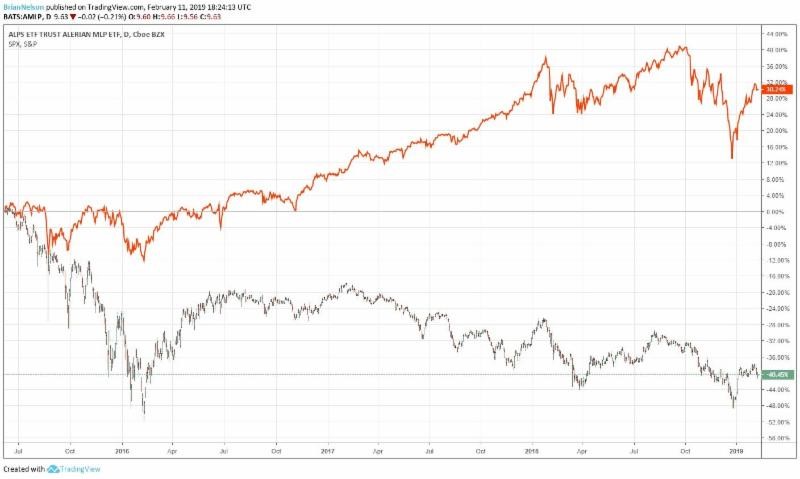

Image shown: Since mid-June 2015, the price of an ETF tracking the midstream MLP energy space (AMLP) has fallen more than 40% while the S&P 500 (SPY) has rallied more than 30%.

No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

Hi everyone!

Hope you are having a nice start to the week. I have some great news for investors. In my lengthy piece from last Tuesday, which can read here, I talked about how master limited partnerships (MLPs) may be starting to embrace the very important metric free cash flow. If you remember, free cash flow is generally calculated as cash flow from operations less allcapital spending.

On the other hand, distributable cash flow, or the most widely-disseminated metric across midstream equities, generally excludes growth capital spending, while still including benefits from that growth capital spending in net income. There’s a big imbalance. I make the plea to retire distributable cash flow in my book, Value Trap: Theory of Universal Valuation.

On January 31, Enterprise Products Partners (EPD), the largest pipeline MLP, said the following on its conference call in response to a question:

—–

Question: …in your comments, I noticed that there was a lot of focus on free cash flow. Is this a structural shift perhaps in how you sort of see messaging your financial flexibility going forward? Are you sort of shifting away from DCF and having an increasing focus on free cash flow? Is that something we should expect going forward.

Enterprise Products Partners’ CFO Randall Fowler: Well, we — I think the transition that we’re making is from the MLP-centric model that, if you would, we had our own specialized financial metrics. And as we come in, the incremental valor of investment is from more traditional funds, institutional investors that are not accustomed to our MLP language. And I guess, 2 things. One, with us going more to a self-funding model, we can come in and utilize traditional financial metrics. So a little bit, we’re just making that transition from an MLP-centric model, consuming a lot of capital and really trying to appeal to generalist investor. And we need to talk their language, which is GAAP measures, whether it’s earnings per unit and price on earnings per unit, whether it’s multiple of cash flow from operations or in terms of free cash flow.

—–

We think this is a huge step forward for the midstream MLP industry in improving transparency and communications with investors. Since mid-June 2015, when Valuentum made its landmark call on MLPs, shares of the group have fallen more than 40%, while the S&P 500 has rallied more than 30%. Dozens of MLPs have cut their distributions, and approximately 40% of energy infrastructure is now C-Corp, up from practically nothing prior to the Kinder Morgan re-consolidation. We applaud the midstream industry for taking investors’ concerns seriously, and we hope to see many more follow Enterprise Products Partners’ lead in emphasizing free cash flow. Read more about this news from S&P Global, “Enterprise’s shift on cash flow reflects ‘metamorphosis’ of US pipeline firms:”

—–

Enterprise Products Partners LP, the biggest pipeline master limited partnership, took a step in that direction when it emphasized free cash flow – interpreted broadly as cash flow from operations minus capital expenditures – and de-emphasized distributable cash flow as the primary way to illuminate how much money it has available to pay out to investors and for debt reduction…Enterprise’s move was a public acknowledgement of a trend away from the sometimes opaque financial reporting of MLPs in recent years…

…”The marketplace … was ignoring the concept that growth capital associated with driving future distributable cash flow is also shareholder capital,” Brian Nelson, president of the investment research firm Valuentum Securities Inc., wrote in a September 2018 note to clients. “It becomes questionable whether distributable cash flow, because it does not deduct for growth capital spending, is a useful measure at all.”

—–

I wanted to mention a few research pieces our team has published recently. We took a look at SurveyMonkey (SVMK) and Sonos (SONO), and you can read about our thoughts here (login required). My colleague Kris Rosemann commented on the outlooks for Ralph Lauren (RL) and Tapestry (TPR) in this note here (login required), and today, we talked about the video game industry from EA (EA) to Activision (ATVI) and beyond, see note here (login required).

Just a few notes on some of our favorite ideas. Remember when we added Verint (VRNT) to the simulated Best Ideas Newsletter portfolio (April 2017)? The company is now well above where we added it, but it just hit another 52-week high today! In fact, the stock is up more than 20% so far in 2019. In 2019! Somebody has been buying this one hand over fist, and we still think there’s more upside in store. Our fair value stands at $56 per share. How about Chipotle (CMG)? The company surged through the $600 per share mark today, and it is up huge since we added it to the simulated Best Ideas Newsletter portfolio in April last year (see image below). Read our take here (login required).

Image shown: The latest new addition to the simulated Best Ideas Newsletter portfolio, Chipotle, continues to surge.

That’s it for now. I’ll have more as the week progresses. We’ll also have the Best Ideas Newsletter out on the 15th. I also wanted to thank you again for all of the kind words regarding the launch of my new book, Value Trap. If you’d like to leave a review on Amazon, please do so here. Also, if you may be interested in leaving a review in the book, itself, on a “Praise for Value Trap” page, please send me an email at brian@valuentum.com. I would appreciate it very much, and thank you again for being here. It truly means the world to me!

P.S. If you are looking for the webinar for the website/methodology walk through, it can be accessed here.

Pipelines – Oil & Gas: BPL, DCP, ENB, EPD, ET, GMLP, HEP, KMI, MMP, NS, PAA, WES

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.