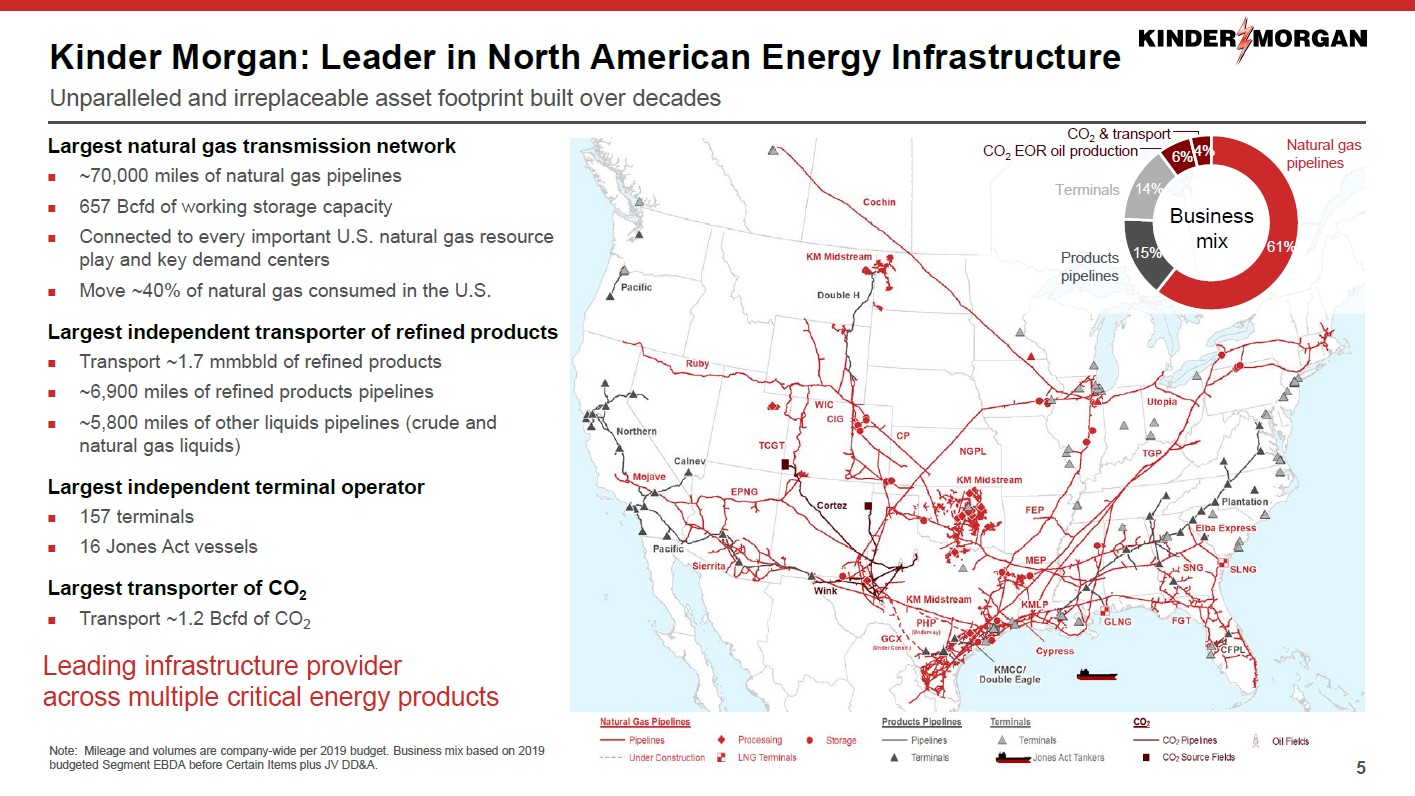

Image Shown: A look at Kinder Morgan Inc’s (KMI) massive oil & gas infrastructure operations that crisscross North America. The natural gas midstream giant is selling its Canadian segment by divesting its 70% equity stake in Kinder Morgan Canada and the US portion of the Cochin pipeline to Pembina Pipeline Corporation (PBA). Image Source: Kinder Morgan Inc – IR Presentation

By Callum Turcan

Dividend Growth Newsletter portfolio holding Kinder Morgan Inc (KMI), a giant in the natural gas midstream space, finally reached a deal to sell the remaining stake in its Canadian spin-off. On August 21, Kinder Morgan announced that it had sold its 70% equity stake in TSX-listed Kinder Morgan Canada Limited (KMLGF) along with the US portion of the Cochin pipeline to Pembina Pipeline Corporation (PBA). In return, Pembina is paying Kinder Morgan ~$1.55 billion and issuing the midstream giant ~$0.95 billion worth of equity (at the time the deal was made public) for a combined value of ~$2.5 billion. Shares of KMI yield 4.9% as of this writing and we continue give Kinder Morgan a fair value estimate of $23/share.

Setting the Stage

Back in 2017, Kinder Morgan completed the IPO of Kinder Morgan Canada which included spinning off a portion of its exposure to the Trans Mountain oil sands pipeline and the related expansion project. The Trans Mountain pipeline primarily transports crude oil produced from the oil sands region in Alberta to the West Coast for use in North American refineries (in British Columbia and US West Coast markets), or on rare occasion for export to overseas markets. Kinder Morgan retained a 70% equity stake in Kinder Morgan Canada, and the spin-off used the IPO proceeds to acquire a 30% stake in its parent company’s Canadian assets.

