The steady growth expected from Diabetes products has come to an abrupt halt. Is Sanofi adequately prepared to replace the revenue loss of its top-selling product?

By Alexander J. Poulos and Kris Rosemann

The diabetes pandemic continues to expand at a rapid pace. Diabetes is a condition where the body is unable to regulate the amount of sugar found in the blood correctly, and it is differentiated into two distinct types. Type one diabetes is defined as a condition where the body does not produce any insulin, thus requiring regular supplementation to maintain proper regulation. The second and more common version is Type 2 diabetes where the body loses the ability to produce an adequate amount of insulin to regulate its blood sugar. Type 2 diabetics can often be controlled with insulin, but due to the high cost of therapy, it is reserved for the cases where less expensive oral agents are not effective.

Image Source: Express Scripts

Diabetes Market Dynamics

The combination of an aging worldwide demographic and an increase in the number of cases of diabetes is expected to continue driving consistent, sustained volume growth in the insulin market. However, a key stumbling block has emerged that has altered the landscape; the pharmaceutical benefit managers (PBMs) have banded together to extract significant price concessions to halt the rise in spending. The aggressive moves by the PBMs have sent shock waves through the industry with shares of Novo Nordisk (NVO) being among those most exposed. Novo Nordisk has enjoyed a prosperous run over the past decade; the company remains a virtual “pure play” on the disease with Novo investing the bulk of its resources behind expanding its share in the diabetes market. Now that a deflationary pricing environment has taken hold of the market, Novo has lost its appeal as a growth darling.

The Lantus franchise, owned by the European pharma powerhouse Sanofi (SNY) finds itself in a particularly tenuous position. Lantus is currently the top-selling insulin with 2016 sales exceeding €5.7 billion dollars, and it is also the top selling product in the Medicare market, as of 2016, according to Express Scripts stats. Lantus remains the Sanofi’s top-selling product, yet unlike its rival Novo Nordisk, Sanofi has a broad product lineup beyond diabetes that can absorb the potential revenue pressure resulting from price pressures.

The PBM’s have seized on the approval given to the third player in the field, Eli Lilly (LLY), to market an “alternative version” of Lantus named Basaglar. Lilly and Novo Nordisk offer a complete lineup of insulin products ranging from human insulins to basal insulins and GLP-1 agonists. The PBM’s have often pitted Novo against Lilly to extract maximum concessions as most clinicians feel the products are interchangeable. For example, Humulin N (Eli Lilly’s product) will be substituted with Novolin N (Novo Nordisk’s product) if the formulary does not cover Humulin with the reverse also true.

Sanofi’s entrance into the insulin market serves as a departure from the company’s primary focus. We do not fault the firm for broadening its product lineup beyond its traditional role as a producer of cardiovascular products, but we were a bit surprised that Sanofi has had such success in the field as Lantus remains the premier insulin product in terms of sales. However, Lantus’ days as a growth driver for Sanofi have come to an abrupt end with PBM CVS Caremark (CVS) now covering Eli Lilly’s Basaglar exclusively. Other payers are is in the process of imitating the move, including United Healthcare (UNH), one of the largest insurers in the US and the third largest PBM, who, as of April 1, will cover Basalgar exclusively in its commercial and Meidcaid Managed Care plans. We expect other plans to follow in a staggered manner as cost containment remains the prime objective.

Sanofi Overview

Sanofi is a diversified healthcare company based in France, and its business is broken down into two core operating segments: ‘Pharmaceuticals’ and ‘Vaccines.’ The ‘Pharmaceuticals’ segment operates in five distinct global business units: ‘Specialty Care,’ ‘Diabetes & Cardiovascular,’ ‘Established Prescription Products,’ ‘Consumer Healthcare,’ and ‘Generics,’ while the ‘Vaccines’ segment is wholly dedicated to vaccines. The ‘Vaccines’ segment is an area of strength for Sanofi, though the vaccines market can be characterized as steady with modest annual growth.

Sanofi’s ‘Specialty Care’ division is home to a well-established line of specialty medications such as treatments for Multiple Sclerosis. The division, also known as Genzyme, was acquired to gain a firm hold in specialty medications, and the company continues to reap the benefits of the move as the division has grown at a solid double-digit pace of late. This division is a core reason why Sanofi is far better positioned than Novo Nordisk to handle the pricing pressure in the diabetes market, as the company also works to offset weakness in some of its top selling drugs in its ‘Established Prescription Products’ division, its largest pharma division in terms of annual sales. Plavix (blood thinner) and Renagel (hypocalcemia) have been two key sources of weakness for the division of late.

The ‘Consumer Healthcare’ division consists of numerous over the counter, non-prescription items, everyday products that many consumers have in their medicine cabinets such as Act, Allegra, Icy Hot and Rolaids. The consumer division offers slow, predictable yet uninspiring growth as branded products compete directly with generic products. The closest US competitors to Sanofi are multinationals such as Johnson and Johnson (JNJ).

Diabetes and Cardiovascular

In an attempt at life cycle management, Sanofi developed a next generation product of top-selling diabetes drug Lantus called Toujeo. Thus far, Toujeo has failed to gain traction, and we expect this to continue for the foreseeable future. Prescribers have been reluctant to stray from the mainstay products such as Lantus, and the PBMs formularies come into play here once again, which no doubt continues to stymie efforts to migrate patients to next generation products with extensive patent protection. CVS and UnitedHealthcare will exclude Toujeo from their commercial and Medicaid Managed Care plans.

