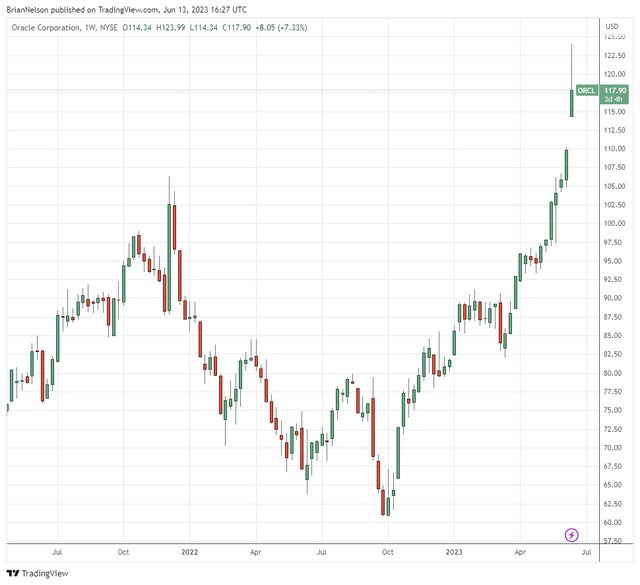

Image: Newsletter portfolio holding Oracle surges to all-time highs!

“Oracle’s Gen2 Cloud has quickly become the number 1 choice for running Generative AI workloads. Why? Because Oracle has the highest performance, lowest cost GPU cluster technology in the world. NVIDIA (NVDA) themselves are using our clusters, including one with more than 4,000 GPUs, for their AI infrastructure. Our GPU clusters are built using the highest-bandwidth and lowest-latency RDMA network—and scale up to 32,000 GPUs. As a result, cutting edge companies doing LLM development such as Mosaic ML, Adept AI, Cohere plus 30 other AI development companies have recently signed contracts to purchase more than $2 billion of capacity in Oracle’s Gen2 Cloud.” – Chairman and CTO Larry Ellison

By Brian Nelson, CFA

On June 12, Dividend Growth Newsletter portfolio holding and ESG Newsletter portfolio holding Oracle Corp. (ORCL) reported fantastic fourth-quarter results for its fiscal year 2023 for the period ending May 31, 2023. Both the company’s top- and bottom-lines came in better-than-expected in the quarter, and we expect continued strength at Oracle for the foreseeable future. Shares are trading at just shy of ~$120 each, and we expect to raise our fair value estimate upon the next valuation report update.

During Oracle’s fiscal fourth quarter, the headlines were mighty impressive. Total revenue advanced 18% on a constant-currency basis led by strength in its Cloud business (+55% on a constant-currency basis) across all verticals: Infrastructure (+77%), Application (+47%), Fusion Cloud ERP (+28%), Netsuite Cloud ERP (+24%). Cerner contributed roughly $1.5 billion to its revenue tally in the fiscal fourth quarter. Non-GAAP operating income advanced 10%, to $6.2 billion in the fiscal fourth quarter, and the firm’s operating cash flow surged during the fiscal year, leaping to $17.2 billion (up 80% in USD). Things are looking great at Oracle.

Here is what CEO Safra Catz had to say:

“Oracle’s revenue reached an all-time high of $50 billion in FY23…Annual revenue growth was led by our cloud applications and infrastructure businesses which grew at a combined rate of 50% in constant currency. Our infrastructure growth rate has been accelerating—with 63% growth for the full year, and 77% growth in the fourth quarter. Our cloud applications growth rate also accelerated in FY23. So, both of our two strategic cloud businesses are getting bigger—and growing faster. That bodes well for another strong year in FY24.

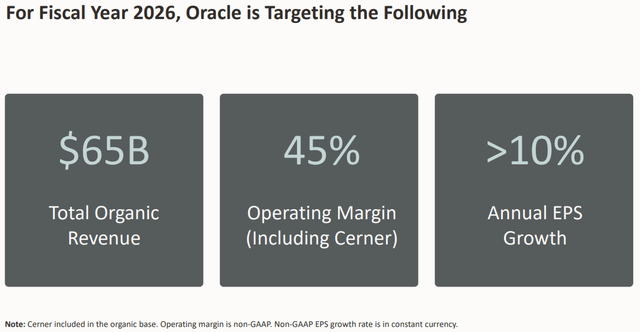

Management’s outlook for the next few years is mighty impressive, too. As shown in the image that follows, for fiscal 2026, Oracle is targeting organic revenue of $65 billion, an operating margin that includes Cerner of 45%, and annual earnings per share growth greater than 10%. With the company generating better-than-expected top-line performance during its fourth quarter of fiscal 2023, we think management has a good handle on the business, and if the executive suite can deliver on the 45% operating margin percentage, that would imply upside to our fair value estimate (we’re modeling an average EBIT margin of ~40.8% over the next five years).

Image Source: Oracle

Oracle has been a strong dividend grower in recent years, and while we have no reason to believe that expansion won’t continue on the back of such fundamental and financial strength, we continue to cast a cautious eye on the firm’s massive debt position. At the end of its fiscal 2023, the company’s cash and marketable securities balance has dwindled to ~$10.2 billion while total debt was ~$90.5 billion. Oracle’s free cash flow generation surged during fiscal 2023, however, and if the company delivers on its 2026 financial targets, good times are still ahead for the company. We continue to like Oracle in both the Dividend Growth Newsletter portfolio and ESG Newsletter portfolio, but its massive debt load is not a risk to be taken lightly.

———-

Tickerized for ORCL, NVDA, WDAY, SNOW, CRWD, COUP, FRSH, BOX, DBX, CRM, IBM

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.