics that influence policy at the Federal Reserve. Since the beginning of 2024, the market has ratcheted down expectations of rate cuts from as many as 5 or 6 to just 1 or 2 in 2024. With yields on risk-free instruments poised to go lower soon, a focus on high yielding equities may be appropriate for the income investor. Here are three high dividend yielders that we like for consideration.

-

Latest Report Updates

Latest Report Updates

Jul 7, 2024

-

Check out the latest report updates on the website.

-

Constellation Brands’ Beer Business Continues to Propel Results

Constellation Brands’ Beer Business Continues to Propel Results

Jul 6, 2024

-

Image Source: Constellation Brands.

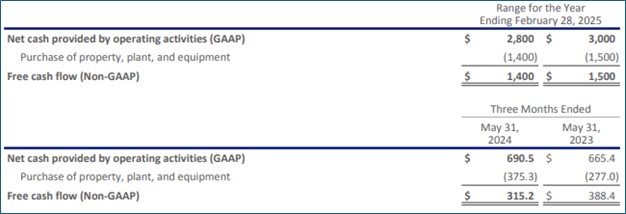

On July 3, alcoholic beverages giant Constellation Brands reported mixed first quarter fiscal 2025 results, where revenue came in a bit light relative to expectations, but non-GAAP earnings per share was better than the consensus forecast. Comparable net sales increased 6%, while comparable operating income jumped 12%. Comparable earnings per share advanced 17%, to $3.57. Shares yield ~1.6% at the time of this writing.

-

Tesla’s Deliveries Bounce Back in Second Quarter

Tesla’s Deliveries Bounce Back in Second Quarter

Jul 6, 2024

-

Source: Tesla.

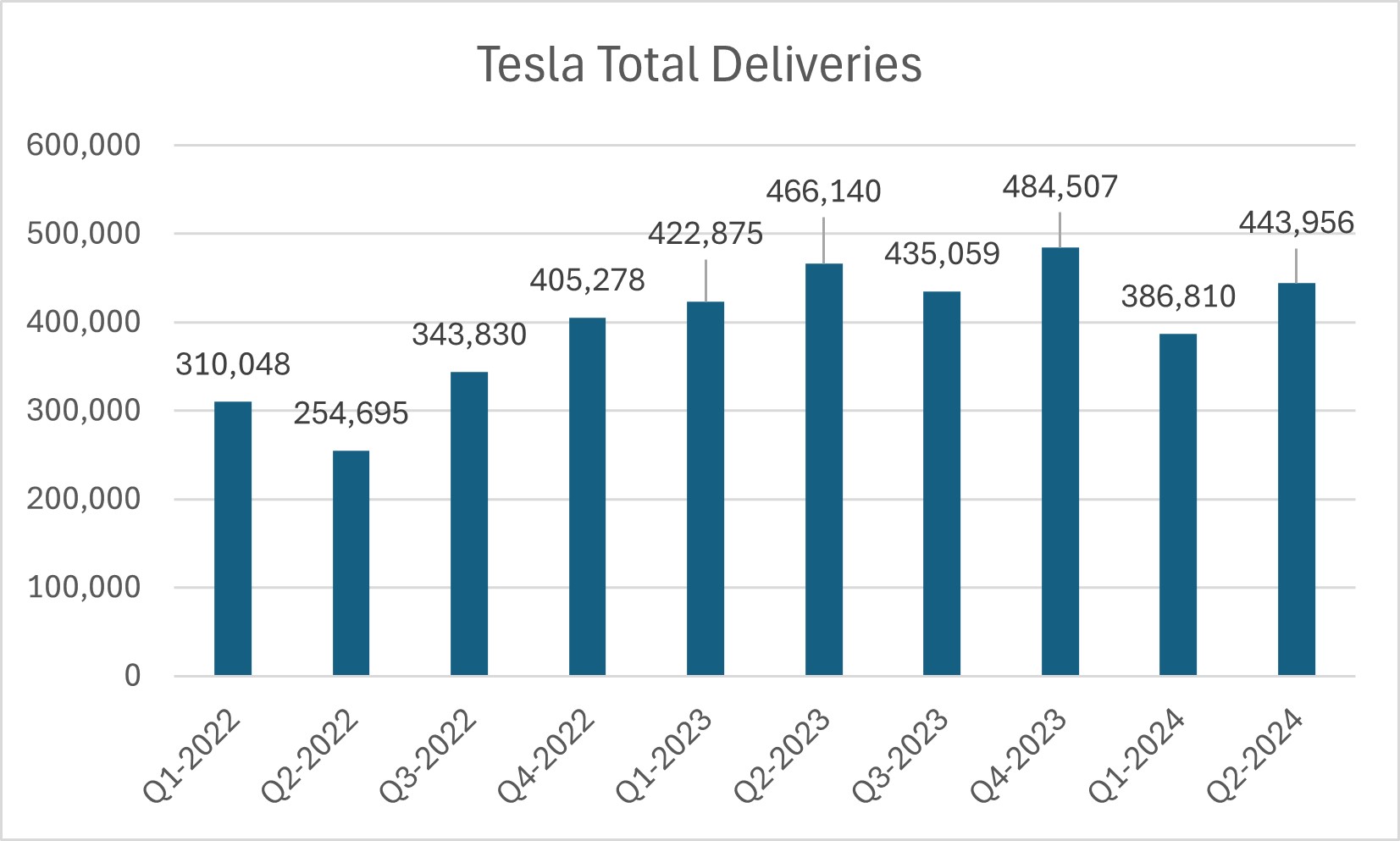

On July 2, Tesla released its production and delivery numbers for the second quarter of 2024. Production of Model 3/Y and other models totaled 410,831, while total deliveries came in at 443,956 units, consisting of 422,405 Model 3/Y and the balance coming from other models. The results were better than expected and helped to propel shares of the electric-vehicle maker higher. Tesla’s equity has shot up past the high end of our fair value estimate range, and while we liked the better-than-feared news regarding its deliveries, we continue to be on the sidelines with respect to Tesla’s shares. The next big catalysts for Tesla’s shares are its earnings release on July 23 and its robotaxi event on August 8. The high end of our fair value estimate range stands at $224, shy of where the company’s equity is trading ($250+).

|