|

|

Recent Articles

-

Net Cash Rich Tesla Reports Solid Free Cash Flow, Closes Out 2021 on a High Note

Net Cash Rich Tesla Reports Solid Free Cash Flow, Closes Out 2021 on a High Note

Jan 27, 2022

-

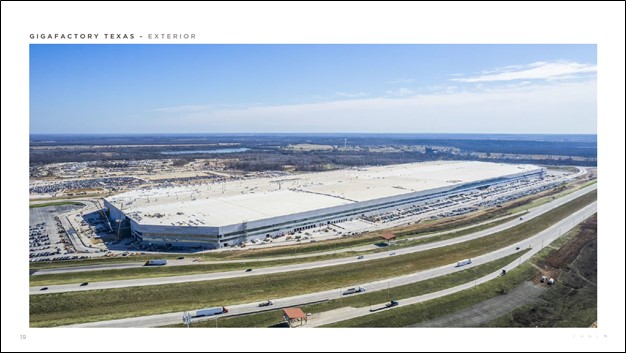

Image Shown: A look at Tesla Inc’s new ‘Gigafactory’ manufacturing facility in Austin, Texas, that is currently under development. Image Source: Tesla Inc – Fourth Quarter of 2021 IR Shareholder Deck.

On January 26, Tesla reported that it had produced ~306,000 vehicles and delivered ~309,000 vehicles during the final quarter of 2021. The electric vehicle (‘EV’) and battery maker beat both consensus top- and bottom-line estimates in the fourth quarter as it continued to successfully ramp its production capabilities. We plan to fine-tune our cash flow valuation model covering Tesla to take its latest earnings report into account, but we still expect the point fair value estimate to be below where shares are trading at the time of this writing (~$937 per share).

-

Capital Spending a Key Headwind to Broader Markets in 2022

Capital Spending a Key Headwind to Broader Markets in 2022

Jan 26, 2022

-

One of the biggest themes in 2022 is the amount of money companies will spend in capex (“capital expenditures”). A key reduction to net cash flow from operations to arrive at traditional free cash flow is capital expenditures, and we’re seeing some of the largest companies spend aggressively to the detriment of internal free cash flow generation. Though such spending may be necessary, in most cases, to enhance long-term revenue and earnings growth, the higher spending this year is a notable trend that we think may be posing a headwind to the broader equity markets so far in 2022.

-

Lockheed Martin On the Road to Recovery, Improved Free Cash Flow Visibility

Lockheed Martin On the Road to Recovery, Improved Free Cash Flow Visibility

Jan 25, 2022

-

Image: Heath Cajandig.

Lockheed Martin is a great play on rising geopolitical uncertainty, and after a “big bath” of a third quarter, the company’s most recently reported fourth-quarter 2021 results, released January 25, offered investors much better greater clarity on free cash flow coverage of its dividend while revealing sequential improvement in its backlog. Though its deal with Aerojet Rocketdyne may not pass muster with the FTC, we’re okay with that. Lockheed Martin already has a sizable net debt position, and given the recent disappointment in the third quarter of last year, we’re not against management focusing more on righting the ship from an organic basis than trying to push through business combinations that could jeopardize the regained fundamental momentum. Lockheed Martin remains an idea in the Dividend Growth Newsletter portfolio, yielding ~3% at the moment. The stock could continue to catch favor as geopolitical tensions intensify.

-

Microsoft’s Fiscal Second Quarter Impressive

Microsoft’s Fiscal Second Quarter Impressive

Jan 25, 2022

-

Image: Mike Mozart.

We’re reiterating our bullish view on newsletter portfolio holding Microsoft Corp. following its fiscal second-quarter report released January 25. We’re huge fans of the company’s strong economic moat and while its net balance sheet cash will erode somewhat in light of its proposal to acquire Activision, the company’s cloud opportunity and suite of recurring-revenue services makes for one attractive free-cash-flow generating powerhouse. The market may have wanted more from Microsoft’s fiscal second-quarter report, ended December 31, 2021, but it was solid across the board, in our view. We’re sticking with our $342 per share fair value estimate at the time of this writing.

|