What can investors expect when it comes to imminent drug approvals? Let’s cover three important ones.

By Alexander J. Poulos

The drug discovery process is a tedious multi-step process that is fraught with peril. The design of the clinical trials remains very costly with little in the way of assured success. Companies that can successfully shepherd through a compound are often rewarded a lucrative patent that allows for monopoly-like margins for a limited time. We monitor the drug-discovery process closely, with a particular emphasis on PDUFA (Prescription Drug User Fee Act) dates. A PDUFA date is when the FDA needs to rule whether or not a new drug application will be approved and become available to the market. A delay in approval can be quite costly, especially for smaller entities which are often focused on a single compound. Let’s discuss three compounds with PDUFA dates set for the next three months.

Lexicon Pharmaceuticals

First up on the calendar is the development-stage biotech Lexicon Pharmaceuticals (LXRX) with its lead product Telotristat Etiprate from the treatment of Carcinoid Treatment in oncology patients. The current standard of care is to treat the afflicted patient population with a long-acting somatostatin therapy. For the compound to gain approval and traction in the marketplace, it would need to post superior outcomes in clinical trials for the patient population that is not adequately controlled with somatostatin monotherapy.

The trial was designed to test two different dosing ranges of Telotristat (250mg and 500mg) taken three times a day along with somatostatin therapy. The comparative arm remained on somatostatin in addition to a placebo. The trial met its primary endpoint with a reduction of 1.71 bowel movements in the 250mg arm and 2.11 bowel movements in the 500mg portion. The side-effect profile was elevated in the 500mg arm with nausea the primary complaint but none of the participants discontinued therapy.

The data looks promising with a PDUFA date set for February 28, 2017, but the challenge for Lexicon remains building a salesforce to push the product. Lexicon will market the product in the US and Japan with its partner responsible for European and additional territories. The product is designated as an orphan drug which will limit the overall patent life to seven years before a competing product can be approved by the FDA. Lexicon does hold a well over $350 million in cash and short-term investments which will be used to offset the increased in overhead as the company ramps up headcount to promote and support Telotristat.

The company’s net-cash balance sheet will come in handy as Lexicon inked a collaboration deal with Sanofi (SNY) for its second compound Sotagliflozin, a proposed treatment for type 1 & 2 diabetes. Lexicon received an upfront payment of $300 million with potential milestone payments that may reach $1.4 billion depending on the success of the product through the testing process. The product recently entered phase 3 testing. The sales results of Telotristat combined with the clinical results of Sotagliflozin will determine if Lexicon morphs into a mature biotech from an investigational company. It’s important to note, however, that annualized revenues at Lexicon are less than $100 million and that the biotech continues to rack up losses, in excess of $100 million on an annual run-rate basis. Lexicon has burned through ~$125 million in cash during the first nine months of 2016.

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals (REGN), on the other hand, has already morphed into a biotech powerhouse thanks to the dominant results of its lead product Eylea for the treatment of macular degeneration. Regeneron is the poster child for what all the development stage companies hope to aspire to.

