|

|

Recent Articles

-

The ARKK CRASHED But Large Cap Growth/Tech Is Still Cheap!

The ARKK CRASHED But Large Cap Growth/Tech Is Still Cheap!

Jan 17, 2022

-

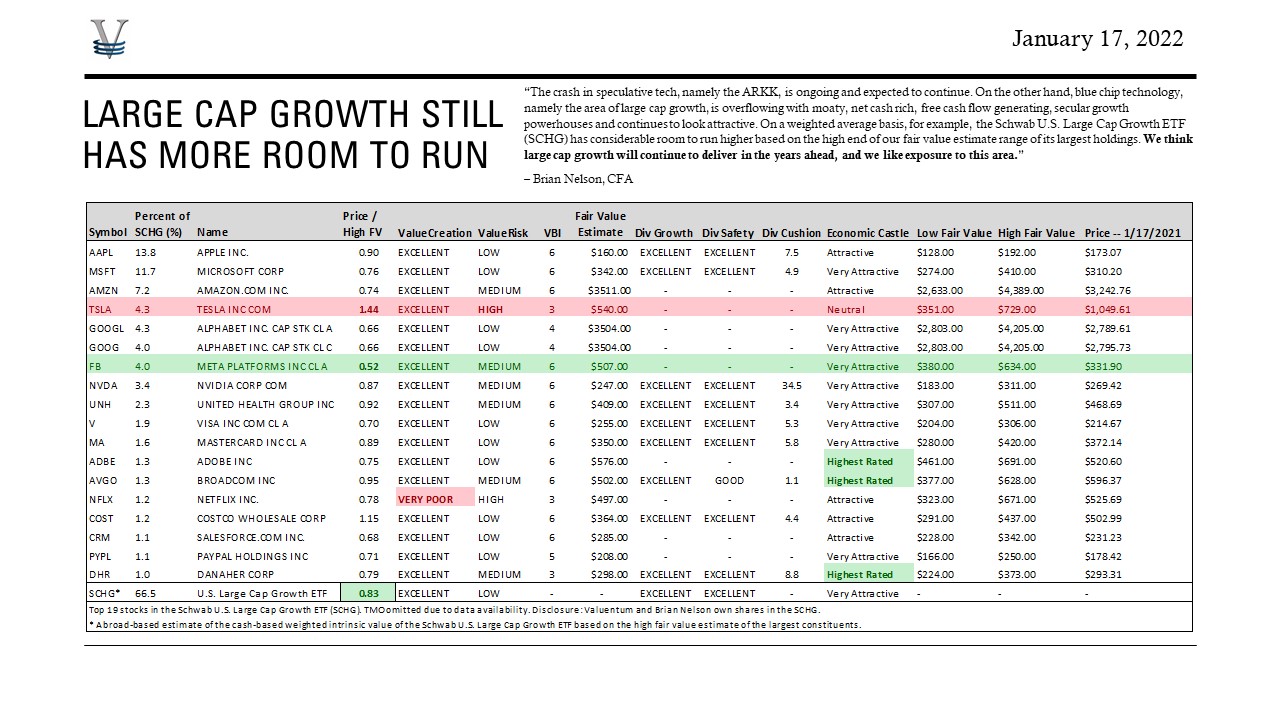

“The crash in speculative tech, namely the ARKK, is ongoing and expected to continue. On the other hand, blue chip technology, namely the area of large cap growth, is overflowing with moaty, net cash rich, free cash flow generating, secular growth powerhouses and continues to look attractive. On a weighted average basis, for example, the Schwab U.S. Large Cap Growth ETF (SCHG) has considerable room to run higher based on the high end of our fair value estimate range of its largest holdings. We think large cap growth will continue to deliver in the years ahead, and we like exposure to this area. ” – Brian Nelson, CFA

-

Dividend Increases/Decreases for the Week January 14

Dividend Increases/Decreases for the Week January 14

Jan 14, 2022

-

Let's take a look at companies that raised/lowered their dividend this week.

