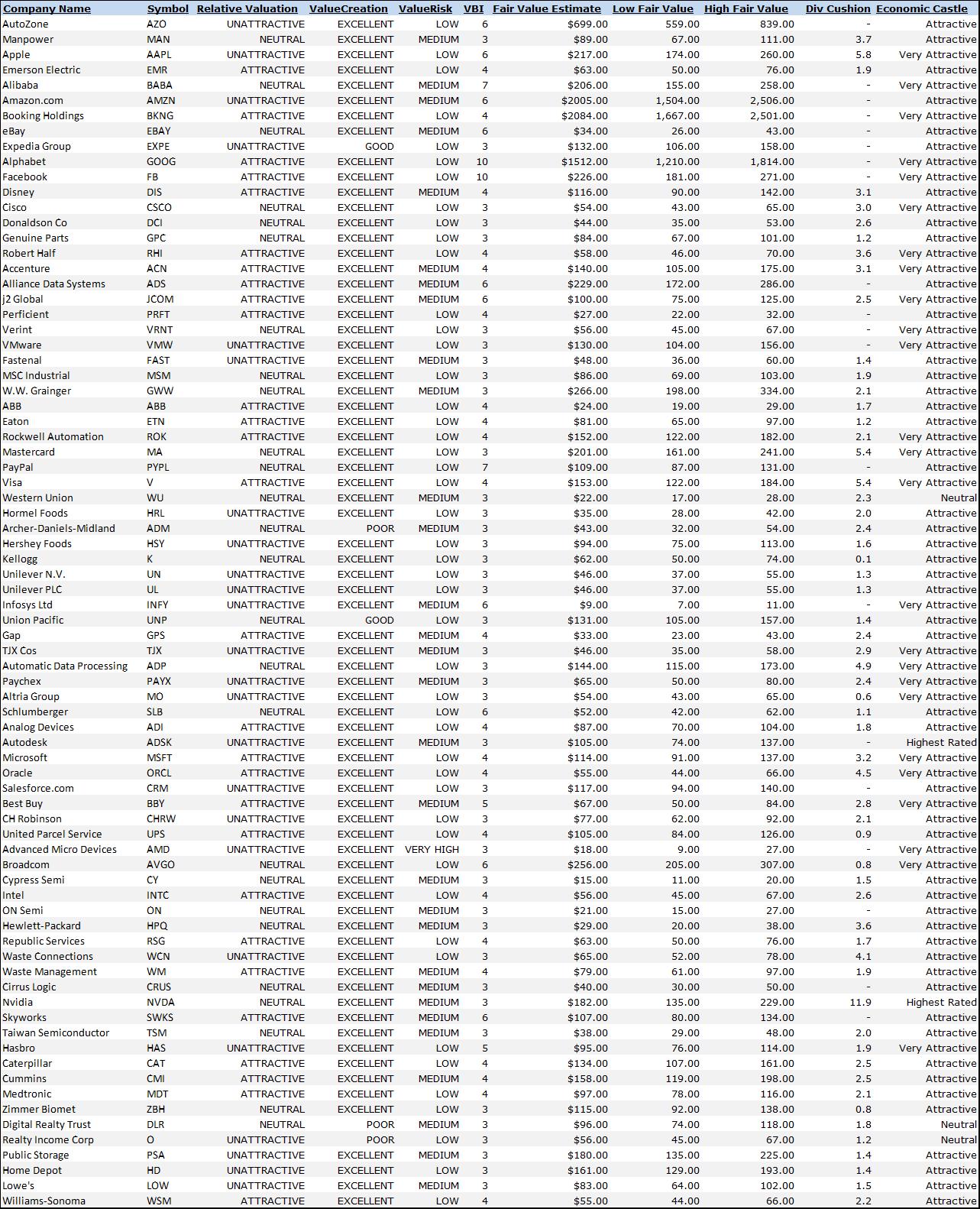

We have updated our 16-page equity and dividend reports for a number of high-profile companies in our coverage universe and have provided a table summarizing the new fair value estimates, Dividend Cushion ratios, and other key metrics following the updates for your convenience.

By Valuentum Analysts

We’ve been actively updating select reports through the course of this market swoon, and we have provided the table above for your convenience.

Guess what — Facebook (FB) and Google (GOOG, GOOGL) are now registering 10s on the Valuentum Buying Index again! These two companies are also the highest weighted equities in the simulated Best Ideas Newsletter portfolio. There’s a lot of “hair” on both names, given political and regulatory risks, and both may experience cost pressures in coming years.

However, their net-cash rich balance sheets, tremendous free cash flow generation, and significant competitive advantages combine with our undervalued assessment of their equity and improving technicals to score highly on our system. Facebook’s breakout is notable, in our view (see below). We’re pretty excited by the developments.

Facebook (FB)

Facebook’s stock page: /search-by-symbol/?tag=fb

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Valuentum Analysts do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.