|

|

Recent Articles

-

Shares of Our Favorite Miner South32 Skyrocketed During Past Year

Shares of Our Favorite Miner South32 Skyrocketed During Past Year

Mar 1, 2022

-

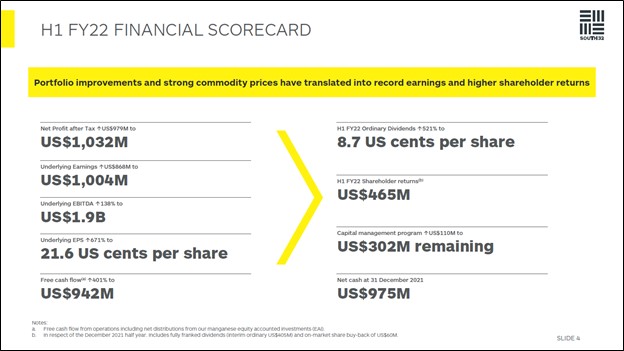

Image Shown: South32, an idea in our ESG Newsletter portfolio and one of our favorite miners, put up tremendous financial performance during the first half of fiscal 2022 as it capitalized on surging realized prices for its commodities sales. Image Source: South32 – First Half of Fiscal 2022 IR Earnings Presentation.

Shares of the American depository receipts (‘ADRs’) of one of our favorite miners, South32, have put up tremendous performance during the past year. According to data provided by Yahoo! Finance, shares of SOUHY are up over 50% during the past year on a price only basis while the S&P 500 is up ~9% on a price only basis during this period as of late February 2022. South32 is focused on building up a portfolio around high-quality nickel, aluminum, alumina, manganese, and zinc assets (these are metals and minerals that are essential for building things such as lithium-ion batteries and electric vehicles) while retaining a meaningful presence in the metallurgical coal space. Let's follow up on this excellent idea.

-

Our Report on Stocks in the Utilities (Mid/Small) Industry

Our Report on Stocks in the Utilities (Mid/Small) Industry

Feb 28, 2022

-

Our report on stocks in the Utilities (mid/small) industry can be found in this article. Report includes AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC.

-

Our Report on Stocks in the Utilities (Large) Industry

Our Report on Stocks in the Utilities (Large) Industry

Feb 28, 2022

-

Image Source: doggo.

Our report on stocks in the the Utilities (Large) industry can be found in this article. Report includes AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL.

-

Valuentum Weekly: Putin, the Aggressor, But Did “the West” Cause the Conflict in Ukraine?

Valuentum Weekly: Putin, the Aggressor, But Did “the West” Cause the Conflict in Ukraine?

Feb 27, 2022

-

We think the newsletter portfolios are well-positioned for inflationary pressures and believe the areas of large cap growth and big cap tech remain the places to be—names like Alphabet, Facebook, Microsoft, Apple and the like. Not only are these equities shorter-duration, more defensive areas relative to more speculative tech, but they also are shielded more from geopolitical uncertainty than international exposure, which many managers seek under modern portfolio theory. We’re also maintaining our bullish view on the energy sector in the near to medium-term. However, please be aware that, while strategically we like the areas of large cap growth and big cap tech because of their moaty business models, attractive valuations, large net cash positions and strong free cash flow generating capacities, we view the overweight “positions” in the energy sector in the simulated newsletter portfolios as tactical short-term decisions given their cyclical nature. The simulated Best Ideas Newsletter portfolio, after coming off huge years in 2019, 2020, and 2021, is performing about in line with the major indexes so far this year and doing far better than more speculative areas, where many investors found themselves caught like a deer in headlights. We remain bullish on stocks for the long run--and our favorite individual ideas remain in the simulated newsletter portfolios, within our additional options commentary and in the Exclusive publication. Stay diversified. May we see peace in Ukraine soon.

|