|

|

Recent Articles

-

What Is Gold Really Worth?

What Is Gold Really Worth?

Oct 28, 2025

-

Image: Gold prices have surged since 2020, and they recently hit an all-time high.

What is the yellow metal really worth? Let's discuss the greater fool characteristics of the price of gold.

-

Thinking Slow: 3 Research Blind Spots That Changed the Investment World

Thinking Slow: 3 Research Blind Spots That Changed the Investment World

Oct 28, 2025

-

Image Source: EpicTop10.com.

We have to be on high alert about how our minds work. PBS recently delivered a four-part series examining how easily our minds are being hacked, and why it is so important to "think slow." When it comes to the active versus passive debate, does the analysis suffer from parameter risk? With respect to empirical, evidence-based analysis, does the analysis have the entire construct wrong? When it comes to short-cut multiples, are we falling into the behavioral trap of thinking on autopilot?

-

Your Role as a Choice Architect

Your Role as a Choice Architect

Oct 28, 2025

-

Image: Impact Hub Global Network.

Richard Thaler in his groundbreaking book Nudge, co-written with Cass Sunstein, talked about the role of the choice architect. A choice architect is basically someone or some organization that has the responsibility for organizing the context and content in which people make decisions. At Valuentum, we can never provide personalized buy/sell advice, but in providing publishing services, we've opted for the healthy option for members, and that sometimes means you won't find a large selection of dessert options. This isn't a shortcoming of our service (i.e. we know desserts are tempting), but rather a key positive attribute. As we've shown time and time again, you don't need to look far to beat the market return (or, by comparison, to have a healthy diet). If something is not on the menu at Valuentum, it means the chef has something better cooking in the kitchen. Here's to your long-term financial health!

-

Ford Reports Record Third Quarter Revenue

Ford Reports Record Third Quarter Revenue

Oct 27, 2025

-

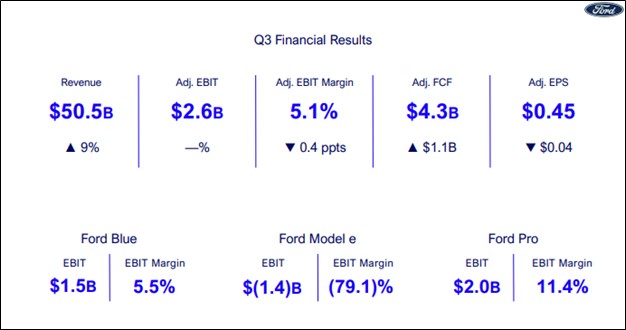

Image Source: Ford.

Looking to full-year 2025, Ford noted that its business is performing at the high end of the guidance range previously outlined in February, despite absorbing a $1 billion net tariff headwind. It also said that between 2025 and 2026, Ford expects the Novelis fire to be a headwind of $1.0 billion or less. Ford now expects full-year 2025 company adjusted EBIT of $6-$6.5 billion, adjusted free cash flow of $2-$3 billion and capital expenditures of ~$9 billion. Ford is working to navigate the Novelis fire impact as well as tariff headwinds, but record revenue speaks to resilience. Ford yields 4.3% at the time of this writing.

|