Member LoginDividend CushionValue Trap |

Governance: The G in ESG Investing

publication date: Jan 12, 2022

|

author/source: Valuentum Analysts

By Valuentum Analysts No discussion of ESG investing would be complete without addressing the role of corporate governance (“stewardship”) in equity investing. As with the other aspects of ESG investing, corporate governance covers a lot of ground. It can include pretty much anything related to how a company is run, including leadership, executive compensation, audits and accounting, and shareholder rights. These areas are just the tip of the iceberg, however. A company with good corporate governance is one that is run well with the proper incentives and with all stakeholders in mind, from employees to suppliers to customers to shareholders and beyond. Good corporate governance practices decrease the risk to investors as it cuts through conflicts of interest, misuse of resources, and a general lack of concern for all stakeholders. A company that fails at implementing good corporate governance is at increased risk of litigation or scandal, which could wreck the share price. With the turn of the century, the dot com bust probably exposed most prominently the need for good corporate governance practices. Fraud was rampant. Whether it was the former CEO of Tyco International receiving millions in unauthorized bonuses, the actions of those at the top of Enron that created one of the biggest frauds in corporate history, the scandal at accounting and auditing firm Arthur Andersen, the demise of MCI/Worldcom, or the questionable practices that led to the Global Analyst Research Settlement, Wall Street had lost its way. In fact, a big reason why our firm Valuentum was founded is based on ensuring that investors get a fair shake and that someone is keeping a watchful eye not only on companies, but also on the sell-side stock analyst research that may still be full of conflicts of interest. As a result of the Global Analyst Research Settlement, all the big investment banks from Goldman Sachs (GS) to J.P. Morgan (JPM) to Morgan Stanley (MS) to UBS Group (UBS) and beyond had to pay stiff fines for producing conflicted, if not fraudulent research. We talk about how the poor corporate governance practices of the dot com bust and the questionable research from the investment banks served as the catalyst for the founding of Valuentum, itself, per our book Value Trap: (Brian Nelson) founded Valuentum in 2011 to help investors, to put investors first. It was all (he) knew. It was more than an extension of (his) principles as a CFA charterholder or (his) experiences at independent research giant Morningstar, however. There was something else to it. The research industry seemed to be flailing. The Global Analyst Research Settlement of 2003 helped to highlight the issues of conflict of interest in relation to securities analyst recommendations, but it only went so far. These ideals have not made it to the mainstream public, social media or blogosphere. In some ways, now 15 years after the research settlement, some investors may seem to be favoring the exact opposite of independent, objective analysis of stocks, confusing credibility and expertise with having “skin in the game.” Hardly anyone talks about the lessons of analyst research from the dot-com bubble anymore, where analysts were pumping “hot IPOs.” While the abuses by the investment banks have been lassoed in, (we) feel investors still need something better, and not just more ambiguous data or more stock screeners. The conversation about investing for most investors seems to be limited to these types of topics or on financial advising, in general, such as saving for retirement, maxing out one’s 401k, staying disciplined, and avoiding behavioral biases. There are blogs and websites that talk about stocks, of course, but access to high-quality financial analysis backed by iron-clad methods such as enterprise valuation just aren’t as prevalent as they should be. Without enterprise valuation, an understanding of universal valuation cannot be attained. They are one and the same. Though Valuentum’s work is heavily focused on fundamental and financial analysis within the context of enterprise valuation in deriving fair value estimates and fair value estimate ranges, we understand there’s a lot more that goes into a successful company than just the numbers. We don’t want investors to get caught up in the next Valeant Pharmaceuticals’ fraud-and-kickback scandal, the next Lehman Brothers that tries to hide toxic assets, management teams that take on far too much leverage in derivatives as with what happened with American International Group (AIG) during the Great Financial Crisis, or