Kinder Morgan pursued the IPO of its Canadian assets largely to shift some of the financial risk associated with building the Trans Mountain Expansion to a different entity, as Kinder Morgan Canada was going to self-fund the project. For various reasons, from regulatory roadblocks to public protests, the Trans Mountain Expansion has long been stymied. Kinder Morgan read the tea leaves and saw that this multi-billion project, regardless of its apparent economic need, was unlikely to ever get completed. By 2018, Kinder Morgan was lucky enough to have the Canadian government acquire the Trans Mountain pipeline and the related project outright in an all-cash deal worth ~C$4.5 billion. That divestment removed one of the biggest clouds hanging over Kinder Morgan and we are very supportive of management’s decision, even if it did come a tad late (little progress has been made on the project since then and we think it’s unlikely the endeavor will ever get completed baring some sort of major domestic political shift).

The sale of the Trans Mountain pipeline was essential to making Kinder Morgan’s deal with Pembina possible. It’s very unlikely Pembina would have wanted to take on the risk of pursuing the Trans Mountain Expansion (Pembina’s management said as much) but Kinder Morgan Canada’s other assets such as the Canadian portion of the Cochin pipeline, oil loading facilities in Edmonton (key oil hub in Alberta), and more are highly complementary. Please note that when the deal closes Pembina will own both the US and Canadian portions of the Cochin pipeline, which transports diluent (namely condensate, a very light oil type) produced in the US up to Alberta’s oil sands patch. There the diluent is used to make viscous heavy oil, the kind produced from upstream oil sands operations, less viscous so it can better flow through long-haul pipelines to end buyers.

Pembina is a Canadian-focused midstream oil & gas player with an enormous (and growing) presence in the Canadian provinces of British Columbia and Alberta. The midstream firm’s infrastructure in the region supports the upstream oil sands industry and the emerging unconventional upstream industry in Alberta and British Columbia (such as the Duvernay and Montney plays), supplemented by operations elsewhere. Recently, Pembina’s proposed Jordan Cove LNG project was further delayed which likely freed up capital that the company wanted to deploy elsewhere considering that liquified natural gas export development is still waiting on key regulatory approvals. That set the stage of Pembina’s purchase of Kinder Morgan’s equity stake in Kinder Morgan Canada.

What Kinder Morgan Plans to Do

Kinder Morgan will use this deal to accomplish a few things. First, a lot of the proceeds will go towards debt reduction. Looking at just the cash proceeds from the sale of the Cochin pipeline, Kinder Morgan’s net debt to adjusted EBITDA ratio will decline from 4.6x at the end of the second quarter to 4.4x by the end of 2019 assuming the deal closes by then (closing is targeted for late-2019 or early-2020). What we like about this news is that Kinder Morgan had been targeting a long-term leverage ratio of 4.5x, yet due to temporarily headwinds (with an eye towards delays at its Elba LNG development) the firm was on track to end 2019 with a leverage ratio above its long-term target.

More importantly, Kinder Morgan has had a lot of trouble with debt in the past and we want to see its attitude towards leverage change. Kinder Morgan had this to say in its press release (emphasis added):

“KMI expects to use the proceeds to reduce debt to maintain its Net Debt-to-Adjusted EBITDA ratio of approximately 4.5 times and use the remaining proceeds to invest in attractive projects and/or to opportunistically repurchase KMI shares. Initially, proceeds will be used to reduce Net Debt. With the cash proceeds from the sale of Cochin alone, and assuming the transaction were to close at the end of 2019, KMI would expect to end 2019 with a Net Debt-to-Adjusted EBITDA ratio of approximately 4.4 times, improved from the approximately 4.6 times year-end projection announced in the second quarter 2019 earnings release.”

Management plans to opportunistically sell down the Pembina equity stake over time in a “non-disruptive manner” in order to maximize value for Kinder Morgan’s shareholders. Dumping those shares would likely see PBA move meaningful lower, at least in the short-term, given how most generalist investors have fled the oil & gas space. Having that equity stake will generate a modest source of cash flow for Kinder Morgan in the interim given shares of Pembina yield 4.7% as of this writing.

Please note Kinder Morgan had a total debt load of $36.1 billion at the end of the second quarter of 2019, versus a marginal $0.2 billion cash position. We caution that Kinder Morgan’s net debt load gets in the way of its very promising dividend growth story. Turning new cash flow generating midstream assets online, such as expanding its vast natural gas pipeline networks in the US, will help push its leverage ratio down over time. However, we caution that Kinder Morgan remains very exposed to fluctuations in raw energy resource prices given its CO2 upstream division and the dynamic effects market forces have on North American energy supply and demand.

Concluding Thoughts

Overall, this deal was very welcome news and removes one of the big questions facing Kinder Morgan (what is the firm going to do with its equity stake in Kinder Morgan Canada now that the Trans Mountain asset has been sold off?). Going forward, we would like to see management push Kinder Morgan’s leverage ratio lower still. Memories of 2015, when Kinder Morgan sharply cut its dividend so it could pay down its massive debt burden (the company was sitting on more than $43.1 billion in total debt at the time), still rings in many investors ears when looking at shares of KMI, a ringing that would subside if the firm’s leverage ratio were to become more manageable.

We like Kinder Morgan because it’s one of the few midstream firms actually targeting free cash flow generation instead of focusing on distributable cash flow, which we see as a deeply flawed metric (not taking growth-related capital expenditures into account completely misses the picture in our view). The company’s natural gas assets in the US are irreplaceable and its pipelines transport ~40% of US natural gas according to Kinder Morgan. The midstream company’s quarterly payout has jumped higher in recent years but we are still waiting to see how the “new” free cash flow and debt reduction-focused Kinder Morgan performs going forward before getting more excited on the name. There’s no change to our intrinsic value estimate for KMI at this time.

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners LP (EPD) and Magellan Midstream Partners LP (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.