|

|

Recent Articles

-

Amazon’s Cloud Business Continues to Propel Results

Amazon’s Cloud Business Continues to Propel Results

Nov 6, 2025

-

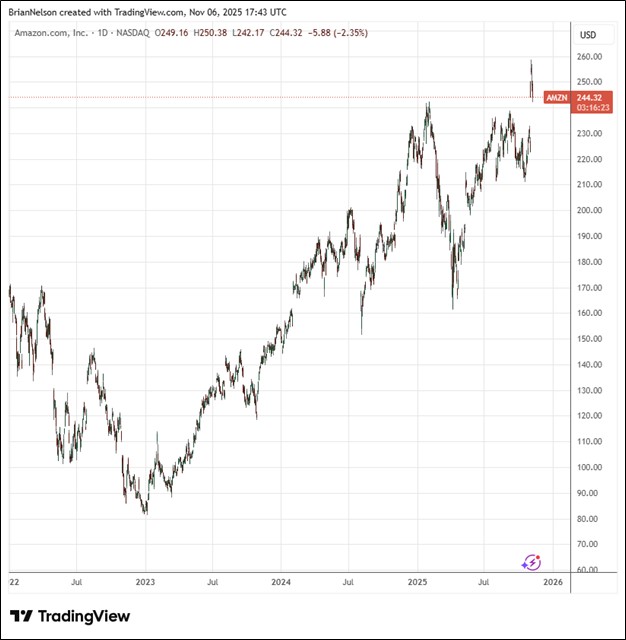

Image Source: TradingView.

For the twelve months ended September 30, Amazon’s operating cash flow increased 16%, to $130.7 billion, better than the $112.7 billion it registered for the trailing twelve months last year. Free cash flow came in at $14.8 billion for the trailing twelve months, down from $47.7 billion for the trailing twelve months last year, driven by a $50.9 billion increase in purchases of property and equipment. Looking to the fourth quarter of 2025, net sales are expected to be between $206-$213 billion, or to grow 10%-13%. The guidance includes a favorable impact of about 190 basis points from foreign exchange rates. Operating income is expected to be between $21-$26 billion, compared with $21.2 billion in the fourth quarter of 2024. We thought Amazon’s third quarter and outlook were impressive, and we continue to like shares in the Best Ideas Newsletter portfolio.

-

Apple Looks to Strong December Quarter

Apple Looks to Strong December Quarter

Nov 3, 2025

-

Image Source: TradingView.

For the 12 months ended September 27, Apple generated $111.5 billion in cash from operations, while it spent $12.7 billion in property, plant, and equipment, resulting in free cash flow of $98.8 billion. Looking to the December quarter, total company revenue is expected to grow 10%-12% year-over-year, resulting in its best quarter ever. Apple expects iPhone revenue to grow double-digits year-over-year, which would be its best iPhone quarter ever. Services revenue is targeted to grow at a similar year-over-year pace to what it reported in 2025. Gross margin is expected between 47%-48%, which includes an estimated impact of $1.4 billion of tariff-related costs. We continue to like Apple as an idea in the newsletter portfolios.

-

Chipotle Facing Consumer Spending Pressures

Chipotle Facing Consumer Spending Pressures

Oct 30, 2025

-

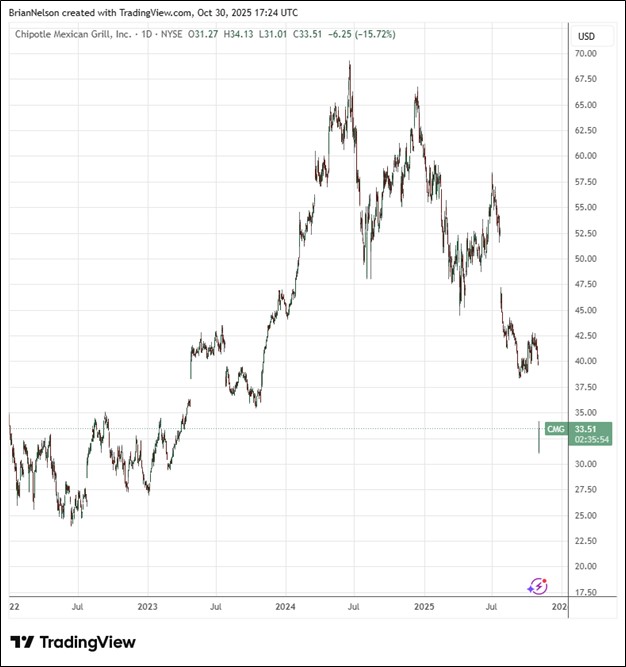

Image Source: TradingView.

For the first nine months of 2025, Chipotle generated $1.69 billion in cash from operations and spent $468.9 million in property and equipment, resulting in free cash flow of $1.22 billion. Looking to all of 2025, management expects full year comparable restaurant sales to decline in the low-single-digit range and to open 315-345 new company-owned restaurants, with over 80% having a Chipotlane. For 2026, management expects to open 350-370 new restaurants, including 10-15 international partner-operated restaurants, with over 80% of company-owned restaurants having a Chipotlane. Though Chipotle’s business is under pressure, we continue to like the long-term growth story. Shares remain an idea in the Best Ideas Newsletter portfolio.

-

Alphabet Remains a Net-Cash-Rich, Free-Cash-Flow Generating Powerhouse

Alphabet Remains a Net-Cash-Rich, Free-Cash-Flow Generating Powerhouse

Oct 30, 2025

-

Image: Alphabet’s revenues eclipsed $100 billion in the quarter.

In the quarter, Alphabet generated $48.41 billion in cash from operations and spent $23.95 billion in property and equipment, resulting in free cash flow of $24.46 billion. Year-to-date, cash from operations was $112.3 billion, while the company spent $63.6 billion in property and equipment, resulting in free cash flow of $48.7 billion. Total cash, cash equivalents, and marketable securities was $98.5 billion at the end of the quarter, versus $21.6 billion in long-term debt. The company pays a quarterly cash dividend of $0.21 per share. Looking to all of 2025, Alphabet expects capital expenditures in the range of $91-$93 billion. Even in the face of higher capital spending, Alphabet remains a net-cash-rich, free-cash-flow generating powerhouse. We continue to like shares in the Best Ideas Newsletter portfolio.

|