|

|

Recent Articles

-

Valuentum Weekly: Outsized Energy Exposure Continues to Buoy Newsletter Portfolios

Valuentum Weekly: Outsized Energy Exposure Continues to Buoy Newsletter Portfolios

Mar 7, 2022

-

Image: Light crude oil futures once traded for roughly -$40 (negative $40) during the COVID-19 crisis, but have now rocketed to more than $120 in recent trading. Image Source: TradingView.

The S&P 500, as measured by the SPY, is down 9% year-to-date, a modest pullback, in our view, particularly in light of the fantastic performance the past few years. Though not necessarily welcome, a down year every now and then for the broader market indexes and a modest bear market can only be expected, at times. The Dow Jones Industrial Average, as measured by the DIA, is down more than 7% year-to-date (not too bad), while the Nasdaq--as measured by the QQQ--and 'disruptive innovation' stocks--as measured by the Ark Innovation ETF--have fallen more than 15% and 36%, respectively, so far this year (data from Seeking Alpha). We like how the simulated newsletter portfolios are positioned. Energy resource prices continue to surge (with WTI crude oil prices skyrocketing north of $120 per barrel at last check), and they are bringing energy equities higher along with them. The simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and simulated High Yield Dividend Newsletter portfolio are all materially overweight energy equities relative to the energy sector’s weighting in the S&P 500, and we expect to maintain such high tactical "exposure." Both the Energy Select Sector SPDR ETF and the Vanguard Energy ETF soared to 13-year highs last week. Our favorite energy ideas are the largest two energy majors, Exxon Mobil and Chevron, and both have hefty 'weightings' in each of the three aforementioned simulated newsletter portfolios. Russian equities, as measured by the RSX, are down nearly 80% so far this year, and we're pleased to say that we've largely avoided the fall out. We continue to like the broader areas of U.S.-heavy, large cap growth and big cap tech when it comes to long-term secular exposure, and we continue to like energy as a tactical overweight for the foreseeable future across the simulated newsletter portfolios, as much as we did even prior to the huge advance in energy resource prices and the invasion of Ukraine by Russia.

-

NextEra Energy’s Bright Outlook

NextEra Energy’s Bright Outlook

Mar 4, 2022

-

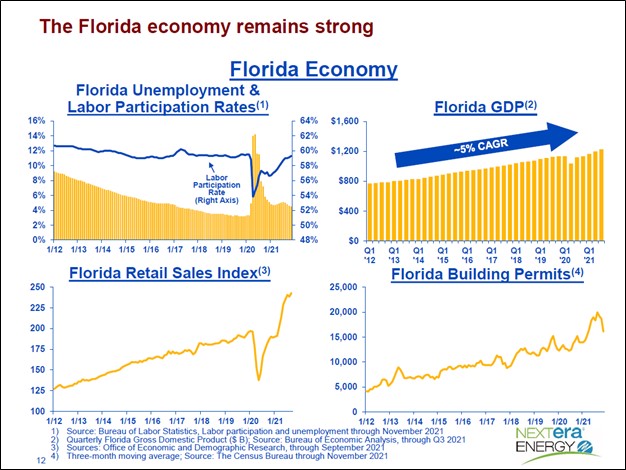

Image Shown: NextEra Energy Inc, one of our favorite utilities, owns the largest regulated electric utility in Florida and has exposure to the state’s promising population and economic growth trajectory. The utility is shifting its power generation base away from coal and towards renewable energy, leaning on natural gas and nuclear power plants to make the transition feasible. Image Source: NextEra Energy Inc – Fourth Quarter of 2021 IR Earnings Presentation.

We are big fans of NextEra Energy. The utility is a cash flow generating powerhouse with a bright adjusted EPS and dividend growth outlook, underpinned by its rapidly growing renewable energy division and exposure to Florida’s promising economic growth trajectory. Shares of NEE yield ~2.2% as of this writing.

-

Dividend Increases/Decreases for the Week March 4

Dividend Increases/Decreases for the Week March 4

Mar 4, 2022

-

Let's take a look at companies that raised/lowered their dividend this week.

-

Evaluating the Exposure of Chevron and Exxon Mobil to Russia’s Energy Industry

Evaluating the Exposure of Chevron and Exxon Mobil to Russia’s Energy Industry

Mar 1, 2022

-

Image Shown: Shares of Chevron Corporation (blue line) and Exxon Mobil Corporation (orange line) have skyrocketed over the past six months.

Chevron Corp and Exxon Mobil Corp, our two favorite large cap energy firms included as ideas in the newsletter portfolios, have relatively modest exposure to Russia. Peers such as BP plc and Shell plc have publicly stated that they would effectively abandon their stakes in Russian operations, and there is a decent chance Chevron and Exxon Mobil will follow suit. Let's talk about the potential impact.

|