|

|

Recent Articles

-

General Mills Managing Inflationary Headwinds; Scaling Up Pets Business

General Mills Managing Inflationary Headwinds; Scaling Up Pets Business

Dec 28, 2021

-

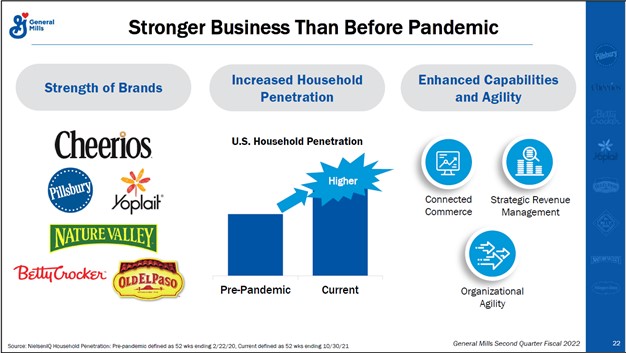

Image Source: General Mills Inc – Second Quarter of Fiscal 2022 IR Earnings Presentation.

On December 21, General Mills, the firm behind the Cheerios, Pillsbury, and Nature Valley brands (among various others), reported second quarter earnings for fiscal 2022 (period ended November 28, 2021) that beat consensus top-line estimates but missed consensus bottom-line estimates. The consumer staples giant also raised its full year guidance for fiscal 2022 in conjunction with its latest earnings report. In the face of major input cost inflationary pressures and supply chain constraints, brought on in part by the coronavirus (‘COVID-19’) pandemic and the fiscal/monetary policies enacted to offset the economic damage caused by the public health crisis, General Mills has done a solid job navigating the ever-changing landscape, all things considered.

-

Net Cash Rich Micron Technology Beats Estimates and Issues Favorable Near Term Guidance

Net Cash Rich Micron Technology Beats Estimates and Issues Favorable Near Term Guidance

Dec 27, 2021

-

Image Shown: An overview of Micron Technology’s outlook for the industry and its own operations for 2022 and beyond. Image Source: Micron Technology – First Quarter of Fiscal 2022 IR Earnings Presentation.

On December 20, Micron Technology reported first quarter earnings for fiscal 2022 (period ended December 2, 2021) that beat both consensus top- and bottom-line estimates. Underlying demand for Micron Technology’s DRAM, NAND, and NOR offerings (used as memory solutions in personal computers, automobiles, data centers, smartphones, and various electronics devices) remained robust last fiscal quarter. The company has done a great job navigating supply chain hurdles and semiconductor component and equipment shortages in the wake of the coronavirus (‘COVID-19’) pandemic to continue meeting booming customer demand. Shares of Micron Technology surged higher after it published its latest earnings report December 20 (and they are now trading in the mid-$90s at the time of this writing). In our view, the big share price increase was largely due to the memory solutions provider issuing favorable near term guidance covering the current fiscal quarter, indicating that its strong performance of late is expected to continue in the near term. Though shares may appear cheap on a forward earnings basis, we caution members that the industry Micron Technology operates within is ultra-competitive and exposed to tremendous pricing competition and cyclical swings. Though technically (its chart) looks attractive at this time, long-term investors should be careful.

-

Nike Beats Estimates in the Face of Supply Chain Constraints

Nike Beats Estimates in the Face of Supply Chain Constraints

Dec 27, 2021

-

Image Shown: Shares of Nike Inc shifted higher in the wake of its latest earnings report.

On December 20, Nike reported second quarter earnings for fiscal 2022 (period ended November 30, 2021) that beat both consensus top- and bottom-line estimates. The company did its best to navigate supply chain hurdles as efforts by public health officials and governments to contain the spread of the coronavirus (‘COVID-19’) pandemic in Southeast Asia (a major production hub for apparel and footwear) weighed quite negatively on its ability to meet demand.

-

VIDEO/TRANSCRIPT: 2021 Valuentum Exclusive Call: Inflation Is Good

VIDEO/TRANSCRIPT: 2021 Valuentum Exclusive Call: Inflation Is Good

Dec 26, 2021

-

Valuentum's President Brian Michael Nelson, CFA, explains why investors should not fear inflation, why government agencies such as the Fed and Treasury are prioritizing something other than price discovery, why the 10-year Treasury rate is a must-watch metric, and why Valuentum prefers the moaty constituents in large cap growth due to their net cash rich balance sheets, tremendous free cash flow generating potential, and secular growth tailwinds.

|