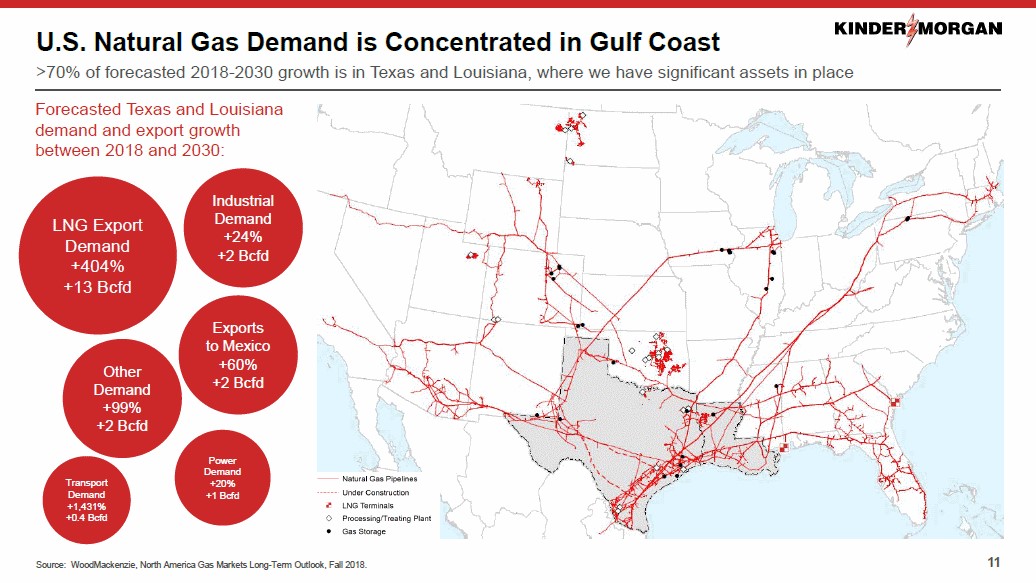

Image Shown: Kinder Morgan Inc expects a lot of organic growth opportunities will be generated via surging domestic demand for natural gas and rising natural gas export capacity in the US. Image Source: Kinder Morgan Inc – IR Presentation

By Callum Turcan

Natural gas pipeline giant Kinder Morgan Inc (KMI), a holding in our simulated Dividend Growth Newsletter portfolio, reported second quarter earnings for 2019 on July 17 which generally disappointed. Problems at its Elba LNG development in Georgia and weaker realized prices for raw energy resources produced by its upstream CO2 segment held down Kinder Morgan’s financial performance. We appreciate Kinder Morgan’s focus on fiscal discipline and see several of its problems as transitory, other than the raw energy resource pricing risk its upstream operations will perennial face. Once the Elba LNG project finally comes online Kinder Morgan will be better able to focus on what it does best, building new natural gas pipelines and expanding existing networks. Shares of KMI yield 5.0% as of this writing.

Quarterly Overview

The midstream company’s Natural Gas Pipelines segment is doing very well with a lot of room for upside, as its Gulf Coast Express Pipeline project is ahead of schedule with a targeted in-service date of October 1, 2019, or slightly beforehand. That system will haul natural gas from the Permian Basin in West Texas to the Agua Dulce hub near Corpus Christi along the US Gulf Coast. Another Permian natural gas pipeline, the Permian Highway Pipeline, that Kinder Morgan’s developing is expected to start up in October 2020. These projects should yield additional organic growth opportunities up and down the pipeline, with Kinder Morgan’s total project backlog standing at $5.7 billion as of the end of the second quarter.

Kinder Morgan’s adjusted EBITDA dropped by a tad under 2% in the second quarter year-over-year to $1.8 billion, while its distributable cash flow (“DCF”) rose by 1% to $1.1 billion. Very strong performance at its Natural Gas Pipelines segment, where transported natural gas volumes rose 10% year-over-year, was key to offsetting weakness at its CO2, Products Pipelines, and Terminals segments. Only Kinder Morgan’s Natural Gas Pipelines segment posted an increase in EBDA last quarter on a year-over-year basis, the other three segments all posted declines.

