|

|

Recent Articles

-

Microsoft’s First Quarter Fiscal 2026 Results Solid

Microsoft’s First Quarter Fiscal 2026 Results Solid

Oct 30, 2025

-

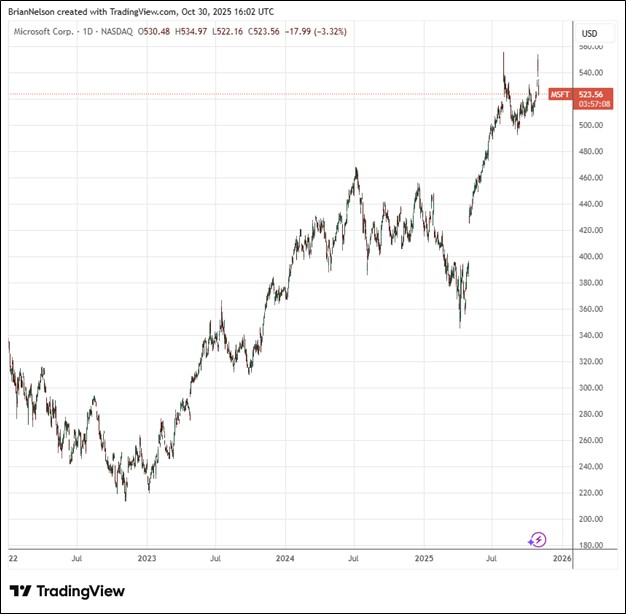

Image Source: TradingView.

Microsoft’s Azure and other cloud services revenue increased 40% (up 39% in constant currency) in the quarter. The company returned $10.7 billion to shareholders in the form of dividends and share repurchases during the first quarter of fiscal 2026. Looking to the fiscal second quarter, revenue is targeted to be between $79.5-$80.6 billion, growth of 14%-16%, compared to expectations of $80.08 billion. Azure is expected to grow 37% in constant currency in the quarter “as demand remains significantly ahead of the capacity (it) has available.” Though some expected more from Microsoft, we thought the quarter and outlook was solid. The company remains a core holding in the newsletter portfolios.

-

Booking Holdings Looks to Robust Growth in Fourth Quarter

Booking Holdings Looks to Robust Growth in Fourth Quarter

Oct 29, 2025

-

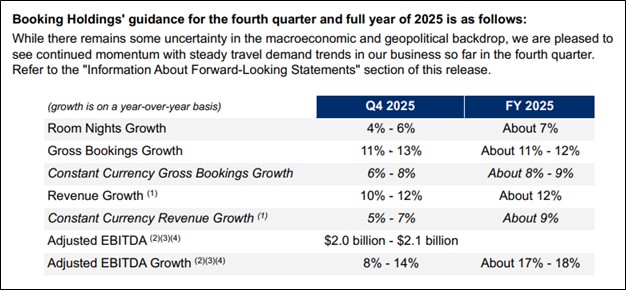

Image Source: Booking Holdings.

Looking to the fourth quarter of 2025, Booking Holdings expects revenue growth in the range of 10%-12% (5%-7% in constant currency), with room nights growth of 4%-6% and gross bookings growth of 11%-13%. Constant currency gross bookings growth is targeted in the range of 6%-8%. Adjusted EBITDA is expected in the range of $2.0-$2.1 billion, reflecting 8%-14% growth. Looking to all of full year 2025, revenue growth is expected to be about 12% (9% in constant currency), with adjusted EBITDA growth of about 17%-18%. We continue to like Booking Holdings as an idea in the newsletter portfolios.

-

Visa Expects Low Double Digit Earnings Growth for Fiscal 2026

Visa Expects Low Double Digit Earnings Growth for Fiscal 2026

Oct 29, 2025

-

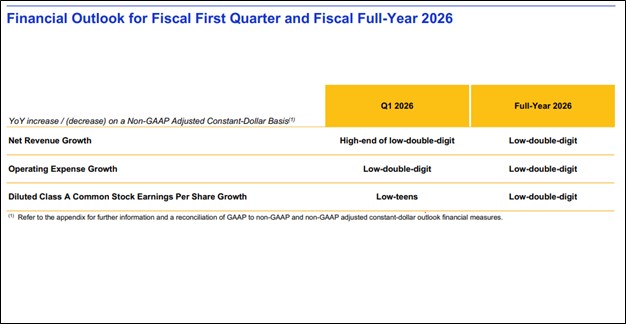

Image Source: Visa.

For the 12 months ended September 30, Visa hauled in $23.1 billion in cash flow from operations and spent $1.5 billion in property, equipment, and technology, resulting in free cash flow of $21.6 billion, or 53.9% of total revenue. Visa ended the year with cash and cash equivalents and investment securities of $19 billion and total debt of $25.2 billion. The company returned $6.1 billion in share buybacks and dividends in the quarter, and the board of directors increased its quarterly cash dividend 14%, to $0.67 per share. For full year fiscal 2026, management expects low-double-digit growth in net revenue, operating expense, and diluted earnings per share. We continue to like Visa as an idea in the Best Ideas Newsletter portfolio.

-

UnitedHealth Group Raises Full Year 2025 Earnings Outlook

UnitedHealth Group Raises Full Year 2025 Earnings Outlook

Oct 28, 2025

-

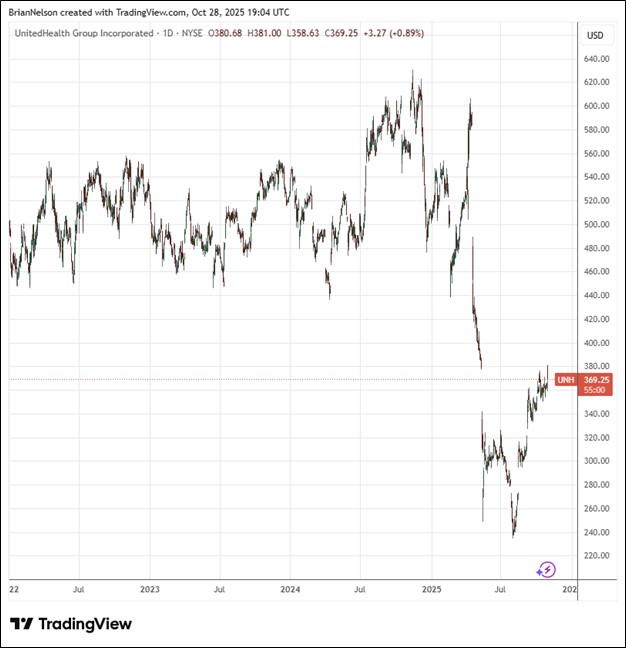

Image Source: TradingView.

UnitedHealth Group continues to work through an elevated cost environment: “The year-over-year increase (in the medical care ratio) of 470 basis points was primarily driven by the previously described significantly elevated cost trends, as well as the ongoing effects of the Biden-era Medicare funding reductions and changes to the Part D program from the Inflation Reduction Act.” Looking to 2025, UnitedHealth Group raised its adjusted earnings guidance to at least $16.25 per share. We continue to include UnitedHealth in the newsletter portfolios.

|