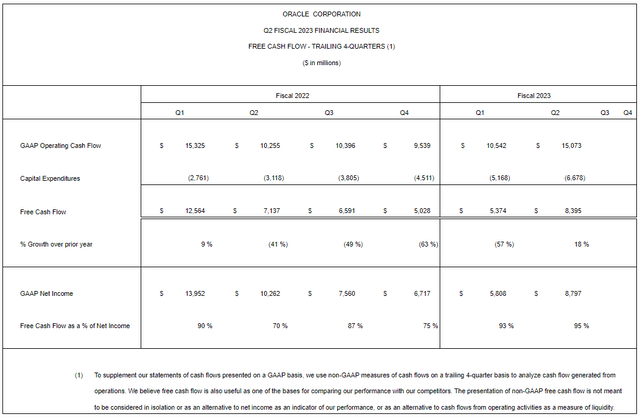

Image: Trailing four-quarter free cash flow trends at Oracle are strong but lumpy. Image Source: Oracle

By Valuentum Analysts

On December 12, Oracle Corporation (ORCL) reported better than expected second quarter fiscal 2023 results for the three months ended November 30. Total revenue advanced 18% in the quarter on a year-over-year basis, leaping 25% in constant currency, thanks in part to strong performance at its infrastructure and application cloud businesses. Non-GAAP operating income increased 5%–and 12% in constant currency–and its non-GAAP operating margin was 41% in the period. Fiscal second-quarter non-GAAP earnings per share of $1.21 beat the consensus estimate, despite foreign currency headwinds. We liked that we saw in the quarterly results, and we’ll be sticking with the company as one of our best ideas.

Oracle offers an expansive slate of database, enterprise resource planning (‘ERP’), infrastructureâ€Âasâ€Âaâ€Âservice (‘IaaS’), platformâ€Âasâ€Âaâ€Âservice (‘PaaS’), and other IT offerings. Over the past decade, the company has pivoted away from onâ€Âpremise offerings and hardware towards offâ€Âsite and hybrid offerings and cloudâ€Âprovided services. More recently, Oracle’s efforts have started to pay off. Though shares of ORCL are down ~7.5% yearâ€Âtoâ€Âdate as of the end of normal trading hours December 12 (excluding dividend considerations), they are outperforming the S&P 500 this year, and we’ve been pleased with this dividend payer. Shares of ORCL yield ~1.6% as of this writing, and its Dividend Cushion ratio, which is weighed down by its net debt position, stands at 1.1.

Oracle’s management, itself, was very happy with the top-line number in the fiscal second quarter results, which was $200 million more than the high end of its internal guidance, and CEO Safra Catz emphasized that “each and every one of (its) strategic businesses delivered solid revenue growth in the quarter.” In July of this year, Oracle closed its all-cash deal for Cerner, which contributed $1.5 billion in revenue in the quarter. Though the Cerner transaction has changed Oracle’s balance sheet (notes payable and other borrowings stood at ~$90.9 billion at the end of the quarter), management’s goals to modernize the healthcare system are admirable. Cerner, under the tutelage of Oracle, is still in the early innings, and we’ll be monitoring developments as the quarters go by.

Oracle’s ESG Considerations

Over one third of Oracle’s board of directors are women or those that come from a diverse background, according to the company’s 2020 Proxy Statement. The majority of Oracle’s board members (nine out of 14) are independent directors, and the CEO and the Chair roles are split between Safra Catz (CEO and board member of Oracle) and Larry Ellison (coâ€Âfounder, CTO and Chair of Oracle). Oracle has only one class of voting stock, no supermajority voting provisions, and provides for outside shareholders to call for a special meeting. Oracle CEO Safra Catz has numerous accomplishments, which we detail.

About Oracle’s CEO Safra Catz

Safra Catz was born in 1961 in Holon, Israel, a city along the Mediterranean coast. When she was a child, her family moved to Massachusetts to begin their new life in the US. She earned a bachelor’s degree from the Wharton School of the University of Pennsylvania and a JD from the University of Pennsylvania Law School in the 1980s. In the 1990s, Catz married Gal Tirosh, and the couple had two sons.

After joining Oracle back in 1999, Catz rose through the ranks to become CEO of one of the largest tech companies in the US. She became a member of Oracle’s board in 2001 and was promoted to CEO in 2014. Catz also serves on Disney’s (DIS) board of directors as her perspective is often sought by large enterprises, and in the past, she served as director of the banking giant HSBC Holdings (HSBC).

Since taking over the top job at Oracle, Catz has aimed to pivot Oracle away from the legacy businesses (namely traditional data enterprise application services) built up by the firm’s coâ€Âfounder, Larry Ellison, and towards technologies of the future (such as offsite and hybrid cloudâ€Âcomputing services and solutions). By revamping Oracle’s database offerings and placing a greater emphasis on growing the company’s cloudâ€Âoriented enterprise resource planning (‘ERP’) services, Catz has been able to revive Oracle’s longâ€Âterm revenue growth trajectory.

She played an outsized role in preventing Oracle from falling into the downward spiral that befell many of its peers over the past decade as they struggled to adapt to the proliferation of cloud computing and was able to do so while adeptly managing the company’s cost structure during the transition. According to Forbes, Catz is a billionaire and well on her way to becoming a multibillionaire, aided by the strong showing shares of Oracle have put up over the past year.

