|

|

Recent Articles

-

Best Idea Vertex Pharma Boosts Guidance (Again), Buying Back Stock While Awaiting Key Clinical Trials

Best Idea Vertex Pharma Boosts Guidance (Again), Buying Back Stock While Awaiting Key Clinical Trials

Dec 1, 2021

-

Image Shown: Vertex Pharmaceuticals Inc is one of our favorite biotech ideas. Image Source: Vertex Pharmaceuticals Inc – Third Quarter of 2021 IR Earnings Presentation.

Vertex Pharma has a robust drug pipeline, though all eyes are on its potential CTX001 treatment. Should the treatment receive the green light from key healthcare regulators, Vertex Pharma’s financial performance would benefit from a major growth catalyst. In the meantime, we think it is prudent for Vertex Pharma to continue leveraging its financial strength to repurchase sizable chunks of its stock. We like Vertex Pharma as an idea in the Best Ideas Newsletter portfolio.

-

Large Cap Growth Dominates, MLPs Have Suffered

Large Cap Growth Dominates, MLPs Have Suffered

Dec 1, 2021

-

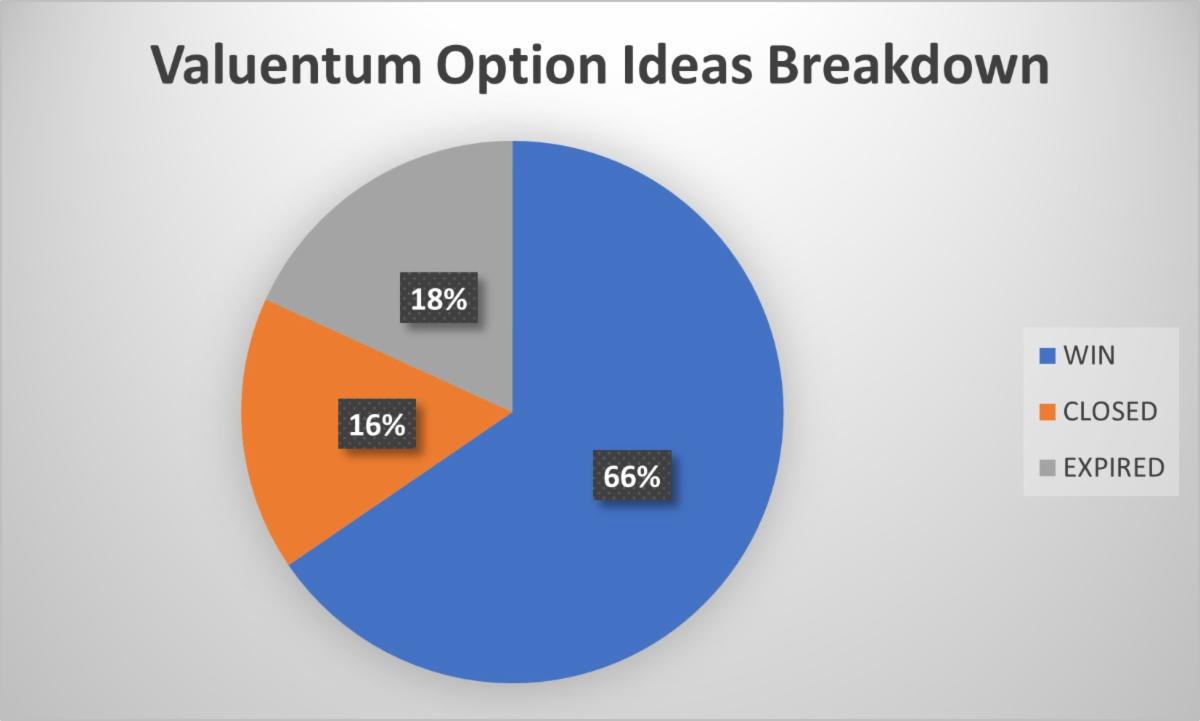

Image: Sign up to our new options commentary. $1,000/year. 4 ideas per month and more! Image: Win = The options contract was closed as a win. Closed = the options contract was closed at a loss. Expired = The options contract expired worthless. Pie chart above does not consider ideas still open. Data through October 26, 2021. Results are hypothetical. No trading is taking place. Past performance is not indicative of future performance.

On behalf of our team at Valuentum, we hope you had a wonderful Thanksgiving holiday weekend, and we wish you the very best this holiday season. We're hoping for a nice Santa Claus rally! Godspeed, and thank you for your membership and attention these past many years!

-

We Remain Bullish on Disney’s Capital Appreciation Upside Potential

We Remain Bullish on Disney’s Capital Appreciation Upside Potential

Nov 30, 2021

-

Image Shown: Shares of The Walt Disney Company have shifted lower over the past month, though are still bullish on its capital appreciation upside. Our fair value estimate sits at $192 per share of Disney.

The Walt Disney Company reported fourth-quarter earnings for fiscal 2021 (period ended October 2, 2021) on November 10 that missed consensus top- and bottom-line estimates. While the company’s ‘Disney Parks, Experiences and Products’ segment (includes its theme parks and resorts operations) staged an impressive turnaround last fiscal quarter, its ‘Disney Media and Entertainment Distribution’ segment (includes its video streaming businesses) grew at a slower pace than expected. Shares of Disney sold off after its latest earnings report, though we remain confident that the company’s free cash flow growth outlook remains stellar and continue to view Disney’s capital appreciation upside potential quite favorably. Disney is included as an idea in the Best Ideas Newsletter portfolio.

-

Bitcoin, U.S. Large Cap Growth, and Technology Continue to Dominate Returns

Bitcoin, U.S. Large Cap Growth, and Technology Continue to Dominate Returns

Nov 28, 2021

-

Image source: Seeking Alpha, retrieved November 28.

Bitcoin (GBTC), Technology (XLK), U.S. Large Cap Growth (SCHG), Russell 1000 Growth (IWF), Consumer Discretionary (XLY) have dominated returns the past 5 years. U.S. MLPs (AMLP), Crude Oil (USO), Energy (XLE), Chinese Stocks (FXI), and various bond ETFs (JNK), (AGG), (MUB) have trailed.

|