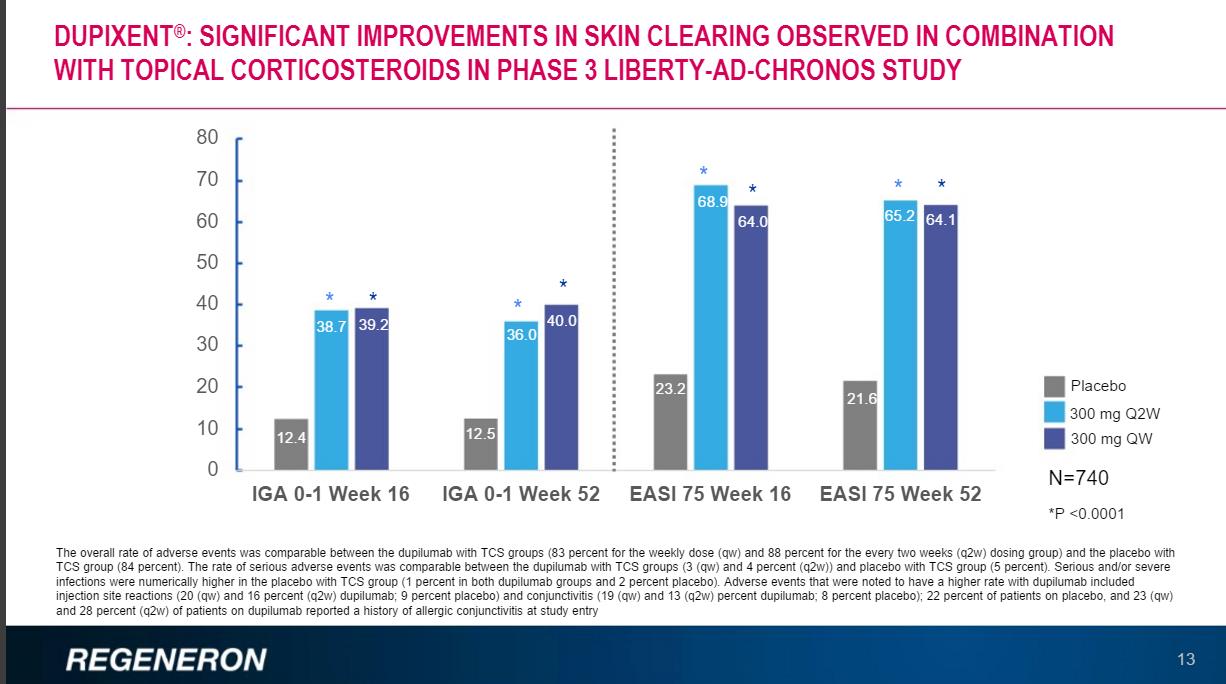

Regeneron has a key near term PDUFA date of March 29, 2017, for its novel treatment of moderate to severe atopic dermatitis Dupilumab. The standard course of treatment is the use of topical corticosteroids that bring with them a host of side effects. The overall patient population is quite large with topical corticosteroids failing to address a significant portion of the overall patient population. If Regeneron can demonstrate a demonstrative difference over the results obtained with corticosteroids the company will have established a dominant first-mover advantage well before potential competing products can be brought to market.

The first-mover advantage is critical, as clinicians begin to use and become comfortable with the product; they often loath switching the patient’s treatments unless forced to by payer constraints. In this regard, Regeneron has taken a far different path than the typical biotech entities. The norm of the industry is to hand down price hikes on a bi-annual basis to drive revenue gains over the entire lifecycle of the product. Thus far, Regeneron has not raised the price of Eylea once even though the product has been on the market since November of 2011.

Source: Regeneron Pharmaceuticals

On numerous recent conference calls, CEO Leonard Schleifer has mentioned the company is prepared to work with payers on a constructive reimbursement scheme. We are heartened by the company’s stance in what is sure to be an expensive, chronic treatment. The future revenue ramp will be highly dependent on how open the various national formularies are. Regeneron would be wise, in our view, to avoid the perception of price gouging, which will hamper initial uptake.

Some of the enthusiasm for the product’s launch cooled significantly upon the disclosure that Regeneron and its partner Sanofi received a complete response letter for its other collaboration, Sarilumab for the treatment of various inflammatory diseases. The FDA took issue with the manufacturing site used to finish the product. While Sarilumab is not as integral for Regeneron’s prospects, a costly delay in the commercial availability would not go over well with the investment community. Schleifer mentioned the FDA has now signed off on the plant, which removed a near-term obstacle for the approval of both compounds.

We are somewhat puzzled by the lack of enthusiasm for the shares, however. The equity remains range bound with three new novel products either brought to market (Praluent) or about to enter the market. Sarilumab has gained approval for marketing in Europe under the trade name Kevzara while Dupilumab will be sold under the name Dupixent. We would expect the equity to begin to trade higher upon the expectations of two new revenue streams, especially for Dupixent.

