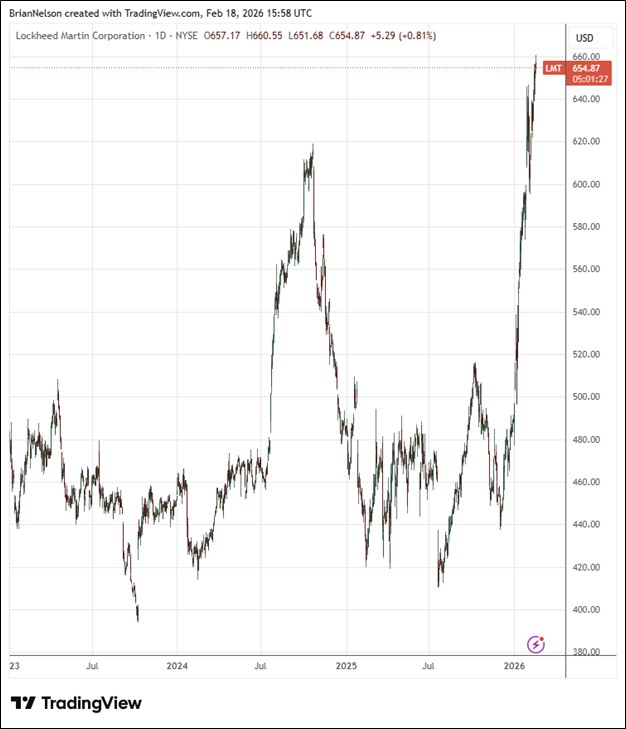

Image Source: TradingView

By Brian Nelson, CFA

Lockheed Martin (LMT) recently reported better than expected fourth quarter results with both revenue and GAAP earnings per share exceeding the respective consensus forecasts. The company reported fourth quarter 2025 sales of $20.3 billion, compared to $18.6 billion in the fourth quarter of 2024. Net earnings in the fourth quarter of 2025 were $1.3 billion, or $5.80 per share, compared to $2.22 per share in last year’s quarter. Operating cash flow was $3.2 billion in the fourth quarter of 2025, compared to $1 billion in the year-ago quarter. Free cash flow was $2.8 billion in the fourth quarter of 2025 compared to $441 million in the fourth quarter of 2024.

Management had the following to say about the results:

With a record $194 billion backlog, 6% year-over-year sales growth, and free cash flow generation above our prior expectation, 2025 marked a year of unprecedented demand for Lockheed Martin capabilities. This escalating demand for our signature programs and systems has been driven by combat-proven performance over recent years that has already been again demonstrated in 2026. During the U.S. military’s recent Operation Absolute Resolve, F-35 and F-22 fighter jets, RQ-170 stealth drones, and Sikorsky Black Hawk helicopters were decisive contributors to enable American soldier, sailors, marines, and airmen to successfully execute extremely difficult missions and return safely. To ensure we continue delivering overwhelming capability at speed and scale, we invested more than $3.5 billion during 2025 in production capacity and next-generation technologies throughout the year, underscoring our disciplined capital allocation.

Having long advocated for a new way of doing business between government and industry, we are well positioned to perform under the Department of War’s Acquisition Transformation Strategy, as evidenced by our landmark, seven-year framework agreement for PAC-3 missiles early in the first quarter. We look forward to continuing our partnership with the DoW and Congress to definitize this contract and officially unleash a new era of increased innovation, accountability and execution within the defense industrial base.

This notable start to 2026 reinforces our confidence in Lockheed Martin’s continued operational and financial growth in the year ahead. We expect sales and reported segment operating profit growth of approximately 5% and 25% year-over-year, respectively, and free cash flow between $6.5 to $6.8 billion, an increase compared to our prior expectation. With a strong emphasis on operational performance and clear alignment with our customers’ national defense priorities, we will continue to deliver superior, reliable capabilities to U.S. and Allied militaries to strengthen deterrence and provide overwhelming combat advantage, while providing strong results and value to our shareholders.

Looking to 2026, Lockheed’s sales are projected to be between $77.5-$80 billion, with business segment operating profit between $8.425-$8.675 billion and diluted earnings per share in the range of $29.35-$30.25. For the year, cash from operations is expected in the range of $9.15-$9.45 billion with capital expenditures of $2.5-$2.8 billion, resulting in free cash flow expected between $6.5-$6.8 billion. We like Lockheed Martin as our favorite defense contractor and are huge fans of its backlog and free cash flow generation. Shares yield 2.1% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.