|

|

Recent Articles

-

Energy Transfer Raises 2024 Adjusted EBITDA Guidance, Units Yield 7.8%

Energy Transfer Raises 2024 Adjusted EBITDA Guidance, Units Yield 7.8%

Aug 19, 2024

-

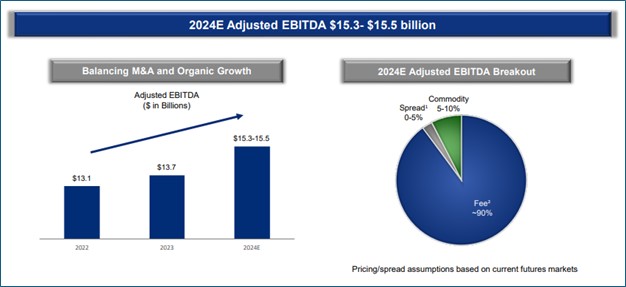

Image Source: Energy Transfer.

Looking to full-year 2024, Energy Transfer's adjusted EBITDA is now targeted in the range of $15.3-$15.5 billion, compared to its previous guidance of between $15-$15.3 billion. The updated guidance includes the impact of its WTG Midstream acquisition as well as outperformance in its base business. Energy Transfer’s fundamental momentum has translated into improved credit ratings, too, with Moody’s upgrading its senior unsecured credit rating to Baa2 in June 2024 (long-term debt totaled $57.4 billion at the end of the quarter). Though its debt level is difficult to get comfortable with, it's encouraging to see the improved adjusted EBITDA guidance as well as Energy Transfer's ability to cover distributions with traditional free cash flow. Units yield 7.8% at the time of this writing.

-

Deere’s Fiscal Third Quarter Results Reveal Challenging Conditions in the Global Agricultural and Construction Sectors

Deere’s Fiscal Third Quarter Results Reveal Challenging Conditions in the Global Agricultural and Construction Sectors

Aug 16, 2024

-

Image Source: Deere & Company.

Looking to all of fiscal 2024, Deere continues to expect weak top-line performance across its portfolio. Production & Precision Agriculture net sales are expected to fall 20%-25%, Small Ag & Turf net sales are expected to decline at a similar pace, while Construction & Forestry net revenues are expected to drop 10%-15% on the year. Financial Services net income is targeted at $720 million for fiscal 2024. Deere ended the quarter with a hefty net debt position. Though Deere’s top line continues to face pressure, and its balance sheet isn’t as strong as we would like, management did reaffirm its net income outlook for fiscal 2024 at approximately $7 billion, which was above the consensus forecast. Shares of Deere yield 1.6%.

-

Dividend Increases/Decreases for the Week of August 16

Dividend Increases/Decreases for the Week of August 16

Aug 16, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Walmart Raises Its Fiscal 2025 Outlook

Walmart Raises Its Fiscal 2025 Outlook

Aug 15, 2024

-

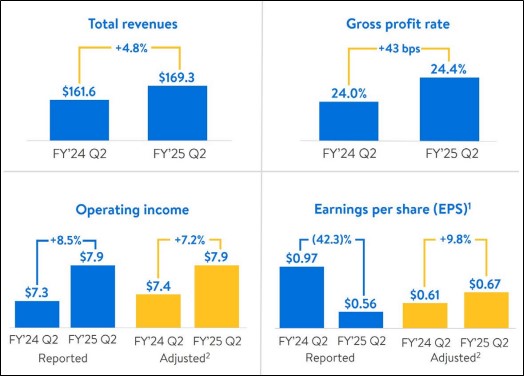

Image Source: Walmart.

Walmart’s adjusted earnings per share for fiscal 2025 is now targeted in the range of $2.35-$2.43 (was $2.23-$2.37). The company ended the quarter with total debt of $47 billion and cash and cash equivalents of $8.8 billion. Walmart hauled in $5.9 billion in free cash flow during the first six months of the year, well in excess of the $3.3 billion it paid in dividends over the same time period. We liked Walmart’s second quarter report, its raised outlook for fiscal 2025, and the company’s very healthy dividend. Shares yield 1.2% at the time of this writing.

|