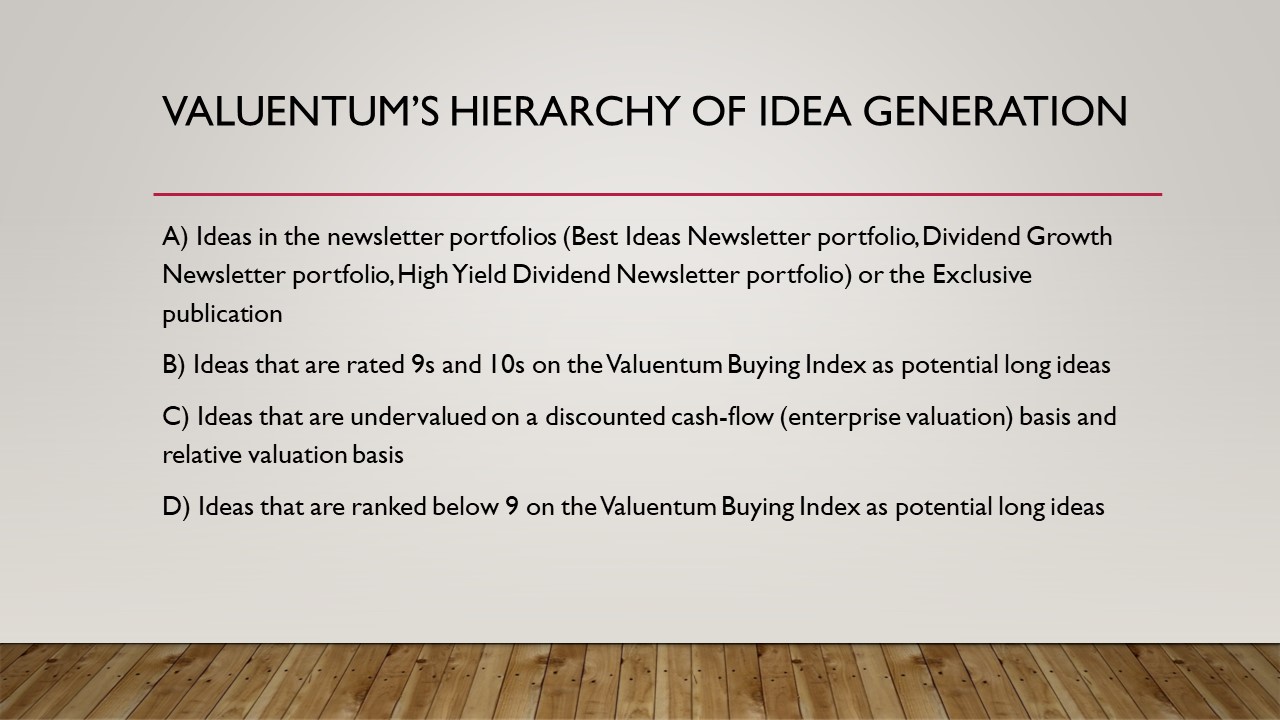

Image: How we rank our favorite ideas. We’re huge fans of ideas in the simulated newsletter portfolios and Exclusive publication. We like the ideas in the simulated newsletter portfolios and Exclusive publication the best.

By Brian Nelson, CFA

Salesforce, Inc. (CRM) has never been an idea in the simulated newsletter portfolios since inception, and that’s not going to change anytime soon. Its share price has been roughly cut in half in 2022, and we’re sticking with our $130-$196 per share fair value estimate range following the company’s disappointing outlook for the fourth quarter of fiscal 2023. Weakness across the software space and the exit of co-CEO Bret Taylor and Stewart Butterfield, the head of Salesforce-owned Slack, aren’t reassuring. Risks are mounting to the Salesforce story, in our view, and we like ideas in the newsletter portfolios and Exclusive publication much better.

Prior to the release of Salesforce’s third-quarter fiscal 2023 results November 30, in mid-October, we reduced our fair value estimate of Salesforce to $163 per share from a level north of $200 per share that we first established in late 2020. A lot has changed during the past many months, and more conservative near-term assumptions for Salesforce have impacted our longer-term mid-cycle assumptions (in Year 5, for example), which have had a cascading impact on our valuation of shares when we updated its report in mid-October. We update our work and fair value estimates to reflect material changes in our views, generally every 3-12 months (depending on the company).

In other words, in factoring in the current more-uncertain economic backdrop, which translates into much more conservative mid-cycle assumptions at Salesforce, we substantially lowered our fair value estimate of its shares in mid-October (when its latest report was updated). Specifically, our mid-cycle assumptions for revenue and operating earnings were adjusted lower for Salesforce in the mid-October report update, and this resulted in a lower fair value estimate at that time. We point to our fair value estimate range to account for the uncertainty embedded in any (our) valuation process, which relies on future expectations that should be expected to change (and sometimes materially) over time as new information comes to light.

When we hiked our fair value estimate of Salesforce to north of $200 in late 2020, things were much different than the current market environment. Interest rates were still benign at that time–especially the 10-year Treasury rate, which has skyrocketed this year–and tech spending looked solid as a negative wealth effect from falling stock and bond prices (as well as housing prices) wasn’t a part of our thesis back then. Further, months ago, the cryptocurrency space was holding up (many investors hadn’t even heard of the crypto exchange FTX), and disruptive innovation stocks hadn’t been completely pummeled as they have today — so a lot has happened that will likely curb tech spending in the near term, in our view.

To top things off, layoffs weren’t even on Silicon Valley’s mind at the time (unlike these days, where we’re hearing layoffs by the tens of thousands at some of the most prominent tech companies). Salesforce also recently lowered its guidance and announced job cuts, itself, prior to the disappointing outlook for the fourth quarter of fiscal 2023 that was released November 30. Members should expect fair value estimates to change over time as companies collect cash and as new forecasts of free cash flow are fine-tuned within the valuation model. This is normal. Some fair value estimates are more sensitive than others, too, and this ‘sensitivity dynamic’ is largely captured by the size of the company’s fair value estimate range.

Download (pdf): “How Well Do Enterprise-Cash-Flow-Derived Fair Value Estimates Predict Future Stock Prices? — And Thoughts on Behavioral Valuation“

Concluding Thoughts

We’re not interested in adding Salesforce to any of the simulated newsletter portfolios at this time, and we’re reiterating our wide fair value estimate range for shares amid executive departures and a weakened software spending environment. Microsoft remains our favorite play on the software space at this time, a company that we include in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Tickerized for CRM, MSFT, ORCL, ADBE, WDAY, NOW

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.