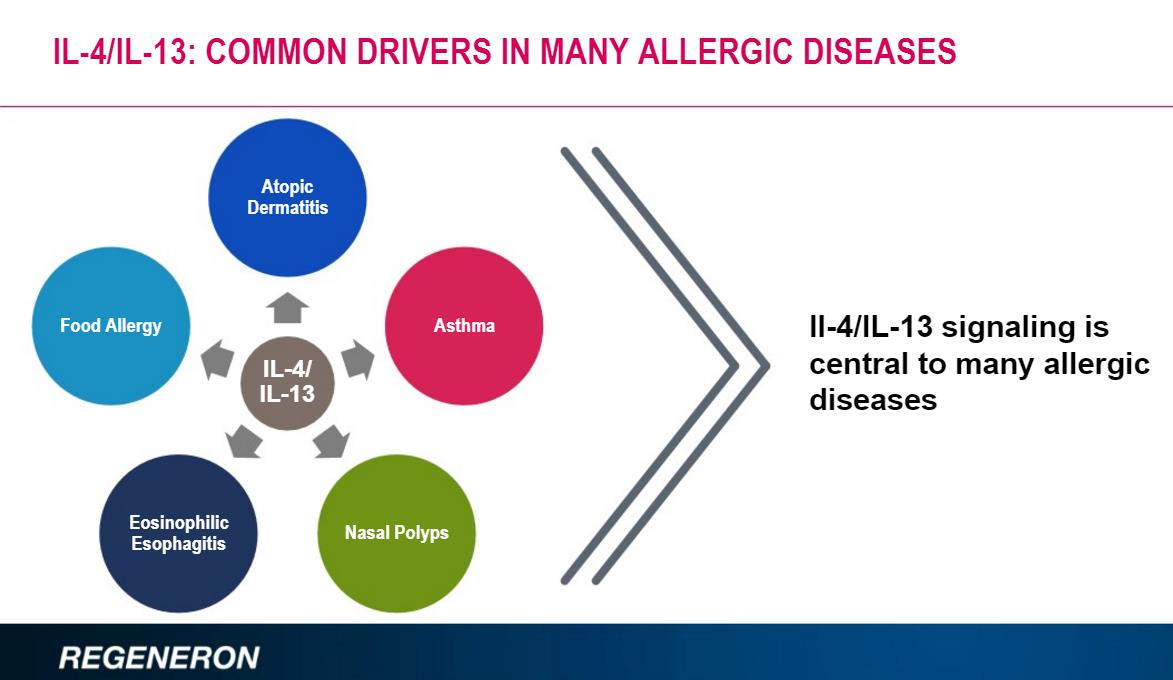

Dupixent is being explored for additional used most notably for nasal polyps, asthma and eosinophilic esophagitis along with the use of Dupixent in children. A pediatric indication will extend the patent life for another six months, a worthwhile endeavor. Our fair value estimate for Regeneron’s shares is $393 at the time of this writing.

Source: Regeneron Pharmaceuticals

The indication that holds the most potential is the use in Asthma. Regeneron believes the IL-4/IL-13 signaling leads to an exacerbation of asthma symptoms, a win that would vastly expand the overall market. The product is currently in phase 3 testing.

Neurocrine Biosciences

Neurocrine Biosciences (NBIX) is a developmental company with a couple novel compounds.

