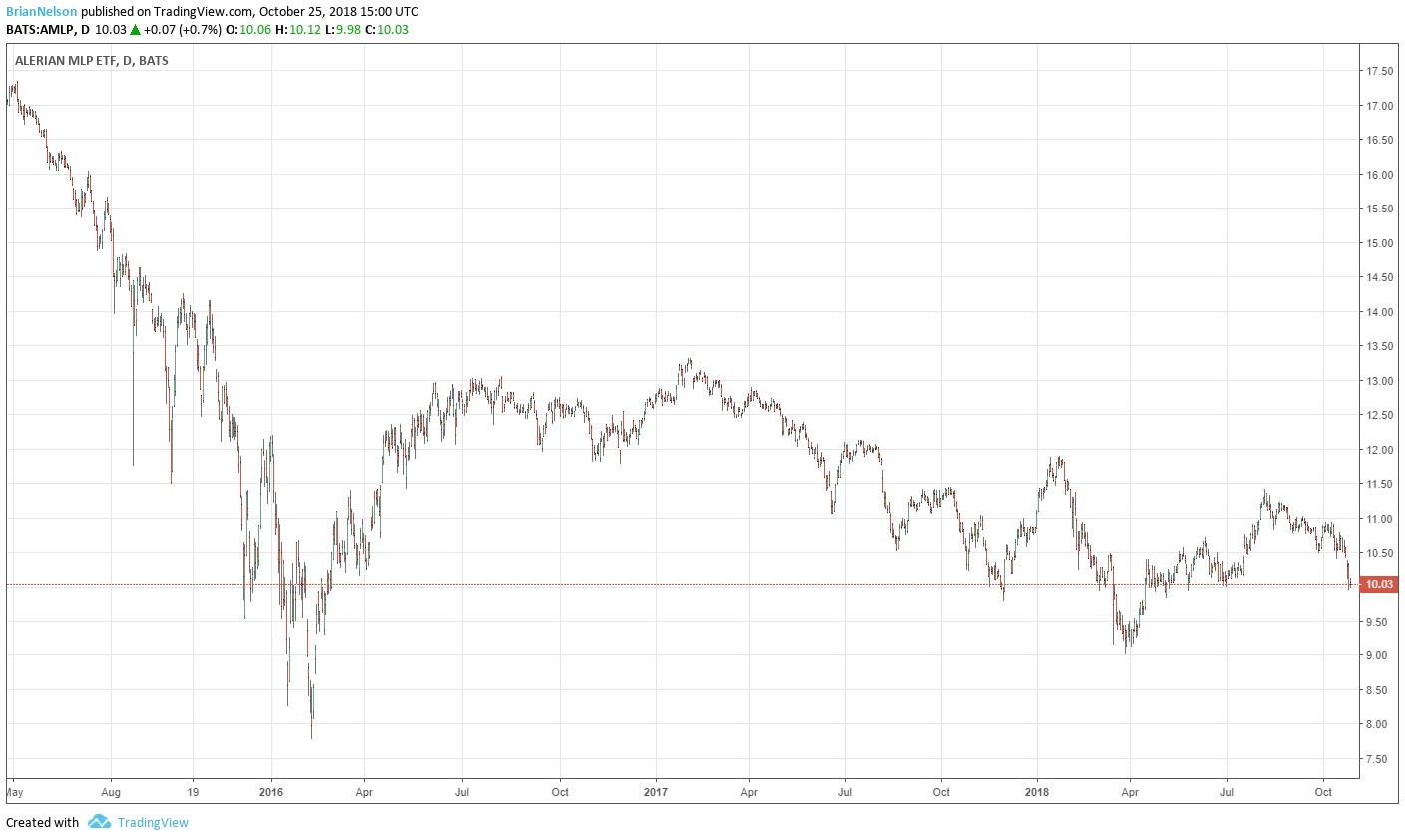

Image shown: The midstream MLP space continues to suffer. Performance of the group since mid-June 2015.

By Kris Rosemann and Brian Nelson, CFA

There aren’t many calls that have been as large as Valuentum’s was in midstream energy in mid-June 2015. Midstream energy equities comprised some $500-$600 billion in market capitalization at their peak, and our work was prominently highlighted in Barron’s for all to see. Within the High Yield Dividend Newsletter, we’ve received great praise in continuing to highlight the risks of the space, but we can’t change that high yield, itself, is risky, as almost by definition, it means that companies will have poor Dividend Cushion ratios.

This doesn’t mean that you won’t be able to find opportunities in the high yield space, or that you won’t be able to generate sufficient yield from ideas, but it does mean that almost all of the ideas will have capital-market dependence risk as they are paying out more than what they can generate internally given their capital spending profiles. The construct of the Dividend Cushion ratio, for example, includes expected cash distributions or dividends paid in the denominator (which are quite lofty for high yielders), and net debt is a detraction from overall dividend health in the numerator. The combination is quite punitive for high-yield dividend payers.

We can’t change that weak Dividend Cushion ratios and capital-market dependence risk is inherent to high-yield dividend investing. It is what it is. Almost by definition, an abnormally-high dividend yield means that coverage will be difficult over long periods of time, without external capital market assistance. Good analysis should keep this front and center for readers to understand. It’s far more important to make sure readers are well-aware of all the risks because the good things tend to take care of themselves. A focus on the risks should account for 90% of your efforts with respect to your favorite ideas. Ask: how can your thesis go wrong?

There have been dozens of distribution cuts in the midstream energy space since we released our call in mid-June 2015, and Golar LNG Partners (GMLP) is the latest, cutting its payout October 24. The entity had been warning that its distribution coverage was not sufficient for some time, and investors were informed that its distribution had been placed under review, so there’s really no surprise. Distribution coverage, even as measured by flawed industry-specific metrics of cash flow, came in at 0.32x and 0.56x in the first and second quarters of 2018 as a result of challenges in the floating storage regasification unit (FSRU) market.

In its distribution capacity review, the MLP has taken a cautious stance on the contract status and future rates applicable with respect to its FSRU Golar Igloo, and no future earnings were assumed with respect to the FSRU Golar Spirit. This level of caution, along with conservative assumptions related to its carriers that are exposed to spot and short-term markets, led the board of directors to conclude a 30% distribution cut was necessary. Golar is just the latest in a long line of MLPs that have cut their payouts since the midstream energy fallout in 2015. On the other hand, we haven’t had one equity dividend cut in the simulated Dividend Growth Newsletter portfolio and not one dividend cut in the simulated High Yield Dividend Newsletter portfolio! Adjusting for currency, we haven’t had one dividend cut with respect to income ideas in the Exclusive publication either!

Back to Golar. The MLP believes it is well positioned financially and upside to the distribution exists if the shipping market does better or if Golar Spirit finds employment, but it did not give an outlook for future distribution growth. As we’ve said time and time again, such growth remains dependent upon access to the capital markets, and units still yield more than 11% after the reduction in the distribution (still signaling outsize risk). Golar’s unadjusted Dividend Cushion ratio was firmly in negative territory prior to the distribution cut, and our dividend report on the MLP was littered with warnings of management’s lack of confidence in its own payout. Financial statement analysis matters, and high yield is synonymous with high risk. Anybody that tells you otherwise is trying to sell you something.

Pipelines – Oil & Gas: BPL, BWP, DCP, ENB, EPD, ETP, GMLP, HEP, KMI, MMP, NS, PAA, SEP, WES

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson and Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.