Debt Commentary

Management’s adjusted net debt metric rose from $34.2 billion at the end of 2018 to $34.8 billion at the end of June. As Kinder Morgan’s adjusted EBITDA on a trailing-twelve-month basis was broadly flat from the end of 2018 to the end of the second quarter of 2019, the midstream company’s leverage ratio (adjusted net debt to adjusted EBITDA) rose from 4.5x to 4.6x during this period.

Please keep in mind the adjustments management made to Kinder Morgan’s net debt load include taking into account 50% of the KML preferred shares, excluding debt fair value adjustments, and removing the impact of foreign exchange movements on Kinder Morgan’s Euro-denominated debt as that’s hedged via currency swaps. When looking at just Kinder Morgan’s net debt load as it would conventionally be understood (cash & cash equivalents less short-term debt and long-term debt), that burden stood at $34.7 billion at the end of June 2019, roughly on par which management’s adjusted net debt figure.

Minor Guidance Changes

In the earnings press release, management mentioned that delays at the firm’s Elba LNG export project and other factors would see Kinder Morgan’s 2019 adjusted EBITDA come in “slightly” below estimates calling for $7.8 billion in adjusted EBITDA:

“Adjusted EBITDA is currently estimated to be slightly below budget, primarily due to the delay in Elba’s in-service date, lower NGL prices impacting the CO2segment, and the impact of 501-G settlements, partially offset by the strong performance of the West Region natural gas business unit…

DCF is expected to be on budget as lower interest expense offsets the slightly lower Adjusted EBITDA. KMI budgeted to invest $3.1 billion in growth projects and contributions to joint ventures during 2019. KMI now expects to be slightly below that amount due to lower capital expenditures in the CO2 segment.KMI expects to use internally generated cash flow to fund the vast majority of its 2019 discretionary spending, without the need to access equity markets.”

By the end of 2019, management sees Kinder Morgan’s leverage ratio standing at 4.6x, a touch above its long-term goal of 4.5x. We appreciate the minor adjustment in Kinder Morgan’s 2019 capital expenditure plans to ensure continued fiscal sustainability but would also like to see that leverage ratio move lower in the future.

Choice Quote from Management

Down below is a quick summary of why Kinder Morgan’s Natural Gas Pipelines segment is so important, summed up by Richard Kinder, co-founder and executive chairman of Kinder Morgan, during the firm’s conference call:

“Looking forward, as we previously said U.S. demand is projected to grow by over 30% between now and 2030 that demand growth is being driven by L&G, power and industrial demand and by exports to Mexico. Turning to the supply side, the U.S. is projected by 2025 to be producing one quarter of all the natural gas in the world, and accounting for over 50% of the growth in supply — in global supply by that year.

Now look I’m aware of Mark Twain saying that making predictions is very difficult, particularly when they concern the future. But I believe that under almost any scenario natural gas is a winner for years to come. Connecting these vast supplies — these vast U.S. supplies to growing demand markets will drive new infrastructure and higher utilization of existing assets.

KMI is very well positioned to take advantage of these opportunities, especially in Texas and Louisiana where our extensive network of pipelines is very well situated to serve the rapidly growing LNG export and petrochemical facilities. That’s a big reason why we feel good about the long-term future of this company.”

Concluding Thoughts

Kinder Morgan was happy to mention that Fitch Ratings upgraded its investment grade credit rating last quarter, joining the ranks of Moody’s Corporation (MCO) and S&P Global Ratings which had both recently upgraded Kinder Morgan’s investment grade credit ratings as well. That’s the result of management’s ongoing focus on fiscal discipline, which we expect will continue going forward. We remain optimistic on Kinder Morgan’s dividend growth opportunities, and our fair value estimate still stands at $23 per share. When Kinder Morgan’s 10-Q SEC filing is made available we will have more to say on the name.

Oil & Gas Pipeline Industry – BPL DCP ENB ET EPD GMLP HEP KMI MMP NS PAA WES

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Contact Valuentum for more information about its editorial policies.