|

|

Recent Articles

-

Dividend Increases/Decreases for the Week December 24

Dividend Increases/Decreases for the Week December 24

Dec 24, 2021

-

Let's take a look at companies that raised/lowered their dividend this week.

-

High-Yielding Crown Castle Is One of Our Favorite REITs

High-Yielding Crown Castle Is One of Our Favorite REITs

Dec 23, 2021

-

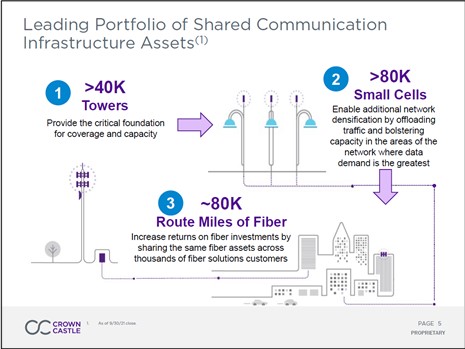

Image Shown: We include Crown Castle International Corp as an idea in our High Yield Dividend Newsletter portfolio. Image Source: Crown Castle International Corp – October 2021 IR Presentation.

Crown Castle International Corp is a real estate investment trust (‘REIT’) that owns and operates cell towers, fiber networks, and small cell nodes in the US. These assets form the backbone of wireless infrastructure and are key to enabling the domestic rollout of 5G networks and supporting existing 4G networks. We include shares of CCI in our High Yield Dividend Newsletter portfolio as we are big fans of its strong dividend coverage (when taking its ability to tap capital markets into account), impressive growth outlook, and high-quality cash flow profile. Shares of CCI yield ~2.9% as of this writing after the REIT boosted its quarterly dividend by 11% sequentially in October 2021, bringing its annualized payout up to $5.88 per share. Over the long haul, Crown Castle targets 7%-8% annual dividend growth. The REIT’s expansive asset base stretches across the US with operations in virtually every major metropolitan market. Crown Castle’s long-term contracts with its tenants (namely telecommunications giants) provide substantial visibility as it concerns its future cash flow performance. Additionally, Crown Castle generates substantial free cash flows, something we like a lot.

-

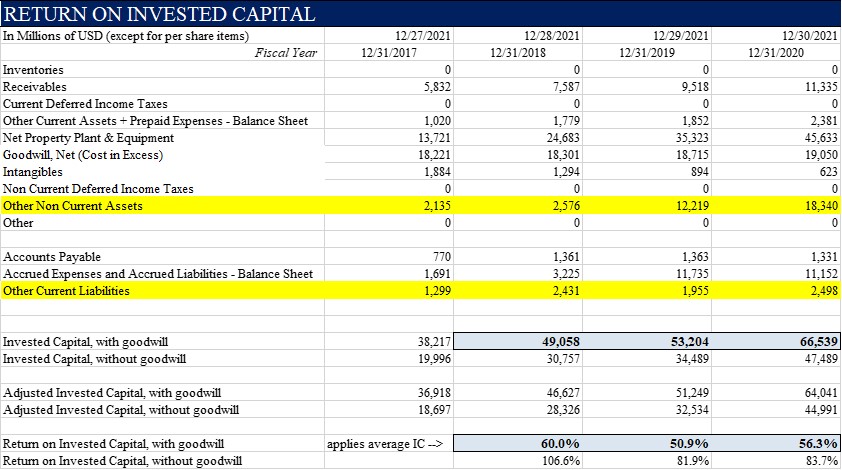

Some Questions Answered: The Fair Value Estimate Range and ROIC

Some Questions Answered: The Fair Value Estimate Range and ROIC

Dec 23, 2021

-

Image: A snapshot of Facebook's valuation model.

Let's cover a few subtle nuances of the fair value estimate range and the calculation behind return on invested capital as it is translated from our valuation infrastructure into the stock reports.

-

Adobe Signals Near Term Growth Rate Slowing Down, Longer Term Outlook Still Quite Bright

Adobe Signals Near Term Growth Rate Slowing Down, Longer Term Outlook Still Quite Bright

Dec 21, 2021

-

Image Source: Adobe Inc – December 2021 Financial Analysts Meeting IR Presentation.

On December 16, Adobe reported fourth quarter earnings for fiscal 2021 (period ended December 3, 2021) that modestly beat consensus top- and bottom-line estimates. However, shares of ADBE plummeted in the wake of its latest earnings report as management signaled that the firm’s near term growth rate would slow down in fiscal 2022 versus levels seen in fiscal 2021. Investors were apparently hoping for more, though in our view, Adobe’s longer term growth outlook is still quite bright. Our fair value estimate sits at $576 per share of Adobe.

|