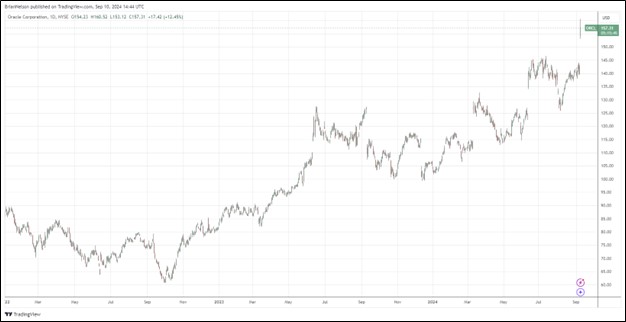

Image: Oracle’s shares have performed quite well during the past couple years.

By Brian Nelson, CFA

Oracle (ORCL) reported better than expected fiscal first quarter results on September 9, with revenue and non-GAAP earnings per share exceeding the consensus forecast. Total revenue expanded 7% in the quarter (up 8% in constant currency), while non-GAAP earnings per share advanced 17%, to $1.39 (up 18% in constant currency). Cloud services revenue advanced 21% (up 22% in constant currency), while cloud license and on-premise license revenues increased 7% (up 8% in constant currency).

Non-GAAP operating income increased 13%, to $5.7 billion, up 14% in constant currency, while its non-GAAP operating margin came in at 43%. Non-GAAP net income increased 18%, to $4 billion, up 19% in constant currency. Fiscal first quarter total remaining performance obligations were up 53%, to $99 billion. During the past twelve months, operating cash flow was $19.1 billion, while free cash flow was $11.3 billion. The company ended the quarter with $10.9 billion in cash, while total debt was $84.5 billion.

Management’s commentary was upbeat in the press release:

As Cloud Services became Oracle’s largest business, both our operating income and earnings per share growth accelerated. Non-GAAP operating income was up 14% in constant currency to $5.7 billion, and non-GAAP EPS was up 18% in constant currency to $1.39 in Q1. RPO was up 53% from last year to a record $99 billion. That strong contract backlog will increase revenue growth throughout FY25. But the biggest news of all was signing a MultiCloud agreement with [Amazon (AMZN)] AWS—including our latest technology Exadata hardware and Version 23ai of our database software—embedded into AWS cloud datacenters. AWS customers will get easy and convenient access to the Oracle database when we go live in December later this year.

Oracle has 162 cloud datacenters in operation and under construction around the world. The largest of these datacenters is 800 megawatts and will contain acres of NVIDIA GPU Clusters for training large scale AI models. In Q1, 42 additional cloud GPU contracts were signed for a total of $3 billion. Our database business growth rate is increasing as a result of our MultiCloud agreements with Microsoft (MSFT) and Google (GOOG) (GOOGL). At the end of Q1, 7 Oracle Cloud regions were live at Microsoft with 24 more being built, and 4 Oracle Cloud regions were live at Google with 14 more being built. Our recently signed AWS contract was a milestone in the MultiCloud Era. Soon customers will be able use the latest Oracle database technology from within every Hyperscaler’s cloud.

Oracle remains a key idea in both the Dividend Growth Newsletter portfolio as well as the ESG Newsletter portfolio, and its fiscal first quarter results support our bullish take on the name. Though Oracle has a rather large net debt position, free cash flow remains robust, while the company capitalizes on its total remaining performance obligations, which advanced 53% in the quarter on a year-over-year basis. We liked the commentary about revenue growth to accelerate throughout fiscal year 2025, and we point to the high end of our fair value estimate range ($178 per share) for shares.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.