Image Source: Johnson & Johnson fourth quarter presentation

Johnson & Johnson’s ‘Pharmaceutical’ segment continues to deliver top-line growth despite ongoing headwinds related to net price decreases in the US pharma space. The company remains one of our favorite dividend growth ideas as its higher-growth ‘Pharmaceutical’ segment is augmented by a solid ‘Consumer’ business and improving ‘Medical Devices’ business.

By Kris Rosemann

Simulated newsletter portfolio idea Johnson & Johnson (JNJ) is simply a powerhouse, but that does not mean its shares are immune to broader market volatility, global economic expectations, and headline risk. While the final of those factors via ongoing legal issues has provided an overhang on shares of the consumer and pharmaceutical giant, its track record of consistency cannot be disputed.

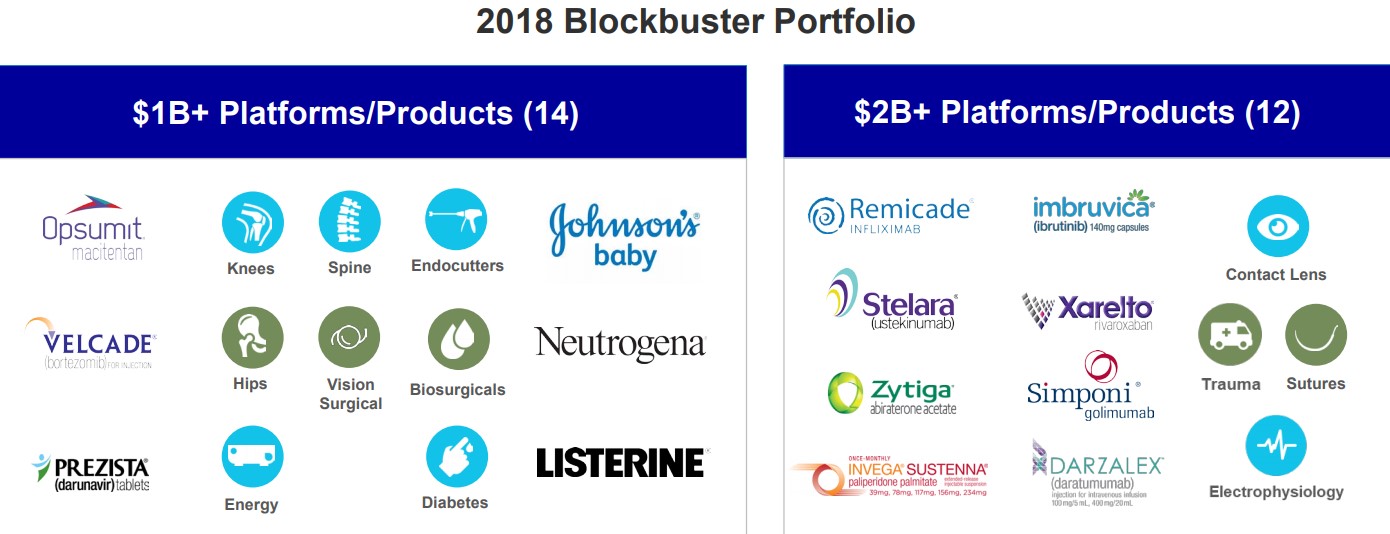

2018 marked Johnson & Johnson’s 35th consecutive year of adjusted operational earnings growth (excludes intangible amortization expense, special items and the impact of translational currency) and its 56th consecutive year of annual dividend increases, and it generates ~70% of sales from products with #1 or #2 global market share positions while having 26 brands or platforms with $1 billion or more in annual sales. The company is one of only two companies to currently hold an AAA credit rating, the other being fellow simulated Dividend Growth Newsletter portfolio idea Microsoft (MSFT).

While we await the release of Johnson & Johnson’s 10-K to roll its valuation model forward and have a look at its balance sheet and cash flow statement for the full-year 2018, we are sticking with our fair value estimate of $137 per share following its fourth quarter earnings report, released January 22. The company’s strong Dividend Cushion ratio of 2.3 pairs nicely with its dividend yield of 2.8% as of this writing, and we expect to continue highlighting it as an idea in the simulated newsletter portfolios. Our stance on its pending legal matters remains the same, and members can find that opinion here.

Ongoing strength in Johnson & Johnson’s ‘Pharmaceutical’ segment continues to drive its top line, and the segment reported 7.2% operational sales (excludes impact of currency translation) growth in the fourth quarter on a year-over-year basis thanks in large part to impressive performance from its ‘Oncology’ and ‘Immunology’ divisions. The company’s ‘Consumer’ segment turned in 3.3% operational sales growth from the year-ago period as its ‘OTC’ division performed will in the quarter thanks in part to the acquisition of Zarbee’s natural-based product portfolio, but its ‘Medical Devices’ segment saw sales decline 2.2% on an operational basis from the fourth quarter of 2017 as it continued to divest businesses such as LifeScan to position itself to achieve its target of above market sales growth in 2020. Overall, worldwide sales at Johnson & Johnson grew 3.3% on an operational basis in the fourth quarter on a year-over-year basis, but the negative impact of currency translation brought its reported growth rate down to 1%.

Johnson & Johnson’s gross margin expanded 190 basis points to 65.9% in the fourth quarter from the year-ago period thanks in part to favorable mix and an inventory step-up related to Actelion, which was acquired in 2017. EBIT margin also fared well in the quarter, expanding to 15.3% from 12.7% in the fourth quarter of 2017, as both selling, marketing, and administrative and R&D expenses declined as a percentage of revenue due in part to lower milestone payments to collaborators. Adjusted net earnings per diluted share advanced to $1.97 from $1.74 in the comparable period of 2017.

Management estimates that it ended 2018 with a net debt position of ~$10.8 billion, consisting of $30.5 billion in debt and $19.7 billion in cash, which is down from $16.3 billion in net debt at the end of 2017. Free cash flow for the full year is estimated at $18.6 billion, an ~$800 million improvement over 2017 levels, and it completed roughly 20% of its $5 billion share repurchase program in 2018.

Looking ahead to 2019, Johnson & Johnson expects operational sales growth to be flat to up 1%, and adjusted earnings per share guidance for the year comes in a range of $8.50-$8.65, which includes a projected $0.15 per share negative impact of currency translation due to expectations for a stronger US dollar, compared to $8.58 in 2018. Adjusted sales growth, which excludes the impact of currency translation and the impact of acquisitions and divestitures, is expected to be 2%-3% in 2019.

Anticipated headwinds for 2019 include generic and biosimilar competition in its ‘Pharmaceutical’ segment–US pharma pricing pressure will likely persist at elevated levels after coming in at “greater than 6%,” according to management–but the company still expects overall segment revenue growth in the year. Excluding the impact of generic and biosimilar competition, which is expected to be a $3-$3.5 billion headwind over the course of the year, company-wide organic growth of 5.7%-7.3% is being targeted. Management expects its ‘Medical Devices’ segment to experience accelerating revenue growth in 2019, and new product innovation and improving omni-channel performance to help its ‘Consumer’ segment grow slightly above market growth rates in the year.

Management commented briefly on its talc-related legal issues on the quarterly conference call, stating that it does not have an impact on the long-term strategic outlook of its ‘Consumer’ segment, a notion we agree with. As we have reiterated in the past regarding the developments:

The magnitude of damages against J&J with respect to its talcum-powder products could be large, but we think the market has slowly factored in the risk of legal liabilities. Once J&J puts these troubles behind it, we think the market may once again warm up to the equity.

We continue to highlight shares of Johnson & Johnson in both simulated newsletter portfolios.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.