|

|

Recent Articles

-

Valuentum Weekly: Nothing Surprising, Well-Positioned!

Valuentum Weekly: Nothing Surprising, Well-Positioned!

Dec 3, 2021

-

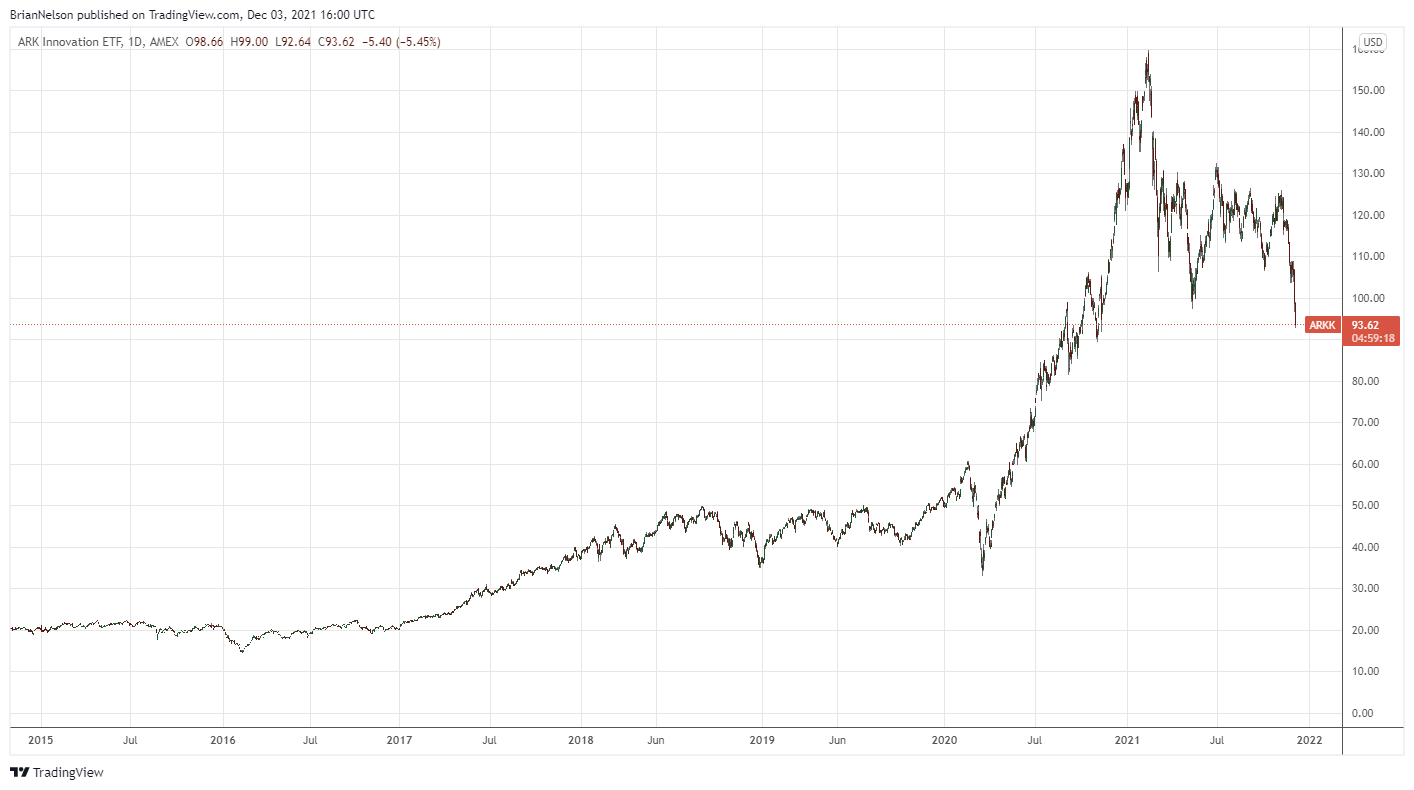

Image source: Cathie Wood's flagship ETF, the ARK Innovation ETF (ARKK) has fallen more than 40% from its 52-week high. This is nothing short of a complete and utter bloodbath for such an actively-managed fund, in our view. We note this for context. We're not just talking about one or two or five stocks that are down 40% from 52-week highs, but the *entire fund.* Investors have to keep things in perspective. It's perfectly reasonable within the context of a portfolio to have a few stocks off 10%, 20%, or maybe even 50% from all-time highs. However, if your entire portfolio is down 40%+ from 52-week highs, you're doing something wrong.

We're finally getting a shake out of the substantial excesses in the market. Entities such as DocuSign are down more than 40% during the trading session December 3, 2021. All-star funds such as the ARK Innovation ETF with well-known fund managers are down over 40% from all-time highs. It's a bloodbath out there if you're not positioned correctly. I can only imagine the sheer panic that's going on right now. It's laughable, but we sometimes get flak if we have one or two or five companies in a couple portfolios of 20-40 stocks that trail the index. My goodness, what must these investors then be saying to fund managers who are down 40%+ from 52-week highs, and whose funds are down 20%-30% on the year when the S&P 500 is up over 20%. It's clear that Valuentum customers demand a lot more from us than even the best, highest-profile managers out there, and we appreciate that. Thank you. A lot of the traditional IBD and Motley Fool stocks look to be stumbling as well. But we're sitting pretty at Valuentum, and here's why.

-

Best Idea Dollar General Announces Plans to Go International

Best Idea Dollar General Announces Plans to Go International

Dec 3, 2021

-

Image Source: Dollar General Corporation – Fiscal 2020 Annual Report.

We are big fans of Dollar General. The discount retailer has several big initiatives underway to extend its growth runway while boosting per store sales and enhancing its margins. Shares of DG have been treading water over the past few months after surging during the 2020 calendar year, though we still room for significant capital appreciation upside potential going forward. The company is a tremendous free cash flow generator, and we like shares of DG as an idea in the Best Ideas Newsletter portfolio.

-

Dividend Increases/Decreases for the Week December 3

Dividend Increases/Decreases for the Week December 3

Dec 3, 2021

-

Let's take a look at companies that raised/lowered their dividend this week.

-

Dividend Growth Idea Dick’s Sporting Goods Is Firing on All-Cylinders; Raises Guidance (Again) While Generating Gobs of Free Cash Flow

Dividend Growth Idea Dick’s Sporting Goods Is Firing on All-Cylinders; Raises Guidance (Again) While Generating Gobs of Free Cash Flow

Dec 2, 2021

-

Image Source: Valuentum.

On November 23, Dick’s Sporting Goods reported third quarter earnings for fiscal 2021 (period ended October 30, 2021) that beat both consensus top- and bottom-line estimates. The sporting goods retailer once again raised its full-year guidance for fiscal 2021 in conjunction with its latest earnings report. Dick’s Sporting Goods also raised its guidance when reporting its fiscal second quarter earnings back in August 2021 and its fiscal first quarter earnings back in May 2021, highlighting management’s growing confidence in the company’s near term performance. Though shares of DKS sold off following its latest earnings update, likely due to concerns over inflationary pressures and supply chain hurdles, Dick’s Sporting Goods’ outlook remains rock-solid. We continue to like the firm as an idea in the Dividend Growth Newsletter portfolio.

|