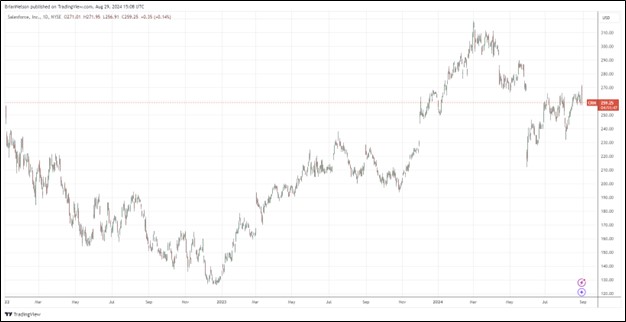

Image: Salesforce’s shares have bounced back nicely during the past year.

By Brian Nelson, CFA

On August 28, Salesforce (CRM) reported better than expected second quarter fiscal 2025 results with both revenue and non-GAAP earnings per share coming in better than the consensus forecasts. Second quarter revenue was up 8.4% year-over-year (9% in constant currency), which includes Subscription & Support revenue growth of 9% (10% in constant currency). Its second quarter GAAP operating margin was 19.1%, while its non-GAAP operating margin came in at 33.7%. Non-GAAP diluted net income per share came in at $2.56 in the quarter, up from $2.12 in the same period last year.

Management’s commentary was upbeat in the press release:

In Q2, we delivered strong performance across revenue, cash flow, margin and cRPO, and raised our fiscal year non-GAAP operating margin and cash flow growth guidance. With our new Agentforce AI platform, we’re reimagining enterprise software for a new world where humans with autonomous Agents drive customer success together. Salesforce is the only company with the leading apps, trusted data and agent-first platform to deliver this vision at scale and help companies realize the incredible benefits of AI.

We continue to deliver disciplined profitable growth and this quarter, operating margins closed at record highs with GAAP operating margin of 19.1%, up 190 basis points year-over-year, and Non-GAAP operating margin of 33.7%, up 210 basis points year-over year. Our capital return program remains a priority and we now expect to more than fully offset our dilution from FY25 stock based compensation.

Salesforce’s current remaining performance obligations advanced 10% on a year-over-year basis (11% in constant currency), while second quarter operating cash flow increased 10% year-over-year, to $0.89 billion. Free cash flow of $0.76 billion was up 20% year-over-year. In the quarter, Salesforce returned $4.3 billion in share buybacks and $0.4 billion in dividends.

Looking to fiscal 2025, Salesforce maintained its fiscal year revenue guidance in the range of $37.7-$38 billion, up 8%-9%, while it also maintained its full year Subscription & Support revenue growth guidance of slightly below 10% year-over-year, or approximately 10% in constant currency. Management updated its fiscal 2025 GAAP operating margin guidance to 19.7% and non-GAAP operating margin guidance to 32.8%. Non-GAAP diluted earnings per share is targeted in the range of $10.03-$10.11 (versus consensus of $9.89). Salesforce also raised its full year operating cash flow growth guidance to the range of 23%-25%. Our fair value estimate stands at $271 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.