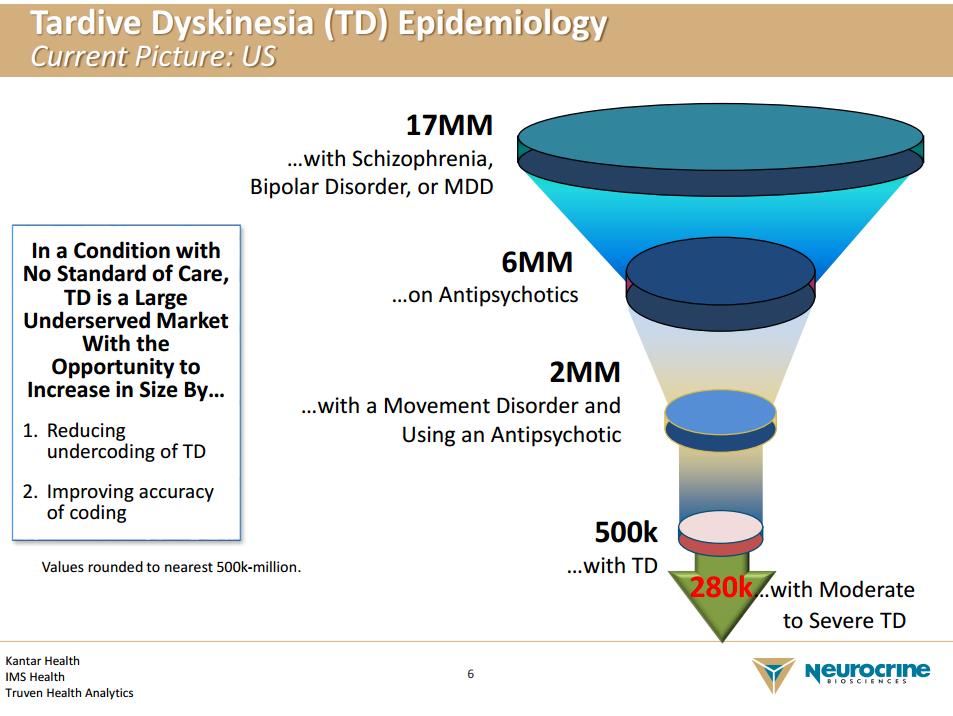

Neurocrine’s lead compound is Valbenazine (Ingrezza) for the treatment of Tardive Dyskinesia (TD). TD is a disease state with a slow onset (Tardive) which manifests itself with involuntary muscle movements (dyskinesia). TD is a relatively rare disorder, however, and it is often a side effect of the use of antipsychotic medications. The second generation of the antipsychotics dubbed atypical antipsychotics carry the warnings of the potential for TD on its label, yet it is believed the group carries a lower risk than the older class.

Ingrezza has posted impressive results in the various clinical trials conducted. We have little doubt the product will be approved to treat TD. Our concern rests with what we perceive will be an uphill battle Neurocrine will face to educate clinicians and ultimately gain payer support and ultimately reimbursement.

Source: Neurocrine Biosciences

TD remains an underdiagnosed malady, which makes identifying the eligible patient population difficult. The delayed onset of the disease impedes the process as it is often easy to overlook some of the symptoms of the disorder, further complicating matters. We feel Neurocrine will spend a considerable sum to build out the initial sales force. Also, expensive direct-to-consumer ads will be necessary to raise awareness, which will stretch Neurocrine’s budget further. Also, the recent loss of patent exclusivity in the atypical antipsychotic class may further hinder matters as clinicians could feel more inclined to prescribe the newer class. The theory remains the atypical class has a lower incidence of TD; thus, a switch over will reduce the overall market if the thesis is accurate.

At the end of 2016, Neurocrine held over $300 million in cash, which it expects will be adequate to fund the company over the next two years. We feel a strategic partnership could be in the company’s best interests, but we suspect the lack of big pharma interest may have to do with recent patent expirations of the atypical class. Ingrezza would have been tailor-made for a company that promoted an atypical psychotic to speak with clinicians about during a sales call. With big pharma pivoting towards oncology as the next area of profit growth, the market for a natural partner seems to have dried up.

That said, Neurocrine was able to partner up its second compound, Elagolix for the treatment of endometriosis and uterine fibroids. We feel royalty deals with a large upfront payment are ideal for early-stage companies such as Neurocrine. Neurocrine initially received $75 million from Abbvie (ABBV) with the potential to receive up to $480 million dependent on the regulatory process. Abbvie will be responsible for ushering the product through testing and ultimate commercial availability with Neurocrine to receive a royalty based on worldwide sales. We like the terms of such a deal; it allows Neurocrine to focus on what it does best, develop novel compounds instead of being bogged down trying to market a new product.

Neurocrine burned through more than $70 million in cash during 2016, while total revenue stood at a mere $15 million during the year. Research and development expenses were $94 million while total operating expenses came in at more than $160 million for the year. Its loss from operations for 2016 was rather large at nearly $150 million, equating to roughly half of its cash on the books.

Conclusion

In this piece, we wanted to bring to light a few near-term drug approvals. We hope you have found this useful, and we plan to continue to compose more of these on under-followed biotechs across our coverage universe.

Alexander J. Poulos is long Regeneron Pharmaceuticals.