-

Governance: The G in ESG Investing

Governance: The G in ESG Investing

Jan 12, 2022

-

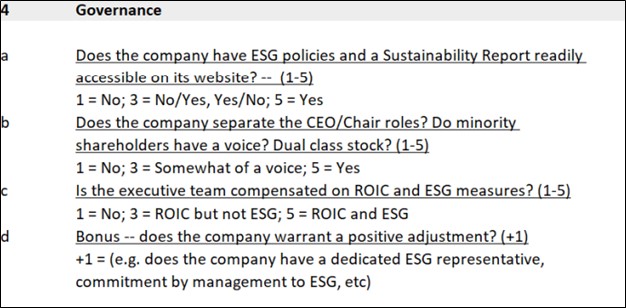

Image: The Valuentum Environmental, Social and Governance (ESG) Scoring System shows how “Governance” considerations are analyzed.

No discussion of ESG investing would be complete without addressing the role of corporate governance (“stewardship”) in equity investing. As with the other aspects of ESG investing, corporate governance covers a lot of ground. It can include pretty much anything related to how a company is run, including leadership, executive compensation, audits and accounting, and shareholder rights. These areas are just the tip of the iceberg, however. A company with good corporate governance is one that is run well with the proper incentives and with all stakeholders in mind, from employees to suppliers to customers to shareholders and beyond. Good corporate governance practices decrease the risk to investors as it cuts through conflicts of interest, misuse of resources, and a general lack of concern for all stakeholders. A company that fails at implementing good corporate governance is at increased risk of litigation or scandal, which could wreck the share price. With the turn of the century, the dot com bust probably exposed most prominently the need for good corporate governance practices. Fraud was rampant. Whether it was the former CEO of Tyco International receiving millions in unauthorized bonuses, the actions of those at the top of Enron that created one of the biggest frauds in corporate history, the scandal at accounting and auditing firm Arthur Andersen, the demise of MCI/Worldcom, or the questionable practices that led to the Global Analyst Research Settlement, Wall Street had lost its way. In fact, a big reason why our firm Valuentum was founded is based on ensuring that investors get a fair shake and that someone is keeping a watchful eye not only on companies, but also on the sell-side stock analyst research that may still be full of conflicts of interest. As a result of the Global Analyst Research Settlement, all the big investment banks from Goldman Sachs to J.P. Morgan to Morgan Stanley to UBS Group and beyond had to pay stiff fines for producing conflicted, if not fraudulent research. In this note, we talk about the considerations that go into the G in ESG investing.

-

Valuentum’s Theses on Best Ideas Chevron and Exxon Mobil Playing Out

Valuentum’s Theses on Best Ideas Chevron and Exxon Mobil Playing Out

Jan 11, 2022

-

Image Shown: Shares of Chevron Corporation (the green/red bars) and Exxon Mobil Corporation (the blue/yellow bars) have been on a nice upward climb over the past six months with room to run higher as investors are rotating into energy firms in a big way.

Raw energy resources pricing has surged higher during the past year with room to run. The global energy complex is on the rebound as demand for crude oil and refined petroleum products is steadily recovering from the worst of the coronavirus (‘COVID-19’) pandemic. As demand for electricity and heating needs held up well during the pandemic, liquified natural gas prices (‘LNG’) put up a strong year in 2021 and remain elevated. The OPEC+ cartel is committed to slowly phasing out its crude oil supply curtailment agreement first enacted in 2020, effectively limiting growth in global oil supplies at a time when demand is rebounding at a brisk pace. We view the near-term outlook for the global energy complex quite favorably and have been pounding the table on this issue for some time. Back on June 27, 2021, we added Chevron Corp and Exxon Mobil Corp as ideas to both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios and highlighted these portfolio changes. Shares of CVX and XOM yield a juicy ~4.3% and ~5.1% as of this writing, respectively. Recently, shares of both CVX and XOM have started shifting higher, and in our view, this is just the beginning of a strong cyclical recovery. We also recently added Chevron and Exxon Mobil as ideas to the High Yield Dividend Newsletter portfolio, and highlighted two of our favorite midstream master limited partnerships (‘MLPs’) in that publication as well. Our fair value estimate for Chevron sits at $140 per share and the high end of our fair value estimate range sits at $175 per share, while CVX is trading at ~$127 as of this writing. Our fair value estimate for Exxon Mobil sits at $92 per share and the high end of our fair value estimate range sits at $122 per share, while XOM is trading at ~$71 per share as of this writing. As investors continue to rotate into energy firms, we expect that the stock prices of Chevron and Exxon Mobil will continue converging towards our estimate of their respective intrinsic values.

|