Oracle recently moved its headquarters to Austin, Texas, to take advantage of the state’s booming tech scene, favorable tax and regulatory regime, and the region’s significantly more affordable cost of living as compared to California’s Silicon Valley, where Oracle used to be headquartered. With Catz at the helm, Oracle is in good hands.

Oracle’s Sustainability and Cybersecurity Considerations

The company has set serious green energy goals, publishes an annual report on sustainability, and has a website dedicated to its progress on ESG issues. Its green energy goals include utilizing renewable energy across 100% of its operations by 2025, focusing on recycling its hardware (in fiscal 2020, Oracle reused or recycled 99.6% of the retired hardware assets it collected), eliminating waste at its facilities (waste sent to landfills from its facilities has fallen by roughly oneâ€Âquarter on a square foot basis since 2015), and plans to push 100% of its key suppliers to have an environmental program in place by 2025. Oracle has a chief sustainability officer (‘CSO’) position currently held by Jon Chorley, who is also the firm’s Group Vice President, Supply Chain Management Product Strategy.

Across Oracle’s ~50 offices around the world, all those facilities are now using 100% renewable energy, and all of Oracle’s European Cloud regions are now using 100% renewable energy as well. Considering Oracle’s operations consist primarily of selling software and services to its clients, with hardware representing a modest portion of its business in the cloudâ€Âcomputing era, its environmental footprint is rather small. The environmental footprint Oracle does leave is being mitigated by its recycling efforts, and commitments to utilizing renewable energy sources.

In our view, one of the biggest risks Oracle faces comes from malevolent cyber actors in the form of cybersecurity attacks and potential breaches, if Oracle’s security efforts are not up to the task (this would be considered a risk on the social side of the ESG matrix). Oracle places a great emphasis on cybersecurity across its suite of offerings. That process includes the “strict separation of duties in Oracle Database” and “isolated network virtualization in Oracle Cloud Infrastructure” as part of its “builtâ€Âin security controls.”

Furthermore, Oracle aims to “automate security to reduce complexity, prevent human error, and lower cost with automated patching for Autonomous Database and threat mitigation for Oracle Cloud Infrastructure” and the company utilizes “alwaysâ€Âon encryption and continuous monitoring of user behavior with Autonomous Database and Oracle Cloud Infrastructure.” Oracle is one of the better companies when it comes to ESG considerations, in our view.

Looking Ahead

Here’s what CEO Safra Catz had to say about the outlook for Oracle’s current third quarter of fiscal 2023 on the conference call:

So now, let me turn to my guidance for Q3, which I’ll provide on a non-GAAP basis. Using currency exchange rates as they are right now, currency should have a 4% negative effect on total revenue and at least a $0.06 negative effect on EPS in Q3. As I say every quarter, the actual currency impact may be different by quarter end, but we’ve got to use a number, so we’re using the number right now. Total revenues for Q3, including Cerner, are expected to grow from 21% to 23% in constant currency and are expected to grow from 17% to 19% in USD. Total cloud growth, including Cerner, is expected to grow from 46% to 50% in constant currency and 43% to 47% in USD. I expect the total cloud growth for the fiscal year, excluding Cerner will be above 30% in constant currency.

Non-GAAP EPS is expected to grow between 9% and 13% and be between $1.23 and $1.27 in constant currency. Again, due to currency headwinds, non-GAAP EPS is expected to grow between 4% and 8% and be between $1.17 and $1.21 in USD. And as I’ve said before, Cerner will be accretive to earnings this year, including in Q3. My EPS guidance for Q3 assumes our base tax rate of 20.5%, which is up from 19% last year. However, one-time tax events could cause actual tax rates for any given quarter to vary.

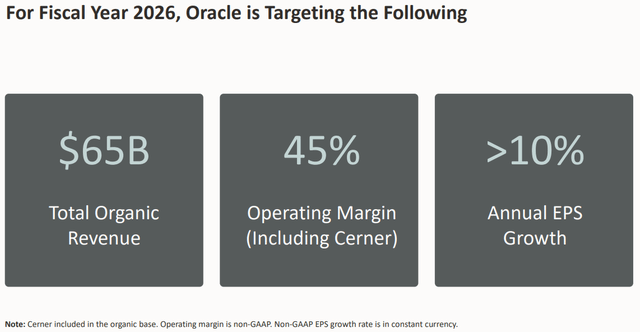

Management’s outlook for the next few years is mighty impressive, too. As shown in the image that follows, for fiscal 2026, Oracle is targeting organic revenue of $65 billion, an operating margin that includes Cerner of 45%, and annual earnings per share growth greater than 10%. With the company generating better-than-expected top-line performance during its second quarter of fiscal 2023, we think management has a good handle on the business, and if the executive suite can deliver on the 45% operating margin percentage, that would imply upside to our fair value estimate (we’re modeling an average EBIT margin of 42.1% over the next five years).

Image Source: Oracle

Concluding Thoughts

On December 12, Oracle reported better-than-expected second-quarter results for fiscal 2023 for the period ending November 30. The company’s infrastructure and applications cloud businesses continue to perform well, and integration efforts with respect to Cerner appear on track. Though we’re not huge fans of its net debt load and free cash flow trends have been lumpy of late, we’re excited about what the long-term has in store for Oracle in light of the company’s impressive fiscal 2026 financial targets. Shares yield ~1.6% at the time of this writing.

Excerpts from an article in the September 2021 edition of the ESG Newsletter were included in this article. Tickerized for ORCL, WDAY, SNOW, CRWD, COUP, FRSH, BOX, DBX, CRM, IBM.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.