companies like those in the news today such as opaque Special Purpose Acquisition Companies (“SPACs”), electric-vehicle truck maker Nikola (NKLA) or the next health care fraud like Theranos and beyond. In general, there are a few broad categories to consider when thinking about corporate governance. Does the Board Have All Stakeholders In Mind? The board of directors is responsible for the big picture direction of the company. The board sets policies and oversees the company’s leadership, including setting executive compensation. Shareholders may technically be the owners of the company, but the board members represent the shareholder interests on a larger scale. They articulate the corporate values through their decisions and also set objectives and goals. The board may also appoint committees to oversee work on things such as the accounting audit and compensation. Because of the important role of board members, when considering the quality of a company’s corporate governance, we evaluate the independence of the board. Having board members with other interests related to the company--such as relationships with the company or its leaders or having board members who also work for the company--creates the potential for conflict (or the appearance of conflict) when it comes to decision making. We prefer company boards to have an independent majority. We also think it as best practice for the CEO to not also serve as the board chairman. Separating the role of CEO and chairman allows the board to focus on the goal of growing and improving the company more objectively, without too much influence falling into the hands of one person. That said, however, if a founder is an authentic genius with tremendous value-add in all areas of the business, we may be okay with that person being both chairman and CEO, as it could be a huge advantage. For example, we’re fine with Satya Nadella being chairman and CEO of Microsoft (MSFT) and Mark Zuckerberg being chairman of CEO of Meta Platforms (FB), formerly Facebook, but even though it hasn’t come back to bite Tesla (TSLA) shareholders, it may have been a good idea to have separated Elon Musk’s role as chairman and CEO before the fraud charges mandating the separation in 2018. Other issues could arise where outside activities could hurt investors. At one time, Jack Dorsey was both the CEO of Twitter (TWTR) and Block (SQ), formerly Square. Heading up one company is more than enough for one person, and Dorsey announced his departure from Twitter, the company he founded, in November 2021. In the discussion of social responsibility, we also consider the importance of diversity--in backgrounds, experiences, gender, race, etc.--in the most successful companies with respect to ESG. The board of directors should demonstrate this diversity in its composition as well as encourage it throughout the company in its policies. A diverse board can surface new ideas and raise new perspectives easier than one that has too similar of backgrounds and can better anticipate potential problems from marketing to brand image and beyond. Are Executives Being Properly Incentivized? Senior leadership is key to the success of a company. As opposed to the board, executives from the CEO, CFO, and COO and beyond oversee the day-to-day operations of a company and enact the board’s vision. Leadership is appointed by, and also reviewed by, the board, but they also have a lot of latitude in how their work is completed. As noted above, it is best if the CEO is not also chairman as there can be conflicts in how goals are set and how work is completed—and whether the company is even pursuing the “right” strategic direction. One of the big areas of corporate governance related to leadership is executive compensation. How an executive is compensated can motivate them to focus on certain metrics rather than others. Many boards adopt a pay-for-performance strategy so that leadership is compensated more when the company does well--thereby tying their pay to shareholder success. It is possible, however, for the board to tie compensation to any measure they deem to be appropriate as long as it aligns with the goals the board has for the company. However, there are a number of areas that may pose as red flags. In general, we want the executive team to be incentivized more on the basis of return on invested capital (ROIC) and economic value add (EVA), and not too much on accounting earnings per share (EPS). A focus on accounting earnings per share could lead the team to pursue aggressive buybacks at lofty prices, engage in value-destroying acquisitions, or other shenanigans to drive earnings per share higher, not the least of which is taking on too much debt. This could end badly.

