|

|

Recent Articles

-

Albemarle Is Getting Back on Track

Albemarle Is Getting Back on Track

Nov 13, 2025

-

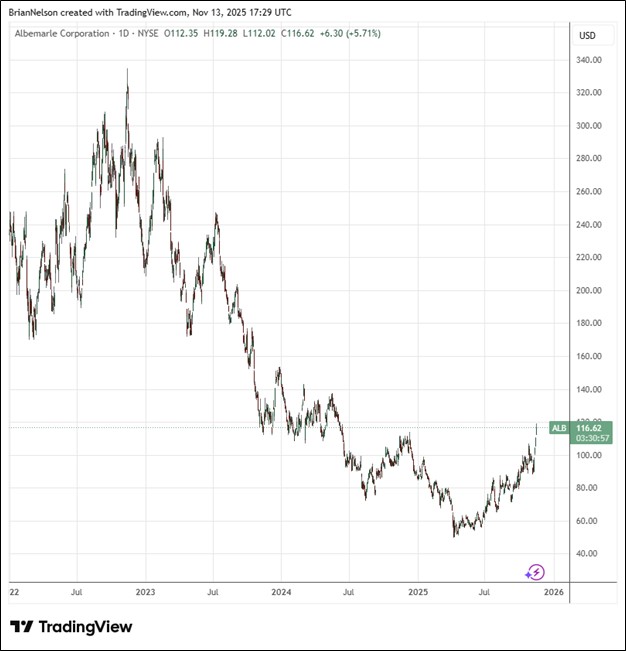

Image Source: TradingView.

Albemarle’s third quarter cash from operations of $356 million increased 57% relative to last year’s mark, while on a year-to-date basis, the metric was up 29%, to $894 million, due in part to cost and productivity improvements, cash management actions, and a customer prepayment received in January. Full-year 2025 capital expenditures are targeted at about $600 million, and the firm reiterated it view that it expects to achieve positive free cash flow of $300-$400 million for the full year 2025. Management expects full-year results to be towards the higher end of the previously published $9/kg scenario ranges, or net sales of $5.2 billion and adjusted EBITDA of $1 billion. We think Albemarle is getting back on track, and the company remains an idea in the ESG Newsletter portfolio.

-

Cisco Puts Up Solid First Quarter Fiscal 2026 Results

Cisco Puts Up Solid First Quarter Fiscal 2026 Results

Nov 13, 2025

-

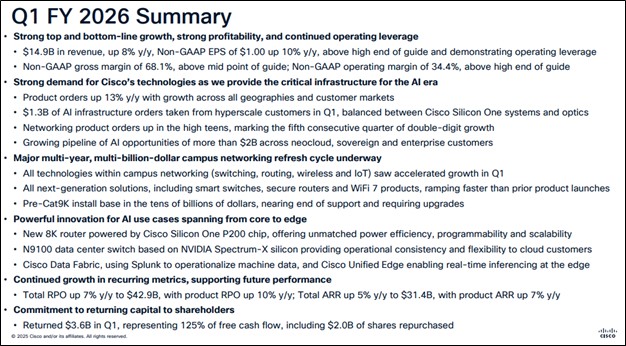

Image Source: Cisco.

In the first quarter of fiscal 2026, Cisco’s product orders increased 13%, with double-digit growth in Networking product orders. AI Infrastructure orders taken from hyperscaler customers totaled $1.3 billion, revealing accelerated growth. Looking to the second quarter of fiscal 2026, revenue is targeted in the range of $15-$15.2 billion on non-GAAP earnings per share of $1.01-$1.03. For all of fiscal 2026, revenue is expected in the range of $60.2-$61 billion, with non-GAAP earnings per share of $4.08-$4.14. Cisco ended the quarter with $15.7 billion of cash and cash equivalents and $28.1 billion in short- and long-term debt. Shares yield 2.2% at the time of this writing.

-

Altria Narrows Outlook While It Expands Its Buyback Program

Altria Narrows Outlook While It Expands Its Buyback Program

Nov 10, 2025

-

Image Source: TradingView.

In the third quarter, Altria repurchased 1.9 million shares for a total cost of $112 million. Through the first nine months of the year, Altria bought back 12.3 million shares for a total cost of $712 million. The board also expanded its existing share repurchase program to $2 billion from $1 billion with expiration date of December 31, 2026. For the third quarter and first nine months of 2025, Altria paid $1.7 billion and $5.2 billion in dividends, respectively. The company’s latest dividend increase in August of 3.9% was the 60th increase in the past 56 years. Altria’s current annualized dividend rate is $4.24 per share, with a forward estimated yield of 7.3%. Though the decline in total cigarette volumes is a headwind, we continue to like shares in the High Yield Dividend Newsletter portfolio.

-

McDonald’s Sees Weakness from Lower-Income Consumers

McDonald’s Sees Weakness from Lower-Income Consumers

Nov 10, 2025

-

Image Source: Valuentum.

In the quarter, McDonald’s consolidated operating income increased 5% (3% in constant currencies). Excluding certain one-time items, adjusted consolidated operating income increased 3% (1% in constant currencies). Diluted earnings per share for the quarter was $3.18, up 2% (flat in constant currencies). Excluding one-time items, however, adjusted diluted earnings per share was flat at $3.22 (a decrease of 1% in constant currencies). McDonald’s is benefiting from higher income consumers trading down, while it faces weakness from the lower-income cohort. Shares look fairly valued on the basis of our discounted cash-flow process.

|