|

|

Recent Articles

-

Johnson & Johnson Finetunes 2024 Bottom Line Guidance

Johnson & Johnson Finetunes 2024 Bottom Line Guidance

Jul 17, 2024

-

Image: J&J’s shares have faced pressure since the beginning of 2023.

Looking to all of 2024, J&J continues to expect adjusted operations sales growth in the range of 5.5%-6%, but it finetuned adjusted operational earnings per share to the range of $10.00-$10.10 from $10.60-$10.75 previously. The company’s improved performance was offset by the collective impact of its recent acquisitions of Shockwave Medical, Proteologix, and NM26 Bispecific Antibody. We’re not reading too much into the downward bottom-line guidance revision as J&J remains a free-cash-flow cow with a pristine AAA credit rating. Though J&J is not included in any newsletter portfolio, it’s hard not to like the company. Shares yield ~3.3% at the time of this writing.

-

ASML Holding Reports Strong Bookings in Second Quarter

ASML Holding Reports Strong Bookings in Second Quarter

Jul 17, 2024

-

Image: ASML Holding has been a strong stock performer since the beginning of 2023.

Though performance in the second quarter could have been better, ASML reiterated its outlook for 2024, which it describes as a “transition year.” Total net sales in 2024 are expected to be similar to 2023. The company ended the quarter with €4.6 billion in long-term debt and €5.0 billion in cash and short-term investments. Second quarter results were disappointing, but we continue to like ASML as one of the most prolific innovators in the semiconductor industry.

-

UnitedHealth Group Reports Messy Second Quarter Results

UnitedHealth Group Reports Messy Second Quarter Results

Jul 16, 2024

-

Image: UnitedHealth Group’s shares have been choppy since the beginning of 2023.

UnitedHealth Group’s second quarter results were quite messy with a lot of moving parts, but cash flow remains resilient and the firm’s dividend growth trajectory remains solid. Back in June, the firm raised its annual dividend rate by 12%, marking the 15th consecutive year that UnitedHealth has increased it at a double-digit pace. UnitedHealth ended the quarter with $75.1 billion in total debt and $77.4 billion in cash and investments. We continue to include UnitedHealth Group as an idea in the Best Ideas Newsletter portfolio.

-

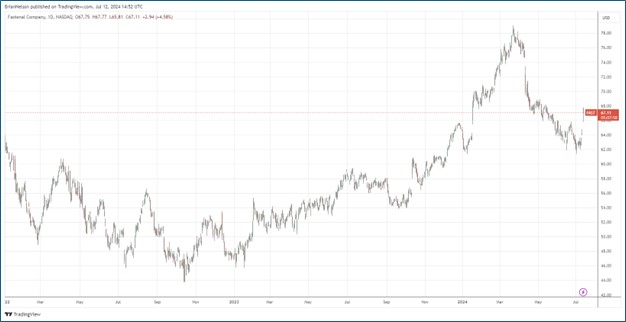

Fastenal’s Revenue Beat a Positive Read Through to the Broader Economy

Fastenal’s Revenue Beat a Positive Read Through to the Broader Economy

Jul 12, 2024

-

Image: Fastenal’s second quarter results were a positive read through to the broader economy.

On July 12, Fastenal Company reported mixed second quarter results where revenue modestly exceeded the consensus forecast, while the company’s GAAP earnings per share was in-line. For the first six months of 2024, net sales advanced 1.8%, while operating income fell 1.4% and net income dropped 0.5%. Diluted earnings per share of $1.03 for the first six months of the year was 0.7% lower than the mark achieved over the same period a year ago. Fastenal’s better-than-expected revenue performance is a positive read through to the broader economy.

|