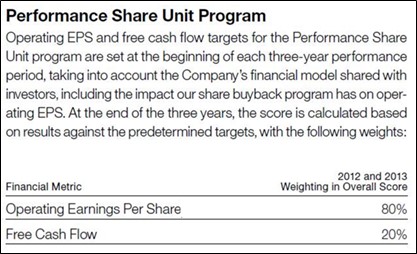

Image Source: IBM IBM (IBM) is a good example of where incentives based on accounting earnings per share did more harm than good. Due arguably to their executive incentive plan that emphasized operating earnings per share more than innovation (see image above), IBM's management "fell asleep at the wheel" during the early part of last decade. Instead of keeping pace with the latest and greatest tech innovators, IBM instead depended more heavily on share buybacks to target operating earnings per share goals, instead of concentrating on tangible operating improvements to drive higher-quality ROIC. The result: IBM faltered and ended up dropping its long-held operating earnings-per-share target for 2015 of $20 per share in late 2014. The company's share buyback "buffer" had not been enough to offset underlying business weakness, and the stock suffered as a result. The company has yet to recover from its misstep in executive incentives. Executive incentives tied to ROIC and EVA are one way that we evaluate whether management and shareholder interests are aligned properly, but we also want to make sure that the executive team has sufficient “skin in the game.” We do feel that non-founder CEOs may be a bit overpaid and perhaps are given too much compensation relative to the everyday employee at the firm, but we do think they should have a sufficient enough stake in the company such that they feel the consequences for their actions. We like to look at this not so much in terms of percentage ownership of the company as opposed to the dollar value of the CEO’s, CFO’s and COO’s as well as other top executive’s stakes in the company. We’d like the executive suite to have millions of their own dollars at risk in an ownership stake in the firm. Aside from the big picture direction of a company, there are also policies that guide day-to-day work within a corporation that ensure everyone is working towards the same goal, with the same corporate culture in mind. While policies may differ from organization to organization, a focus on transparency helps assure investors that the company is committed to the things they say and do. For those interested in ESG, these policies may refer to things like equity, diversity, and inclusion (EDI). For companies serious about doing corporate governance right, tangible executive incentives tied to ESG considerations also matter. Skin in the Game and Minority Shareholders That said, we don’t want management with too much skin in the game, whereas it leads to them having too great of control over strategic decisions. For example, while some CEOs are visionaries and their majority control may be a blessing for minority shareholders, a CEO with majority ownership could send the company down the wrong strategic path. Good corporate governance, in our view, means that all shareholders get an equal voice. If a company has dual class shares--Class A, Class B, and the like--with unequal rights (such as voting power), we think that could create a big issue for shareholders, especially if the majority shareholder(s) pursue(s) endeavors from acquisitions to capital allocation decisions and beyond that may run counter to the best interests of the firm. According to research from the Harvard Law School Forum, approximately 7% of Russell 3000 companies have dual class structures, and more and more new issues are adopting the practice. Perhaps the most well-known companies with dual class share structures are Alphabet (GOOG) (GOOGL) and Berkshire Hathaway (BRK.A) (BRK.B). In the former, GOOGL shares get one vote, while GOOG shares have no voting rights. Class B shares at Berkshire Hathaway have 1/1,500th of the economic interest of Class A shares but 1/10,000th of the voting power. Though we might want visionary founders to continue to have control of their companies without penalizing them for not having the corresponding economic interest and perhaps we may have no qualms with Warren Buffett heading up Berkshire Hathaway for as long as possible, dual class structures could result in entrenched management teams and poor decision making that was common following the dot com bust from self-dealings to weak accounting controls to other practices that could create problems for minority shareholders. Protecting minority shareholders has become a top priority at the Securities and Exchange Commission (SEC) of late. In particular, the SEC has emphasized in recent bulletins that investors do not have control of Chinese companies that are listed on United States exchanges. Such companies score low when it comes to corporate governance on our rating system. Here is an excerpt from a ‘Statement on Investor Protection Related to Recent Developments in China," for example: Recently, the government of the People’s Republic of China provided new guidance to and placed restrictions on China-based companies raising capital offshore, including through associated offshore shell companies. These developments include government-led cybersecurity reviews of certain companies raising capital through offshore entities. This is relevant to U.S. investors. In a number of sectors in China, companies are not allowed to have foreign ownership and cannot directly list on exchanges outside of China. To raise money on such exchanges, many China-based operating companies are structured as Variable Interest Entities (VIEs). In such an arrangement, a China-based operating company typically establishes an offshore shell company in another jurisdiction, such as the Cayman Islands, to issue stock to public shareholders. That shell company enters into service and other contracts with the China-based operating company, then issues shares on a foreign exchange, like the New York Stock Exchange. While the shell company has no equity ownership in the China-based operating company, for accounting purposes the shell company is able to consolidate the operating company into its financial statements. For U.S. investors, this arrangement creates “exposure” to the China-based operating company, though only through a series of service contracts and other contracts. To be clear, though, neither the investors in the shell company’s stock, nor the offshore shell company itself, has stock ownership in the China-based operating company. I worry that average investors may not realize that they hold stock in a shell company rather than a China-based operating company. U.S.-listed ADRs of Chinese companies from Alibaba (BABA) to Baidu (BIDU) and beyond have faced enormous selling pressure in recent months because of heightened U.S.-China tensions in the capital markets. The selling pressure reveals just how important control is to investors, as many market participants have re-set the values of Chinese companies listed on U.S. exchanges much lower largely because of what can best be described as a “lack of control” discount and intermediate-term concerns over delisting. With all this said, let’s take a look at how the Valuentum ESG Scoring System addresses corporate governance.