Sanofi will need to broaden its product lineup further to return the group to growth, and management recognized the need for constant innovation by partnering with promising research-based entities to broaden the product lineup. The key product that was expected to mitigate the loss is the PCSK9 class for elevated cholesterol, which is the result of a partnership with Regeneron Pharmaceuticals (REGN) to market the treatment sold under the trade name Praluent. However, the treatment has failed to catch on, partially due to the enormous list price for a yearly treatment. The best hopes for expanded use rests with compelling long-term outcome data that conclusively proves the superiority of the treatment versus conventional therapies, but with the data still pending, near-term growth prospects have been hampered.

Further complicating matters is the pending litigation between Sanofi/Regeneron and Amgen (AMGN) over the infringement of Amgen’s patent on its competing product. The negotiations have taken an acrimonious stance with Amgen pushing for Praluent to be withdrawn from the US market. We do not envision this scenario playing out; the most likely outcome is a royalty will be paid with Praluent remaining on the market. The greater issue is the uncertainty has given Amgen an opportunity to steal share and become the primary product clinician’s use. The PCSK9 class requires extensive pre-authorization which is a time-consuming endeavor. Clinicians will opt for the path of least resistance, with the future of Praluent in doubt as the legal case plays out. Also, if Praluent is banned, clinicians would have to abruptly discontinue therapy, which is often not in the best interests of the patient. A break in the continuity of care often leads to worse outcomes, the opposite of what all in the healthcare field should strive for.

Role of the Dividend

Image Source: Valuentum

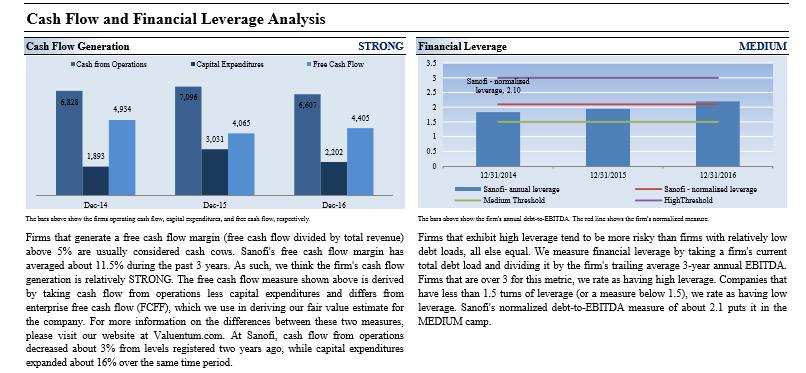

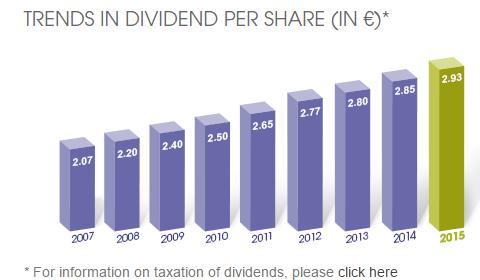

Similar to its big pharma brethren, Sanofi pays a robust dividend. With Sanofi domiciled in France, the company follows the tradition of most European equities, paying an annual dividend instead of a quarterly payout, the model most income-seeking investors prefer. Sanofi current yield of ~3.5% is attractive, especially in today’s yield starved markets. However, Sanofi’s dividend is subject to currency fluctuations, which may cause volatile net payouts in US dollars though it is steady when denominated in euros. The company has a consistent history of raising the dividend in euros, but the actual payout to US ADR-holders paints a far different picture.

Image Source: Sanofi

Taxation of Dividends

The dividends received from foreign-based companies may be taxed at a far higher rate than the current US rate. While we are not tax experts and suggest the consultation of a qualified expert in this matter (we cannot give any advice), a few points of interest are worth highlighting. According to current French law, dividends received from a company domiciled in France are subject to a withholding tax of 30%. Certain situations do apply such as the following quote taken from a recent regulatory filing:

Dividends paid to an eligible U.S. holder may immediately be subject to the reduced rates of 5% or 15% provided that such holder establishes before the date of payment that it is a U.S. resident under the Treaty by completing and providing the depositary with a treaty form (Form 5000). Dividends paid to a U.S. holder that has not filed the Form 5000 before the dividend payment date will be subject to French withholding tax at the rate of 30% and then reduced at a later date to 5% or 15%, provided that such holder duly completes and provides the French tax authorities with the treaty forms Form 5000 and Form 5001 before December 31 of the second calendar year following the year during which the dividend is paid.

Conclusion

In our view, Sanofi is taking the correct actions to move past the loss of revenue from top selling product Lantus. The diversified revenue stream of multinational pharmaceutical giants helps to prevent a significant decline in revenue, thus providing a healthy backdrop for a steady, uninterrupted stream of income via the dividend. Sanofi is not a growth vehicle like its partner Regeneron, but it should be viewed as a consistent performer that returns excess cash to shareholders.

For those who are interested in further details on this partnership, please review the February 23 article, “3 Critical Drug Approvals for your Radar.” All things considered, Sanofi is a fine payer of dividends, but we are not looking to add additional healthcare exposure to the Dividend Growth Newsletter portfolio at this point in time, especially after considering the currency implications on the payout.

Disclosure: Alexander J Poulos is long Regeneron Pharmaceuticals (REGN).