Member LoginDividend CushionValue Trap |

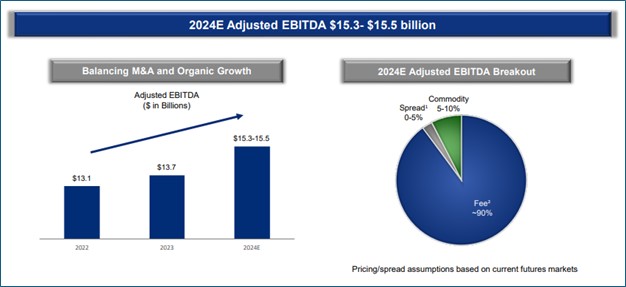

Energy Transfer Raises 2024 Adjusted EBITDA Guidance, Units Yield 7.8%

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|