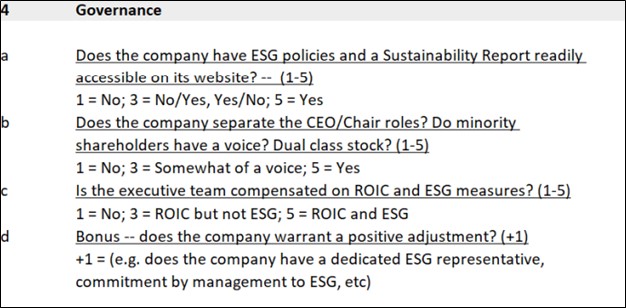

Image: The Valuentum Environmental, Social and Governance (ESG) Scoring System shows how “Governance” considerations are analyzed. As shown in the image above, there are four considerations that Valuentum analysts look at when considering governance as part of their ESG evaluation. The first consideration is with respect to ESG policies. This points to a focus on ESG as part of the corporate culture and transparency in how the company is looking to achieve these goals. Both an ESG policy and a Sustainability Report should be available and accessible on a company’s website. ESG policies tell investors where the company’s focus is in the areas of the environment, social responsibility, and governance, while the Sustainability Report details the environmental performance and impact. Companies with a focus on ESG should also provide additional reporting/metrics in investor presentations and their annual reports to keep investors updated on their progress. The second consideration relates to the voice of the shareholders. The three questions that go into this assessment are if the company has a separate CEO/Chair (to reduce conflicts of interest), if minority shareholders (those without a majority stake in the company) have a voice, and if there is dual class stock. Each of these is meant to keep the focus on the growth and improvement of the company as a whole and benefit all shareholders and stakeholders rather than just one group. The third consideration relates to executive compensation. Good corporate governance requires leadership to be compensated on measures such as ROIC or EVA. Going a step further, Valuentum analysts also look at how compensation relates to ESG measures, and whether they are being considered in incentive structures. That’s a more challenging goal to expect leadership to not only perform, but to do so with a focus on sustainability and social responsibility, but it’s not out of reach. The final consideration is a catch-all intended to give companies a bonus point towards their ESG rating if they have other efforts not mentioned in the above categories. Putting It All Together Now that we’ve reviewed all the considerations the Valuentum analysts review for the Valuentum ESG rating (note we covered E and S in prior articles), you might be wondering how to interpret the final rating. Each of the big categories – Environmental, Social, and Governance – includes several different aspects, and all of that goes into a final rating out of 100 (with 100 being the best). However, it is possible for a company to score well on all the categories, some, or none. When you look at the ESG rating, you’ll want to consider the overall rating, but also the individual categories that matter to you as an investor. As with any individual data point in any of our analysis, the ESG rating is just one piece of the puzzle when it comes to stock research. A company that scores well on environmental, social, and governance considerations is better able to appeal to customers, employees, and investors, and is well-positioned to minimize its regulatory and legal risks. Depending on your goals and risk tolerances, there will always be plenty of other things to consider in your analysis such as the fair value estimate range, the Dividend Cushion ratio (income safety), the Valuentum Buying Index (VBI) rating, and beyond. Always make sure to take a look at the 16-page reports and dividend reports to accompany the ESG analysis, too. Also tickerized for various ESG ETFs. ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment